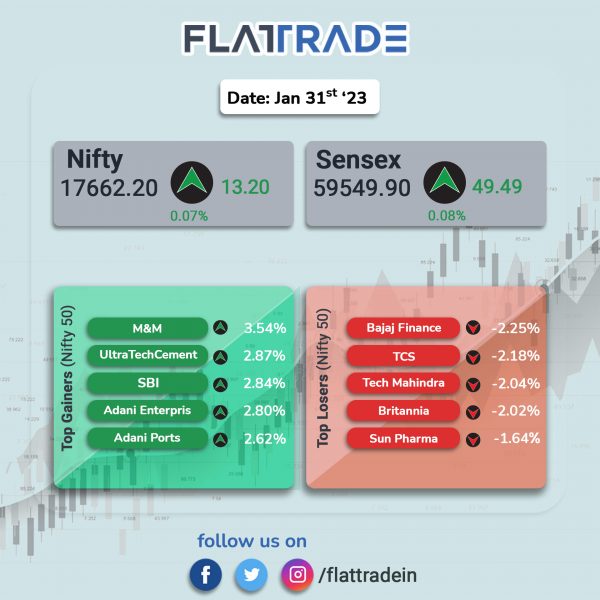

Benchmark indices closed nearly flat ahead of the Union Budget as gains in PSU Bank and Auto stocks were offset by losses in IT, Pharma and Oil & Gas stocks. The Sensex inched up 0.08% and the Nifty gained 0.07%.

Broader markets outperformed headline indices. The Nifty Midcap 100 index jumped 1.63% and the BSE Smallcap surged 2.21%.

Top gainers were PSU Bank [4.28%], Media [2.37%], Auto [1.89%], Metal [1.52%] and Energy [1.19%]. Top losers were IT [-1.18%], Oil & Gas [-1.12%] and Pharma [-0.99%].

Indian rupee fell 42 paise to 81.92 against the US dollar on Tuesday.

The Economic Survey for 2022-23 has pegged India’s real GDP growth for the next fiscal 2023-24 in a broad range of 6-6.8% depending on global economic and political developments. The Economic Survey for 2022-23 was tabled in Parliament on Tuesday by finance minister Nirmala Sitharaman.

Stock in News Today

Adani Enterprises: The company’s FPO was fully subscribed at 1.03 times. The QIB portion was subscribed 0.97 times, while NII portion was subscribed 2.19 times and retail portion subscribed 0.09 times. The FPO closes on January 31.

Indian Oil Corp Ltd (IOCL): The oil marketing company reported a net profit of Rs 448 crore in Q3FY23 as against a loss of Rs 272 crore in Q2FY23. Its revenue stood at Rs 2.04 lakh crore as against 2.07 lakh crore in the preceding quarter. The company’s EBITDA stood at Rs 3,594 crore in the reported quarter as against Rs 1961 crore in the quarter ended September 2023.

Sun Pharmaceutical Industries: The drugmaker posted a net profit of Rs 2,166 crore in Q3FY23, up 5.2% from Rs 2058.8 crore in Q3FY22. The revenue rose 14% to Rs 11,241 crore in Q3FY23 from Rs 9,863 crore in Q3FY22. Its EBITDA rose 15.3% to Rs 3,004 crore from Rs 2,606.3 crore in the year-ago period.

Godrej Consumer Products: The net profit rose 3.5% to Rs 546.3 crore in Q3FY23 from Rs 527.6 crore in Q3FY22. The revenue rose 9% to Rs3598.9 crore from Rs 3302.6 crore in the same quarter last fiscal. The company’s EBITDA climbed 8.8% to Rs 726.6 crore in Q3FY23 from Rs 668 crore in the year-ago period. During the quarter, the India business sales rose by 11% to Rs 1,975 crore and volume grew by 3%. While the Home Care category recorded a rise of 10%, Personal Care category reported a growth of 14%.

Mindspace Business Parks REIT: The net profit of the realty company declined 14.90% to Rs 115.90 crore in the quarter ended December 2022 as against Rs 136.20 crore during the quarter ended December 2021. Revenue was up 26.65% to Rs 558.90 crore in the quarter ended December 2022 as against Rs 441.30 crore during the quarter ended December 2021.

Lupin: The company announced that it has received tentative approval from the United States Food and Drug Administration (USFDA) under the US President’s Emergency Plan for AIDS Relief (PEPFAR) for its New Drug Application for Dolutegravir, Emtricitabine and Tenofovir Alafenamide (DETAF) Tablets. The product will be manufactured at Lupin’s Nagpur facility in India. DETAF would be a welcome new addition in the management of HIV infections and will be available for supplies to low- & middle-income countries.

Godrej Properties: The company rose 1.10% to Rs 1176.90 after the company announced that it has entered into an agreement for outright purchase of a land parcel in the fast-developing micro market of Khalapur in Raigad, Maharashtra. The land is spread across 89 acres, and the proposed project is located near Imagicaa Theme Park. It is estimated to have a development potential of approximately 1.9 million square feet of saleable area comprising primarily of residential plotted development.

TTK Prestige: The company’s net profit fell 35.6% to Rs 58.4 crore in Q3FY23 from Rs 90.7 crore in Q3FY22. Its revenue was down 9.2% YoY to Rs 694.8 crore in Q3FY23 as agaisnt Rs 765.3 crore in Q3FY22. Its EBITDA slumped 38.2% to Rs 80 crore as against Rs 129.3 crore in the year-ago period.

Hester Biosciences: The company said its net profit jumped 32.1% to Rs 11.1 crore in Q3FY23 from Rs 8.4 crore in Q3FY22. The company’s revenue rose 34.7% to Rs 74.9 crore in Q3FY23 as against Rs 55.6 crore in the year-ago period. The company’s EBITDA was up 24.8% to Rs 18.6 crore in the quarter under review from Rs 14.9 crore in the year-ago period.

Andhra Paper: The company’s net profit surged multi-fold to Rs 170.2 crore in Q3FY23 from 37.3 crore in Q3FY22. Revenue soared 64.8% YoY to Rs 570.9 crore in the reported quarter as against Rs 346.5 crore in the year-ago period. Its EBITDA stood at Rs 236.9 crore in the reported quarter as against Rs 62 crore in the same period last fiscal.

Century Textiles: The company’s consolidated net profit fell 44.33% to Rs 6.77 crore in Q3FY23 from Rs 12.16 crore in Q3FY22. Net sales was at Rs 1,149.94 crore in Q3FY23, up 9.5% as against Rs 1,049.95 crore in the corresponding quarter last year. EBITDA stood at Rs 91 crore in Q3FY23, down 13.33% from Rs 105 crore reported in Q3FY22. The company’s revenue from Pulp & Paper business jumped 18% to Rs 863 crore in Q3 FY23 as compared to Rs 731 crore registered in Q3 FY22.

Mangalore Chemicals & Fertilizers: The company’s net profit of soared 145.16% to Rs 76.17 crore in the quarter ended December 2022 as against Rs 31.07 crore during the quarter ended December 2021. Revenue jumped 54.03% to Rs 1173.24 crore in the quarter ended December 2022 as against Rs 761.70 crore during the quarter ended December 2021.

Piramal Enterprises: The company’s board has approved to raise up to Rs 500 crore through non convertible debentures on private placement basis. The company said that debentures shall be secured by a first ranking security consisting of charge over the hypothecated properties, designated account assets and such other assets as set out in debenture documents.

Nippon Life India Asset Management: The AMC reported 18% YoY rise in consolidated net profit at Rs 205.2 crore on a 5% YoY increase in revenue from operations to Rs 353.8 crore in Q3FY23. Operating expenditure during the period under review rose by 12% YoY to Rs 149.4 crore. Core operating profit was Rs 204.5 crore in the third quarter as compared with Rs 205.1 crore in the same period last year. The company’s India’s assets under management (AUM) was Rs 3,60,292 crore.

Apar Industries: The company posted a net profit of Rs 170 crore in Q3FY23 from Rs 55 crore in Q3FY22. Its revenue was up 76.9% YoY to Rs 3,942.4 crore from Rs 2,228.8 crore in the year-ago perio. EBITDA stood at Rs 347.1 crore in Q3FY23 as against Rs 115.7 crore in Q3FY22. EBITDA margin stood at 8.8% in the reported quarter comapred with 5.2% in the corresponding quarter last fiscal.