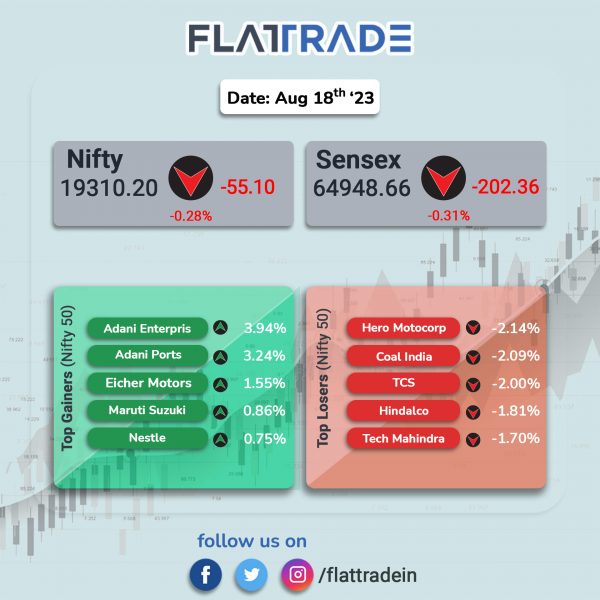

Headline equity indices closed lower due to weak global cues and strong selling in technology-related stocks. The Sensex fell 0.31% and the Nifty 50 index dropped 0.28%.

In broader markets, the Nifty Midcap 100 index lost 0.21% and the BSE Smallcap index shed 0.23%.

Top losers were IT [-1.47%], Realty [-0.73%], Healthcare [-0.67%], Pharma [-0.57%], and Consumer Durables [-0.51%]. Top gainers were Media [0.65%], PSU Bank [0.23%], FMCG [0.22%], and Metal [0.20%].

The Indian rupee appreciated 4 paise to close at 83.11 against the US dollar on Friday.

Stock in News Today

Reliance Industries (RIL): Shares of the company advanced after the company confirmed that Jio Financial Services listing date is on August 21, 2023. The issued, subscribed and paid-up equity capital consists of 635 crore shares of face value Rs 10 each aggregating to Rs 6,353 crore.

Adani Energy Solutions (Adani Transmission): The company said in an exchange filing that it is not engaged in any discussion with Abu Dhabi National Energy Company, known as TAQA, for investments up to $2.5 billion in Adani Group firms. Shares of three Adani Group stocks had risen after media reports said that TAQA showed interest in investing in Adani Group companies.

Route Mobile: The company said that its wholly owned subsidiary, Route Mobile (UK), has signed an agreement with Vodafone Idea (VIL) for VIL’s International A2P SMS traffic. Under the agreement, Route Mobile will provide comprehensive A2P monetization solutions to VIL by deploying its Artificial Intelligence/Machine Learning (AI/ML) driven analytical firewall solution, an SMS Hub on the VIL network, and aggregating international A2P SMS traffic on the VIL network.

Lupin: The pharma company said that it has acquired German brands Ondero and Ondero–Met from Boehringer Ingelheim International for a cash consideration of €26 million.

Dilip Buildcon: The company received a letter of acceptance (LoA) through its joint venture, Dilip Buildcon – Vijay Kumar Mishra Construction from Water Resource Department in Mandsaur, Madhya Pradesh. The LoA includes construction of Malhargarh Pressurized Micro lifting major irrigation project at a cost of Rs 699.03 crore. The project is expected to be completed within 36 months, and after completion of the project, its management, operation and maintenance (MOM) is for a period of 5 years.

Jubilant Ingrevia: The company said that its board has approved a proposal for raising funds up to Rs 600 crore by issuance of commercial paper, according to its exchange filing.

Indian Hume Pipe: The company has secured a water supply project worth Rs 639 crore from Odisha Government. The project entails building of piped water supply in Puri (Odisha), with five years of operation and maintenance. The project is expected to be completed in two years.

Mahindra & Mahindra (M&M): The automaker has received Rs 14.31 lakh penalty notice from the CGST and Central Excise Commissionerate. The penalty is imposed for availing input tax credit wrongly while transitioning from excise to GST regime by Mahindra Vehicle Manufacturers.

HP Adhesives: The company said that its board will meet on Monday (September 4) to consider a proposal for alteration of equity share capital of the company by way of sub-division/splitting its existing equity shares.

Confidence Petroleum India: The company said it has expanded its total number of Auto LPG Dispensing Stations to 248, enhancing accessibility for cars and auto rickshaws. The company recently unveiled 13 new Auto LPG Dispensing Stations (ALDS) to their network. The expansion is aimed at catering to the growing demand from car owners and auto rickshaw drivers.

Yatharth Hospital: The company’s consolidated net profit jumped 73% to Rs 190 crore in Q1FY24 as compared with Rs 110 crore in Q1FY23. Revenue from operations jumped 39% to Rs 154.50 crore during the quarter under review as against Rs 111.10 crore posted in corresponding quarter last year. EBITDA stood at Rs 414 crore, up 61% as compared with Rs 257 crore recorded in same quarter last year. Shares of the company closed 9.43% higher to Thursday’s closing.

Punjab & Sind Bank: The lender said that CRISIL Ratings has revised its rating outlook for the tier-II bonds (under Basel III) of the bank to ‘stable’ from ‘negative’ and reaffirmed the rating at ‘CRISIL AA’. The rating agency attributed the revision to sustained improvement in earnings and asset quality, as well as strengthening of capital position.

Shree Renuka Sugars: Rating agency India Ratings and Research (Ind-Ra) has upgraded the company’s long-term issuer rating to ‘IND A’ from ‘IND A-‘ with ‘stable’ outlook. Ind-Ra stated that the higher rating reflects the improvement in the company’s business and financial profile in FY23, led by an improvement in the profitability and successful commencement of expanded distillery operations.

Concord Biotech: The company had a strong stock market debut on Friday. The company shares got listed at 21.4% premium to its issue price. The shares were listed at Rs 900 apiece on NSE as against a n issue price of Rs 741. The shares hit a high of Rs 987.7 and closed at Rs 942.8 on the NSE.

Sula Vineyards: The company in an exchange filing said that its wine tourism business achieved a record-breaking sales during the long weekend as visitor attendance surged at the Nashik and Bengaluru wine tourism facilities between August 12 and August 14. Revenues over the three days touched Rs 2.08 crore, 40% higher than the previous three-day record of Rs 1.47 crore. Shares of the company rose over 4% in intraday trading.