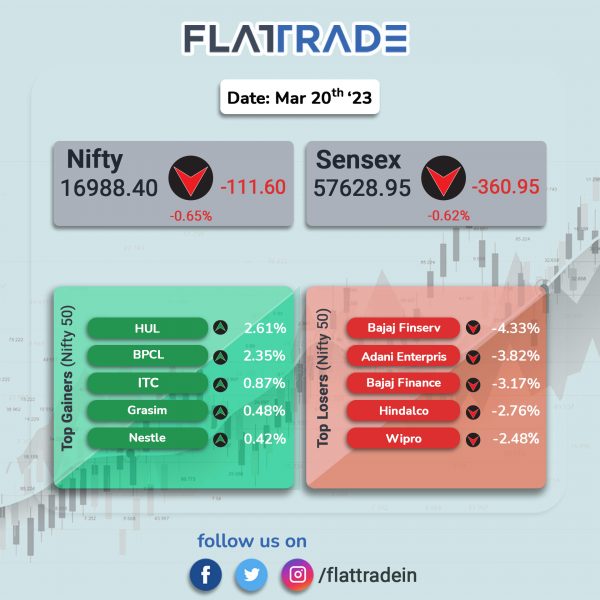

Benchmark indices pared some losses but ended in the red, weighed by losses in metal, public sector bank and IT stocks. The Sensex closed 0.62% and the Nifty was down 0.65%. In daily chart, the Nifty has formed a hammer candlestick pattern.

In broader markets, Nifty Midcap 100 index was down 1.03% and the BSE Smallcap fell 0.99%.

Among Nifty sectoral indices, the top losers were Metal [-2.35%], PSU Bank [-1.74%], IT [-1.43%], Realty [-1%] and auto [-0.93%]. Top gainers were FMCG [0.79%] and Media [0.12%].

Indian rupee fell 8 paise to 82.63 against the US dollar on Monday.

Stock in News Today

Reliance Industries Ltd (RIL): The company shares have hit a new 52-week low of Rs 2180 apiece due to negative domestic cues. Shares of the company recouped some losses but closed 0.98% lower at Rs 2201.25 apiece on the NSE compared to previous day closing price.

Mahindra and Mahindra (M&M): The company has completed the acquisition of MITRA Agro Equipments by increasing its shareholding from 47.33% to 100%. M&M bought venture capital Omnivor’s full stake in the company, which was one of its first institutional investors in MITRA. MITRA plans to accelerate the expansion of its product portfolio and its network in India and overseas markets after the acquisition.

Tata Steel (TSL): The company said it has acquired 1,55,34,738 equity shares of its wholly owned subsidiary, Tata Steel Advanced Materials (TSAML) for Rs 19.90 crore. TSL has ventured into new materials business (NMB) in areas of composites, graphene, medical materials amongst others. On completion of the said transaction, TSL holds 75.94% stake in TSAML and the balance 24.06% stake will be held by Tata Steel Downstream Products.

Cochin Shipyard: The company has bagged an international order from NAVSHUTTLE 1 AS and NAVSHUTTLE 2 AS, Lysaker Norway, for the construction of two zero emission feeder container vessels with an option for two more vessels. The total project cost is about Rs 550 crore and the first vessel is to be delivered in 28 months and the second will be delivered within 34 months. NAVSHUTTLE 1 AS and NAVSHUTTLE 2 AS are part of the Samskip Group, headquartered in the Netherlands.

Radico Khaitan: The company unveiled its newest whisky from Rampur Distillery, Sangam World Malt Whisky at ProWein 2023 in Dseldorf. Sangam World Malt Whisky will be launched in the USA, at a retail price of $64.99 to $69.99 for a 70cl bottle and also in the EU, UK, Singapore, Australia and Travel Retail with shipments starting from April 2023.

Paras Defence and Space Technologies: The company announced that it has secured an order around Rs 64 crore for Avionics Suite for Saras MK-2 Aircraft from Council of Scientific & Industrial Research (CSIR) – National Aerospace Laboratories (NAL). The PSU company said that the diliveries of Avionics Suite for Saras MK-2 Aircraft will be done in FY24.

Ahluwalia Contracts (India): The company announced that it has secured an order worth Rs 723.34 crore for construction of cancer hospital building in Mumbai. The project involves construction of cancer hospital building – platinum jubilee block for Tata Memorial Centre at Parel, Mumbai. with this, the order inflow during the FY23 stands at Rs 5,056.97 crore.

Fiem Industries: The company informed that it has signed an MoU with Gogoro India, a group company of Gogoro Taiwan, to expand its product portfolio in 2-wheeler electric vehicles (EV) segment. In addition to lighting & rear view mirror business, Fiem Industries will manufacture hub motor assembly, electric control unit (ECU) and motor control unit (MCU) for Gogoro. In terms of MoU, Gogoro will provide the technical know-how and other support in setting up manufacturing facility as well as production, quality and testing support for above new product line.

Unichem Laboratories: The company’s board has approved the appointment of Priti Puri as an Additional Non-executive Independent Director of the Company w.e.f. 21 March 2023 for a period of three (3) years, subject to the approval of the shareholders.

Godawari Power & Ispat: The company announced that its board has approved a share buyback of upto Rs 250 crore at a price of Rs 500 per equity share through tender offer route. The maximum buyback price is Rs 500 apiece representing a 28.77% premium to Friday’s closing price of Rs 388.30 on the BSE. The record date for the buyback is 31 March 2023. The company will buyback up to 50 lakh equity shares of face value of Rs 5 each.

Sumitomo Chemical India: The company has announced that the Gujarat Pollution Control Board (GPCB) has revoked the closure issued to the company’s Bhavnagar site for three months. In February 2023, a fire accident had occurred at the company’s Bhavnagar site after which GPCB had issued closure order for the site.

Westlife Foodworld: The company which operates McDonald’s restaurants in Western and Southern India has announced the elevation of Saurabh Kalra as the Managing Director (MD) of its subsidiary. Prior to this, Saurabh was the Chief Operating Officer (COO) of the organization. In this new role, Saurabh will focus on the overall business strategy and growth opportunities, driving the company’s long-term success while continuing to remain deeply involved in day-to-day operations.

Navin Fluorine International: The board of company’s subsidiary NFASL gas approved capex of Rs 450 crore. The capital will be used for setting up a 40,000 tonne per annum hydrofluoric acid capacity at Dahej. The company has an AHF manufacturing plant with a capacity of approximately 20,000 tonnes per annum at Surat. The new capacity is expected to come on stream in two years.

Garware Technical Fibres: The company has entered into an agreement with solar power generation company TP Bhaskar Renewables to acquire its 26% equity shares for Rs 4.5 crore. The 26% stake acquisition will enable Garware to become a captive user of solar power generated by TP Bhaskar Renewables.

Dr Lal PathLabs: The National Company Law Tribunal’s Ahmedabad bench has sanctioned the Scheme of Amalgamation between Dr Lal PathLabs and APL Institute of Clinical Laboratory & Research, a wholly owned subsidiary of Dr Lal PathLabs.