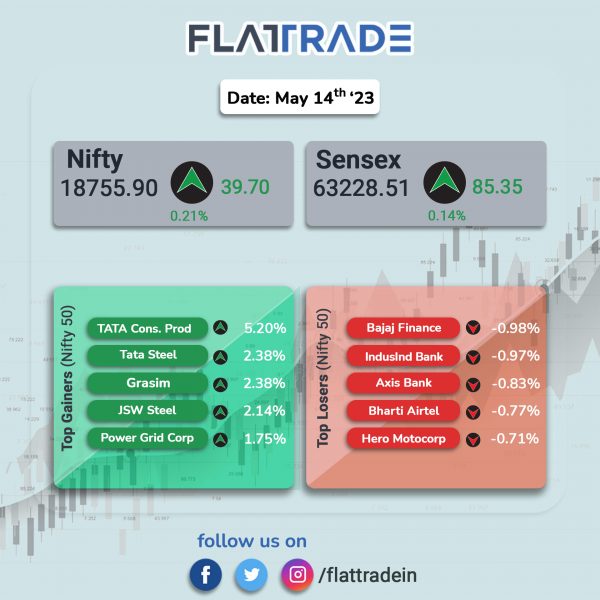

Dalal Street ended with modest gains as investors remained cautious ahead of the US Federal Reserve’s interest rate decision. The Nifty 50 index gained 0.21% and the Sensex rose 0.14%.

In broader markets, the Nifty Midcap 100 advanced 0.21% and the BSE Smallcap index climbed 0.42%.

Top gainers were Metal [1.42%], Energy [0.98%], Oil & Gas [0.91%], FMCG [0.59%], and Realty [0.28%]. Top losers Media [-0.56%], Private Bank [-0.42%], Financial Services [-0.26%], Bank [-0.21%], and IT [-0.15%]

Indian rupee appreciated significantly by 29 paise to close at 82.10 against the US dollar on Wednesday.

On the economic front, Wholesale Price Index-based inflation (WPI) fell to -3.48% in May 2023 compared to -0.98% in April. The decline in inflation can be attributed to a fall in prices of basic metals, food products, textiles, crude petroleum and natural gas, among other, according to the press release by Ministry of Commerce and Industry release. Further, WPI-based food inflation fell to -1.59% in May, from 0.17% in April.

Stock in News Today

Tata Consumer Products: Shares of the company soared 5.2% on NSE on positive growth outlook and heavy volumes. In September 2021, the company shares touched a high of Rs 892 per share. The management said the company will continue to drive sustainable profitable growth and also scaling the new growth businesses through higher brand investments and expanding the distribution network, among other initiatives.

Adani Group: The group is in talks with lenders, including global banks, as it seeks to refinance up to $3.8 billion of a loan facility taken for its acquisition of Ambuja Cements last year, Bloomberg reported citing people familiar with the matter. The ports-to-power conglomerate owned by Gautam Adani is mulling whether to convert the original loan into debt with a longer maturity period, the report said. Banks such as Barclays, Deutsche Bank, Standard Chartered and Mitsubishi UFJ Financial Group are in talks to participate in the deal, the sources said.

Infosys: Keytrade Bank, the first online bank in Belgium and part of Credit Mutuel Arkea, has selected Infosys Finacle as the preferred partner for the modernization of its core banking system. The bank will subscribe to the Infosys Finacle suite in a software-as-a-service (SaaS) mode on the Microsoft Azure public cloud. Infosys Finacle is a part of EdgeVerve Systems, a wholly-owned subsidiary of Infosys.

KEC International: The infrastructure EPC major has secured new orders worth Rs 1,373 crore across its various businesses, namely, railways, civil, transmission & distribution (T&D), and cables.

One97 Communications (Paytm): Shares of the company rose over 2% to cross 52-week high and close at Rs 856.85 apiece. Brokerage firm BofA Securities, recently, upgraded the stock to ‘buy’ citing its dominant position in the payment industry and also upgraded the target price to Rs 885 apiece.

Vodafone Idea: Shares of the company rose 2.6% after reports said that the promoters of the company are planning to infuse funds in the debt-ridden telecom company. The promoters — Aditya Birla Group (ABG) and UK’s Vodafone Group Plc — could likely infuse Rs 14,000 crore in the Indian telecom company.

Central Depository Services (CDSL): Shares fell 6% in intraday trade after media reports said that BSE sold 56.3 lakh shares, or 5.4% equity stake, worth Rs 586 crore in the company. The shares were reportedly offered at an average of Rs 1,000 each. BSE held 20% in Central Depository Services (India) (CDSL) as on March 2023.

Ipca Laboratories: The company announced that the USFDA had concluded its inspection at its Madhya Pradesh-based APIs manufacturing facility with 11 observations. The USFDA conducted the inspection from 5th to 13th of June 2023. The company plans to submit a comprehensive response on these observations to the USFDA within the stipulated time and shall work closely with the agency to resolve these issues at the earliest, Ipca Labs said in a regulatory filing.

Sonata Software: The company announced that it has incorporated a wholly owned subsidiary (WOS) in Malaysia, Sonata Software Malaysia SDN. BHD. on 13 June 2023 to provide end‐to‐end solutions to information technology services. The paid-up share capital of Sonata Malaysia is MYR 10,000 (10,000 equity shares of MYR 1 each) for which no government/ regulatory approval is required.

Dhampur Sugar Mills: The company announced that it has completed expansion of its grain-based distillery capacity of 100 kilo litre per day (KLPD) at its unit located at Dhampur, Bijnor in Uttar Pradesh. This enhanced capacity will be interchangeable between molasses, syrup and grain and it will facilitate better utilization of distillery capacity, it added.

Dev Information Technology: The company, in an exchange filing, said that its board will meet on Friday (June 16) to consider raising funds through preferential issue on a private placement basis, qualified institutions placement, rights issue.

Pricol: Shares of the company rose over 4% in intraday trading after the company’s promoters increased their stake by 0.58% via open market. Pricol disclosed in a regulatory filing that promoter group companies Pricol Engineering Industries and Pricol Logistics acquired 210,000 and 500,000 shares, respectively.

Ramkrishna Forgings: The company has received an order to supply undercarriage parts to an European railway passenger coach manufacturer. The contract is valued at 4.5 million euros and is set to be fulfilled within a span of two years.

Heranba Industries: The company announced the revocation of closure order issued by the Gujarat Pollution Control Board (GPCB) to the company’s Vapi plant. In May 2023, the GPCB had issued an order instructing the company to prohibit and close the operation at its Vapi’s Plant Unit-I and GPCB had laid down certain conditions to be fulfilled by the company.

IndInfravit Trust: The company’s board approved the allotment of 1,37,500 senior, secured, listed, rated, redeemable and non-convertible debentures (NCDs) of a face value of Rs 1 lakh each aggregating to Rs 1,375 crore on private placement basis.