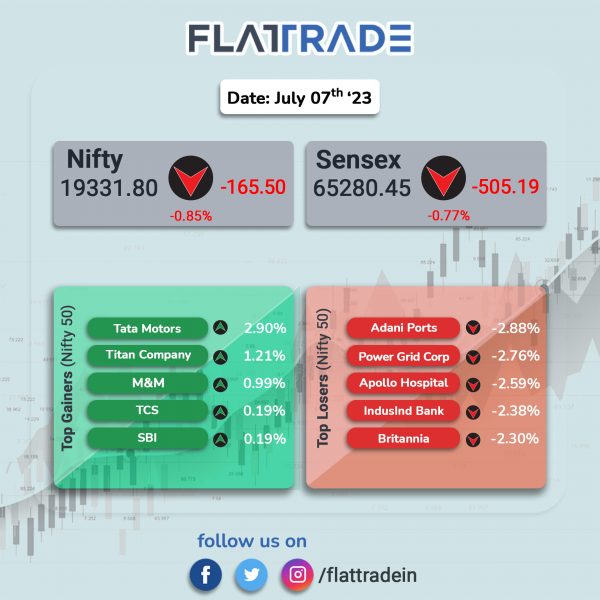

Dalal Street ended lower as investors were worried over further interest rate hikes after strong private jobs data in the US. The Sensex fell 0.77% and the Nifty 50 index 0.85%.

In broader markets, the Nifty Midcap 100 index dropped 0.81% and the BSE Smallcap fell 0.285.

Top losers among Nifty sectoral indices were FMCG [-1.53%], Realty [-1.18%], Private Bank [-1.1%], Energy [-0.95%], and Bank [-0.92%]. Top gainers were Media [3.91%], PSU Bank [0.98%], Auto [0.29%].

Indian rupee fell 22 paise to 82.74 as against the US dollar on Friday.

Stock in News Today

Tata Motors: The automaker said its witnessed a strong Jaguar-Land Rover (JLR) sales during the quarter ended June 2023. Wholesales volumes in Q1FY24 were up 30% YoY to 93,253 units. JLR retail sales in Q1FY24 were 101,994, up 29% over Q1FY23. The company said JLR order book remained strong at 1,85,000 units, reflecting strong client demand, according to its business update. It added that demand for Range Rover, Range Rover Sport and Defender continues to be particularly strong, with retail sales up significantly compared to Q1FY23 and representing 76% of the order book. Shares of the company ended 2.9% higher at a lifetime high of Rs 618.20 apiece.

NTPC: The state-run power major said that the Unit-2 of 660 megawatt (MW) capacity of Stage-I (3 x 660 MW) of Barh super thermal power project in Bihar, has successfully completed trial operation. With this, installed capacity of NTPC and NTPC group has become 57,038 MW and 73,024 MW respectively, said the company.

Kalyan Jewellers India: The company’s consolidated revenue growth for the Q1FY24 was about 31% as compared to the same period in the previous financial year. The company witnessed revenue growth of approximately 34% for its India operations during the recently concluded quarter as compared to Q1FY23. Non-South markets recorded higher overall revenue growth largely due to the greater number of showrooms launched in that region over the last twelve months. The firm added 12 new Kalyan showrooms across non-south markets during the recently concluded quarter and expects to launch approximately 20 new showrooms across non-south markets before Diwali.

Zen Technologies: The company announced that it has secured an order from the Government of India valued at approximately Rs 160 crore. The company said that the order is part of the government’s indigenous design and development (IDDM) initiative, which requires Indian IP and over 60% indigenous content. Zen Technologies is a leading provider of military training and anti-drone solutions. Shares jumped 4.53% in intraday trade on the NSE.

Talbros Automotive Components: The company has received multiyear orders worth Rs 400 crore from domestic and overseas customers across its business divisions, product segments and JVs. These orders are to be executed over a period of next 5-7 years covering the company’s product lines – gaskets, heat shields, forgings and chassis.

JSW Ispat Special Products: The company said that its crude steel production surged 74% YoY to 1.84 lakh tonnes in Q1FY24 as against 1.06 lakh tonnes recorded in Q1FY23. Sequentially, the company’s crude steel production declined 1% as against 1.83 lakh tonnes produced in Q4 FY23.

Olectra Greentech: A consortium of the company and Evey Trans has received Letter of Intent (LOI) from Maharashtra State Road Transport Corporation (MSRTC) to supply 5,150 electric Buses. The order includes supply, operation and maintenance of 5, 150 electric buses and allied electrical and civil infrastructure. The order is based on on gross cost contract (GCC) / OPEX model over a period of 12 years.

Suzlon Energy: The company announced that its board has approved the conversion of 1.59 crore partly paid-up equity shares aggregating to Rs 3.97 crore. The company is in the process of completing necessary formalities for corporate actions / obtaining listing and trading approvals with respect to the converted rights equity shares. The Suzlon Group is one of the leading renewable energy solutions provider in the world with presence in 17 countries.

RailTel Corp.: The PSU company announced that it has received a work order from National Informatics Centre Services Incorporated (NICSI), aggregating to Rs 39.37 crore. The order entails onsite security operations center (SOC) and network operations center (NOC) with high availability solution with five years support installation and training. The order is to be executed within five years from the service start date.

SpiceJet: The Supreme Court has refused to grant extension to SpiceJet, and has reprimanded the airline for failing to pay Rs 75 crore to Maran, according to the apex court’s earlier order. The court also directed SpiceJet to pay the entire arbitral amount of Rs 380 crore to its former promoter Kalanithi Maran. The case is related to the share transfer dispute between SpiceJet’s chairman and managing director Ajay Singh and Maran as well as his KAL Airways.

FSN E-Commerce Ventures (Nykaa): The company in an exchange filing said that it expects its consolidated revenue for Q1FY24 to grow in the mid-twenties on a yearly basis. Consumption in the Beauty and Personal Care (BPC) categories continue to remain strong, in line with longer term trajectory. Apparel industry has been impacted due to discretionary slowdown during the quarter, especially in small towns. The company expects discretionary spending to improve with the revival of seasonal demand.

Punjab & Sind Bank: The company reported a 10.88% increase in gross advances to Rs 80,638 crore as on 30 June 2023 as against Rs 72,727 crore as on 30 June 2022. Total deposits for the quarter ended 30 June 2023 was at Rs 1,14,229 crore, up 12.5% from Rs 1,01,534 crore as on 30 June 2022. The bank’s total business stood at Rs 1,94,866 crore as on 30 June 2023, registering a growth of 11.82% from Rs 1,74,261 crore in the year-ago period. CASA deposits rose 4.89% YoY to Rs 36,211 crore as on 30 June 2023.