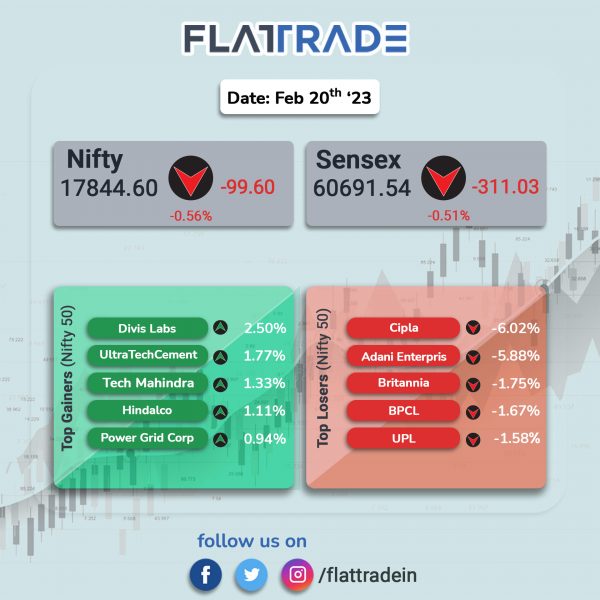

Benchmark stock indices closed lower due to losses in financial services stocks and some index heavyweight such as RIL, Maruti Suzuki and Nestle India. The Sensex fell 0.51% and the Nifty was down 0.56%.

In broader markets, the Nifty Midcap 100 index edged up 0.08% and the BSE Smallcap dropped 0.16%.

Top losers were Oil & Gas [-1.14%], PSU Bank [-1.11%], Bank [-1.05%], Energy [-0.98%] and Nifty Financial Services [-0.98%]. Top gainers were IT [0.54%] and Auto [0.28%].

Indian rupee rose 11 paise to 82.72 against the US dollar on Monday.

Stock in News Today

Tata Motors: The company would supply 25,000 XPREST electric vehicle (EV) units to Uber in one of the largest deals in the green mobility space till date, according to various media reports. Under the agreement, Uber will utilise the electric sedans in its premium category service. Tata Motors will begin the deliveries of the cars to Uber fleet partners in a phased manner, starting this month, the reports added.

Bharat Dynamics: The defence equipment manufacturer has inked an export order worth $255 million (Rs 2,108.12). The agreements were signed with top companies such as Thales, Al Tariq, and Bultexpro, as well as domestic players like the Indian Institute of Technology-Madras and Tamil Nadu Industrial Development Corporation. Separately, the company’s stock is also trading ex-dividend today and its board has approved an interim dividend payout of Rs 8.15 for the current financial year.

Kalpataru Power Transmission (KPTL): The company has secured new orders worth Rs 3,185 crore. The orders consist of Rs 1,481 crore for the company’s transmission and distribution business, Rs 1,509 crore for engineering, procurement and construction (EPC) projects in the water business, and Rs 195 crore in the commercial building segment.

NMDC Steel: Shares of the company surged 5% and were locked in the upper circuit after getting listed at the exchanges on Monday. The Shares were listed at Rs 30.25 on both exchanges and gained about 4.96%. NMDC shareholders were allotted one share of NMDC Steel for every equity share held.

Coforge: The company has introduced Quasar e-BOL, leveraging its document processing engine to address a universal need in the freight movement industry. Coforge’s Quasar e-BOL is a technology-agnostic cost-effective solution to digitize Bills of Lading (BOL). The Quasar e-BOL will give carriers an unparalleled ability to streamline and automate the entire billing process, while reducing errors and rework.

Surya Roshni: The company has bagged an order worth Rs 113.63 crore from Bharat Petroleum Corporation for its Hyderabad pipeline project. The contract involves supply of bare and 3LPE (external) coated line pipes for BPCL’s project located at Krishnapatnam – Hyderabad territory in Andhra Pradesh. The project has to be executed within a period of nine months.

Zydus Lifesciences: The company’s subsidiary, Zydus Pharmaceuticals (USA) Inc., has received tentative approval from the United States Food and Drug Administration for Gabapentin Tablets. The drug will be manufactured at the group’s formulation manufacturing facility at Moraiya, Gujarat. Gabapentin Tablets had an annual sales of $90 million in the US, according to IQVIA MAT December 2022 data.

Lumax Auto Technologies: The company announced that it will buy a 75% stake in auto components supplier IAC International Automotive India (IAC India) for a total consideration of Rs 587 crore in cash. The deal is expected to be completed by March 2023 and the stake will be acquired from IAC India’s existing shareholder IACNA Mauritius Ltd. IAC India is a Tier-1 interior systems and components supplier to key automotive OEMs in the country such as M&M, Maruti Suzuki, Volkswagen, and Volvo Eicher Commercial Vehicles.

Seacoast Shipping Services: The company signed contract with Dubai’s Maria Shipping for providing shipping and logistic services in the region. The contract will be effective from April 1, 2023, for a period of one year and can be renewed further. The company said that the contract will result in an additional revenue of about Rs 100 crore per annum.

Ugro Capital: The financial services company’s board has approved fund raising of up to Rs 20 crore by issuing non-convertible debentures (NCDs) on a private placement basis. The company said it will issue 2000 NCDs with a a face value of Rs 1 lakh aggregating up to Rs 20 crore on a private placement basis. The NBFC said that the NCDs will be issued at a coupon rate of 10% per annum.

Capital Trade Links: The company has appointed Priyanka Bhatia has as Additional Executive director and Parveen Kumar as Additional Non-Executive director by Board of Directors of the company vide resolution passed in their meeting held on 13 February 2023, have tendered their resignation from the Board of the company with effect from 18 February 2023, due to their preoccupancy and professional commitment.