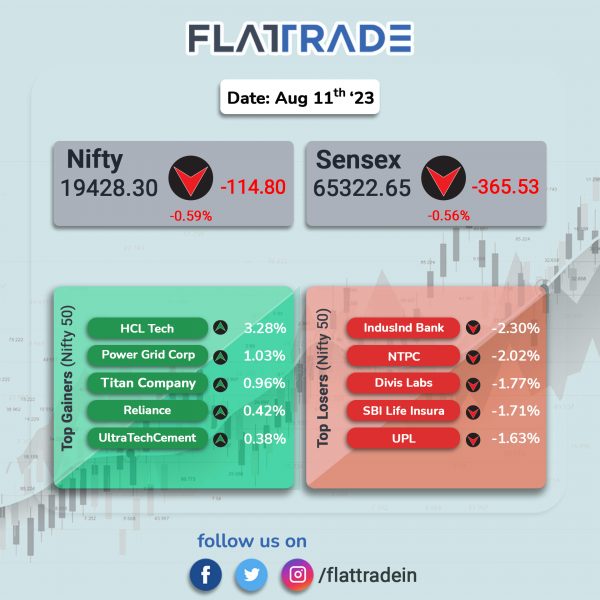

Dalal Street ended lower on Friday due to selling pressure across sectors and as investors remained cautious ahead of inflation data next week. The Sensex fell 0.56% and the Nifty ended 0.59%.

In broader markets, the Nifty Midcap 100 index dropped 0.45% and the BSE Smallcap lost 0.31%.

Top losers were Media [-1.83%], Pharma [-1.45%], Healthcare [-1.39%], Private Bank [-0.99%], and Financial Services [-0.87%]. Top gainer was only PSU Bank [1.25%] index.

The Indian rupee fell 14 paise to 82.84 against the US dollar on Friday.

Stock in News Today

Adani Group: Adani Ports and SEZ as well as Adani Airport Holdings are in talks with merchant bankers to raise up to Rs 1,500 crore, each, through local currency bonds, Reuters reported citing sources. The companies are likely to issue five-year bonds as soon as September, the report said, adding, Adani Enterprises and Adani Electricity Mumbai are also mulling possible debt issues.

Apollo Hospitals: The healthcare chain said its consolidated net profit dropped 47.48% to Rs 166.6 crore in Q1FY24 as compared to Rs 317.2 crore in Q1FY23. Revenue from operations stood at Rs 4,417.8 crore during the quarter, up 16.39% from Rs 3,795.6 crore recorded in the same period last fiscal. During the quarter, the company’s revenue from Healthcare Services was Rs 2,310.7 crore (up 13.71% YoY) and revenue from Digital Health & Pharmacy Distribution was Rs 1,805.4 crore (up 22.05% YoY) and the revenue from Retail Health & Diagnostics stood at Rs 318.7 crore (up 8.77% YoY).

Info Edge (India): The company reported a standalone net profit of Rs 199.90 crore in Q1FY24, up 35% from Rs 148.42 crore recorded in Q1FY23. Revenue from operations jumped 15.1% to Rs 584.29 crore during the quarter under review as against Rs 507.65 crore in corresponding quarter last year. Its standalone operating profit grew 37% to Rs 208.9 crore in the reported quarter.

Raymond: The textile company’s Q1FY24 consolidated revenue was up 2.5% at Rs 1771.46 crore as against Rs 1728.14 crore in Q1FY23. EBITDA fell 5.7% to Rs 196.63 crore in Q1FY24 from Rs 208.48 crore in Q1FY23. Consolidated net profit stood at Rs 1,065.27 crore in Q1FY24 as against Rs 80.9 crore in Q1FY23.

Zydus Lifesciences: The company revenue was up 29.65% at Rs 5139.6 crore in Q1FY24 as against Rs 3964.3 crore in Q1FY23. Net profit soared 109.7% at Rs 1,086.9 crore in Q1FY24 from Rs 518.3 crore in Q1FY23. EBITDA was up 80.7% at Rs 1,505.3 crore in Q1FY24 as against Rs 833 crore in Q1FY23. Revenue from US formulations business was at Rs 2,454.1 crore up 57% YoY. The business accounted for 48% of consolidated revenues. In constant currency terms, the business registered revenues of $298 million. Revenue from emerging markets (EM) and Europe formulations business jumped 30% YoY to Rs 489.3 crore in Q1FY24, The business accounted for 10% of consolidated revenues.

Container Corporation of India (CCI): The company’s consolidated net profit slipped 17.3% to Rs 245.56 crore in Q1FY24 from Rs 297.08 crore in Q1FY23. Revenue from operations fell 3.6% YoY to Rs 1,922.84 crore during the period under review. Meanwhile, the company’s board has declared an interim dividend for FY24 of Rs 2 per equity share and the record date is August 19 and will be paid to eligible shareholders on or after August 25.

SJVN: The company announced that its wholly owned subsidiary SJVN Green Energy (SGEL) has bagged 90 MW Solar Power Project from REWA Ultra Mega Solar (RUMSL). The company bagged the full quoted capacity of 90 MW (unit- B) floating solar project at Rs 3.79 per unit on build own and operate (BOO) basis. The floating solar project (FSP) project shall be developed by SGEL at the Omkareshwar reservoir, Madhya Pradesh through EPC contract. The tentative cost of construction and development of this project is Rs 610 crore.

Apollo Tyres: Shares of the company tanked over 8% after the company reported lower-than-expected revenue growth in the June quarter of 2023. The revenue from operations for the quarter rose 5% to Rs 6,245 crore in Q1FY24, as against Rs 5,942 crore in the year-ago period. Its consolidated net profit jumped 124% to Rs 397 crore for the June 2023 quarter against Rs 177 crore in the corresponding period last year, driven by lower rubber costs and strong domestic auto sales. The company’s EBITDA stood at Rs 1,087 crore, up 55.19% from Rs 700.42 crore in the June quarter of 2022.

Tilaknagar Industries: The company has pre-paid Rs 176 crore restructured debt of Edelweiss Asset Reconstruction Company. The pre-payment was funded through Rs 130 crore debt from Kotak Mahindra Bank and internal accruals.

Divgi TorqTransfer System: The company has bagged Rs 219 crore order from Mahindra Group to supply product for EV model and the production for the same is expected to commence from Q4FY24. The expected project lifespan is five years.