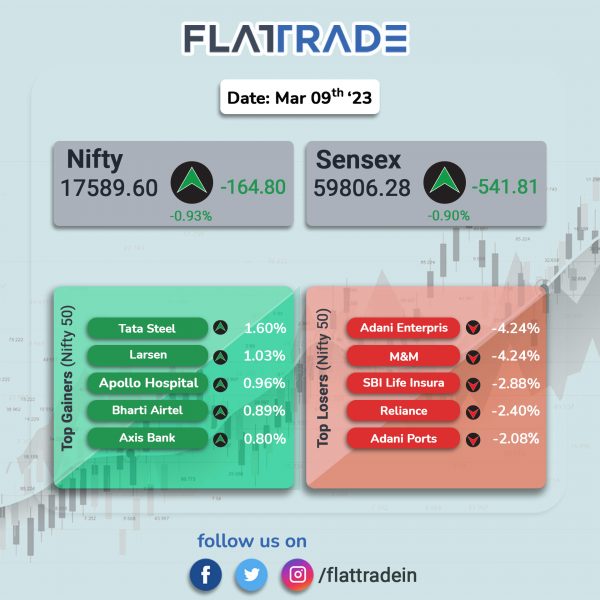

Dalal Street ended lower on weak global economic growth concerns and investors adjusting their positions amid the weekly F&O expiry. The Sensex tanked 0.9% and the Nifty 50 index slumped 0.93%

In broader markets, the Nifty Midcap 100 index lost 0.55% and the BSE Smallcap was down 0.2%.

Top losers were Auto [-1.83%], Consumer Durables [-1.22%], Realty [-1.17%], PSU Bank [-1.13%] and IT [-1.08%]. Almost all Nifty sectoral indices closed lower.

Indian rupee rose 8 paise to 81.97 against the US dollar on Thursday.

Stock in News Today

Reliance Jio: Radisys Corporation, a wholly-owned subsidiary of Reliance Jio Platforms has signed definitive aggreements to acquire Mimosa Networks from Airspan Networks Holdings for $60 million on a debt free, cash free basis. Mimosa’s product development, manufacturing, and sales teams of 56 employees will continue with Mimosa following the acquisition by Radisys. The acquisition will further accelerate Jio’s innovation and leadership in the production of telecom network products that deliver value to consumers and enterprises across the globe with cost-effective, rapidly deployable fixed and mobile broadband, said Mathew Oommen, president of Jio.

Tata Consultancy Services (TCS): The IT company is in the final stage of closing a deal with Marks & Spencer (M&S), according to The Economic Times report. (ET), TCS plans to close the deal worth $1 billion in the next few weeks. In addition to this, TCS is also working towards renewing their existing five-year engagement with the UK-headquartered company. The new deal may include payments for business process services and digital transformation programmes, among others, the report said.

IndiGo: The airline has appointed Mark Sutch as the new Chief Commercial Officer of CarGo International. Mark has 25 years of airline industry experience across different verticals, including extensive cargo experience. Mark’s most recent assignment was as Chief Commercial Officer with CMA CGM Air Cargo based in Marseille. Prior to that he was with Cathay Pacific Airways, including being based for five years in Mumbai as the airline’s Regional General Manager for South Asia, Middle East and Africa, said the airline.

Religare Enterprises: Shares of the company rose after the company said that its subsidiary, Religare Finvest (RFL), has completed the entire one time settlement (OTS) payment of Rs 2,178 crore to sixteen OTS lenders. RFL will receive the No-Dues Certificates (NDC) from the OTS lenders as per the terms of the OTS agreement. The settlement shall pave the way for restarting of business of RFL and focusing on building a niche in the MSME lending space.

Earlier, RFL was facing a significant asset-liability mismatch and to overcome the same, various steps have been taken for revival including a OTS proposal to the lenders.

Paytm: The company’s payments bank arm has gone live with UPI LITE, a feature enabled by the National Payments Corporation of India (NPCI) for multiple small-value UPI transactions, thus empowering its users with lightning fast UPI payments. With this, users can activate their UPI LITE accounts linked to their Paytm Payments Bank savings accounts for hassle-free transactions. A maximum of Rs 2,000 can be added twice in a day to UPI LITE, making the cumulative daily usage up to Rs 4,000.

Glenmark Pharma: The drugmaker said that it has entered into an exclusive supply and distribution agreement with Cediprof to supply and distribute the latter’s USFDA approved drugs. The agreement is for Cediprof’s FDA-approved Dextroamphetamine Saccharate, Amphetamine Aspartate, Dextroamphetamine Sulfate and Amphetamine Sulfate tablets. Glenmark expects to commence distribution of the product in the US during the second half of 2023. According to IQVIA sales data for the 12-month period ending January 2023, the Adderall tablets achieved annual sales of approximately $389.8 million.

Godrej & Boyce Manufacturing Company: The company’s net profit declined 90.59% to Rs 21.42 crore in the quarter ended December 2022 as against Rs 227.62 crore during the quarter ended December 2021. Sales rose 6.94% to Rs 3382.22 crore in the quarter ended December 2022 as against Rs 3162.75 crore during the quarter ended December 2021.

JSW Steel: The company reported a standalone crude steel production at 17.32 lakh tonnes in February 2023, a growth of 10% YoY. The company’s achieved crude steel production of 15.80 lakh tonnes in February 2022. The production of flat steel rolled products rose 9% YoY to 12.57 lakh tonnes, while production of long steel rolled products rose 2% YoY to 3.75 lakh tonnes in February 2023.

HFCL: The company announced its collaboration with Microsoft to roll out private 5G solutions for enterprises. In an exchange filing, the company said that with the rapid roll-out of 5G in India, enterprises are looking at 5G technology to further their digital transformation.

Sonata Software: The company has announced that it has signed a Global Gold Services partnership agreement with Sinequa, the leading enterprise search cloud company. The said partnership will enable Sonata to offer its customers a powerful intelligent search solution on which knowledge-intensive organizations can support enterprise-wide search and develop customized domain and situational applications.

Power Grid Corporation of India: The PSU has been declared as successful bidder under Tariff Based Competitive Bidding to establish Inter-State Transmission System for Transmission System Strengthening Scheme for Evacuation of Power from Solar Energy Zones in Rajasthan (8.1 GW) under Phase-II Part-E on build, own operate and maintain basis.

The company’s board has approved issuance of bonds having base size of up to Rs 300 crore and green shoe option up to Rs 600 crore. Power Grid will issue unsecured, non-convertible, non-cumulative, redeemable, taxable PowerGrid bonds-LXXI aggregating up to Rs 900 crore on private placement basis. The company said that the funds will be utilized for securitization of cashflows of 10 years, which is till FY 2032-33 of its operational special purpose vehicle (SPV), Power Grid Mithilanchal Transmission.

The Great Eastern Shipping Company: The company’s wholly-owned subsidiary Greatship (India) has taken delivery of a 2007 built 80T Anchor Handling Tug cum Supply Vessel (AHTSV), Greatship Amaira. The Company had contracted to buy the vessel in January 2023.

G R Infraprojects: The civil construction company announced that it has been emerged as lowest (L‐1) bidder for a tender by National Highways Authority of India (NHAI) under Bharatmala Pariyojana in Bihar on hybrid annuity mode. The scope of the project entails construction of six lane greenfield Varanasi‐Ranchi‐Kolkata Highway from Anarbansalea village to Sagrampur village in Bihar. The project cost stood at Rs 1,248.37 crore. The construction is expected to be completed in 730 days from appointed date and the operation period is 15 years from the commercial operation date.

Magellanic Cloud: The company’s board has approved allotment of 11,33,500 equity shares aggregating to Rs 44.77 crore on preferential basis. The face value is set at Rs 10 per share and the issue price is Rs 395 per share.

Datamatics Global Services: The company said that it has successfully launched a ready-to-configure connector in Workato for its Robotics Process Automation tool TruBot, which will offer pre-built integration with 1000+ enterprise applications. The launch of the connector in Workato’s app directory further strengthens the reach of Datamatics’ intelligent automation platform, enabling businesses to seamlessly integrate their apps and automate their critical tasks without coding.

Kabra Extrusiontechnik: The company said that it has acquired 100% of the equity of Kolsite Energy at a total consideration of Rs.10,000. Kolsite Energy will be used as a Special Purpose Vehicle for setting up a new manufacturing plant in North India for manufacturing Lithium-ion battery packs.

Muthoot Finance: The company’s board has approved raising funds up to Rs 6500 crore by issuance of redeemable Non-Convertible Debentures through private placement which shall be issued in one or more tranches.

Aptus Value Housing Finance India: The company has denied being part of any negotiation to handover management control to Cholamandalam. Shares of the company closed 6.9% lower.

LT Foods: The company has completed the acquisition of 56,55,341 equity shares of Daawat Foods Ltd. from United Farmers Investment Company.