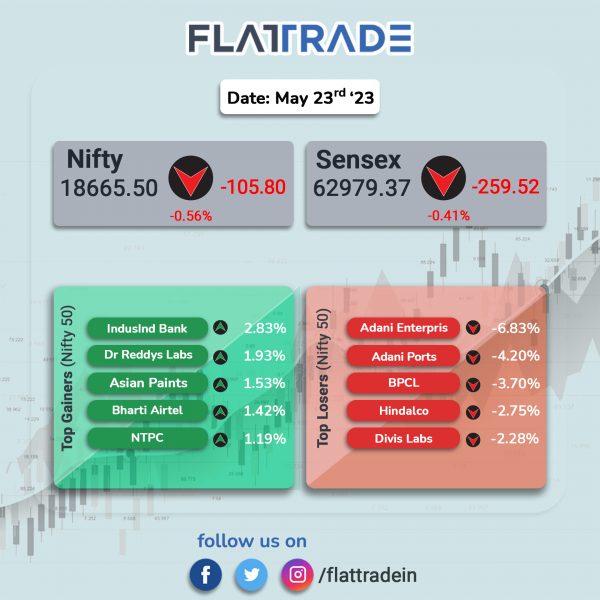

Benchmark equity indices closed lower due to negative sentiments on the back of persistent inflation, high interest rates and concerns over global economic growth. The Sensex fell 0.41% and the Nifty 50 index dropped 0.56%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index tanked 1.24% and the BSE Smallcap slumped 1.17%.

Top losers were Metal [-2.48%], Media [-2.13%], Oil & Gas [-1.51%], PSU Bank [-1.18%], and Auto [-1.03%]. Nifty Pharma [0.15%] was the only sectoral index which ended in the green.

Indian rupee fell 7 paise to close at 82.03 against the US dollar on Friday.

Stock in News Today

Adani Enterprises: AdaniConneX, a joint venture between Adani Enterprises and EdgeConneX, has executed a $213 million senior debt facility with participation from international banks to finance its under-construction data center portfolio of 67 MW in Noida and Chennai. ING Bank N.V., Mizuho Bank, MUFG Bank, Natixis, Standard Chartered Bank, and Sumitomo Mitsui Banking Corporation have committed to the facility. The company said that access to wide pool of liquidity strengthens AdaniConneX strategy to fast-track the implementation of the under-construction asset portfolio.

BEML: The state-owned company has won an order worth Rs 423.11 crore from the Ministry of Defence for the supply of high mobility vehicles, according to its exchange filing.

UPL: The company said that it has spun off specialty chemical business on a slump sale basis as a going concern to wholly-owned subsidiary UPL Speciality Chemicals for consideration of Rs 3,752 crore. Further, it has separated the global seeds business vertical under ‘Advanta Enterprise’ and India crop protection business and digital business under ‘UPL Sustainable Agri Solutions (UPL SAS)’. The company has raised $500 million by divesting minority stakes in Advanta Enterprises (13.3% ) and UPL SAS (9.1%) to global investment firms Abu Dhabi Investment Authority, KKR and Brookfield at a ‘significant valuation premium’. The business realignment is expected to be completed within four months.

Dr Reddy’s Laboratories: The company announced its entry into the trade generics business in India with the launch of its new dedicated division ‘RGenX’. Through this, Dr. Reddy’s aims to provide patients with access to a wider range of products and increased affordability. The new business will further the company’s goal of reaching over 1.5 billion patients by 2030.

Asian Paints: The company has acquired further 11% of the equity share capital of White Teak (earlier known as Obgenix Software Private Limited) for a consideration of Rs. 54 crores (approx.) from the promoters of White Teak. With this acquisition, Asian Paints now holds 60% of equity share capital of White Teak, and White Teak has become a subsidiary of the company.

RattanIndia Power: Kotak Credit Funds has invests Rs 732 crore In in the non-convertible debentures of RattanIndia Power. Out of this total amount of Rs 732 crore, Kotak Strategic Situations India Fund II has invested Rs 582 crore, and Kotak Private Credit Fund has invested Rs 150 crore

Landmark Cars: The company said in an exchange filing that Sanjay Karsandas Thakker, Hindu Undivided Family Promoter Group, has sold an aggregate of 5,60,094 equity shares of the company for charity and personal reasons.

Granules India: The company said that its Jeedimetla facility located at Hyderabad has successfully completed the USFDA’s surveillance inspection with zero observations. The inspection happened form June 19–2, 2023. Jeedimetla facility manufactures active pharmaceutical ingredients (API) and pharmaceutical formulation intermediates (PFIs).

Lupin: The drugmaker announced the launch of Rufinamide Oral Suspension in the United States market. The said drug is a generic equivalent of Banzel Oral Suspension of Janssen Eisai Inc. Rufinamide prevents and controls seizures in people with epilepsy by calming overactive nerves in the body. According to IQVIA MAT April 2023, Rufinamide Oral Suspension had estimated annual sales of $72 million in the U.S.

Aurobindo Pharma: The company’s wholly owned subsidiary, Eugia Pharma Specialities, has entered into a voluntary sub-licensing agreement with Medicines Patent Pool (MPP), to develop and market Nilotinib capsules. Nilotinib capsules were originally developed by Novartis, for the treatment of chronic myeloid leukemia (CML).

Orchid Pharma: Shares of the company was locked in an upper circuit of 5% after the company said that its board has approved the opening of qualified institutional placement (QIP) of equity shares with the floor price of Rs 425.19 per share. A meeting of the board of directors is scheduled to be held on or after 27 June 2023, to consider and and determine the issue price for the equity shares to be allotted to qualified institutional buyers.

Man Infraconstruction: Shares of the company rose after the company said that it has received letter of acceptance (LoA) worth Rs 680 crore from Bharat Mumbai Container Terminal (BMCTPL) for Jawaharlal Nehru Port (JNPT) Container Terminal Works.

Saregama India: The NCLT gave the green signal for the demerger of the company’s e-commerce distribution business. The National Company Law Tribunal (NCLT) approved the demerger of Saregama India’s e-commerce distribution business along with identified non-core assets, into Digidrive Distributors Ltd., according to the NCLT order. The demerged company intends to create a ‘specialized master distributor’ for retailing all its physical products, including Carvaan, on digital marketplaces, the order said.

Shilpa Medicare: The company’s board has approved issuing equity shares worth up to Rs 325 crore via rights issue, and also has approved scheme of amalgamation of arm Shilpa Therapeutics with the company.