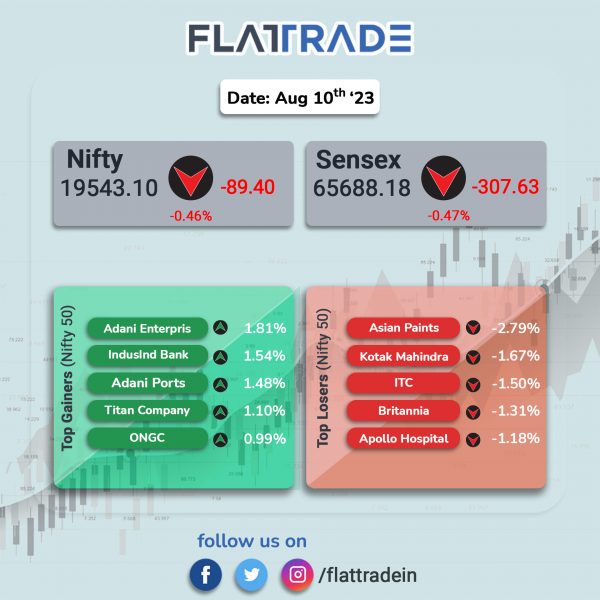

Domestic equity indices closed lower after the central bank projected higher inflation for the current fiscal due to elevated vegetable prices and also said that scheduled banks in India must maintain a 10% incremental cash reserve ratio (ICRR) from August 12 as part of RBI’s measures to absorb excess liquidity from the banking system. The Sensex fell 0.47% and the Nifty dropped 0.46%.

Meanwhile, RBI maintained status quo with respect to Repo Rate and kept the rate unchanged at 6.5% and Standing Deposit Dacility rate will be 6.25%. Marginal Standing Facility Rate stood at 6.75% and Bank Rate is 6.75%. Real GDP growth for FY24 is projected at 6.5% and Consumer Price Index (CPI) based retail inflation is projected at 5.4% for FY24.

In broader markets, the Nifty Midcap 100 index slipped 0.08% and the BSE Smallcap was down 0.15%.

Top losers were FMCG [-0.91%], PSU Bank [-0.81%], Financial Services [-0.77%], Bank [-0.76%], Pharma [-0.74%]. Top gainers were Media [6.63%], Metal [0.68%], and Energy [0.34%].

Stock in News Today

Zee Entertainment Enterprises (ZEE): The National Company Law Tribunal (NCLT) has approved ZEE-Sony deal to create $10 billion media company by rejecting all objections against the merger deal. The court has reserved its order given on July 10. After the merger, Sony will hold a 50.86% stake in the merged entity. The promoters of Zee will hold 3.99% and other Zee shareholders will hold a 45.15 % stake in the combined company. Shares of the company closed 16.88% higher.

Hindalco Industries: The company said that it has entered into a strategic alliance with Texmaco Rail & Engineering to develop and manufacture aluminium rail wagons and coaches for Indian Railways. Both the companies will explore opportunities, where Hindalco will provide profiles, sheets and plates of its unique aluminium alloys, along with fabrication and welding expertise.

Grasim Industries: The company’s consolidated revenue was up 10.8% at Rs 31,065.19 crore in Q1FY24 as against Rs 28,041.54 crore in the year-ago period. Consolidated Ebitda rose 6.2% to Rs 6,356.75 crore in Q1FY24 as against Rs 5,982.84 crore in Q1FY23. Consolidated net profit fell 6.6% to Rs 2576.35 crore in Q1FY24 from Rs 2758.75 crore in Q1FY23.

Pidilite Industries: The company reported a consolidated net profit of Rs 473.69 crore in Q1FY24, up 32.5% YoY and its revenue from operations rose 5.6% YoY to Rs 3,275.11 crore in Q1FY24. The company’s revenue growth was driven by strong volume growth. Consumer & Bazar segment (C&B) grew by 9% with domestic C&B business registering double digit revenue and underlying volume growth, while Business to Business segment (B2B) registered single digit revenue decline due to lower exports.

Page Industries: The company said its revenue was down 7.5% at Rs 1240.03 crore in Q1FY24 as against Rs 1341.26 crore in Q1FY23. Ebitda fell 18.8% to Rs 241.82 crore in Q1FY24 as against Rs 297.76 crore in Q1FY23. The company’s net profit was down 23.5% at Rs 158.3 crore in Q1FY24 as against Rs 207 crore in Q1FY23.

JSW Steel: The company said that its crude steel production rose by 12% YoY to 20.39 lakh tones in July 2023 from 18.25 lakh tones in July 2022. While the production of Indian Operations increased by 10% to 19.72 lakh tones, production of JSW Steel USA jumped by 96% to 0.67 lakh tones in July 2023 as compared with July 2022.

Adani Enterprises: The company said that Adani Defence Systems and Technologies has incorporated a wholly owned subsidiary — Atharva Advance Systems and Technologies (AASTL). The company’s authorized capital and paid-up share capital is Rs 1 lakh, each. AASTL is incorporated with the purpose of developing and manufacturing of various autonomous aerial technology and systems for defence applications.

Schneider Electric Infrastructure: The company’s consolidated net profit surged 151.4% to Rs 34.92 crore in Q1FY24 as compared with Rs 13.89 crore in Q1FY23. Revenue from operations jumped 33.3% to Rs 495.25 crore in Q1FY24 from Rs 371.48 crore posted in same quarter last year. Meanwhile, the board has approved the appointment of Suparna Banerjee Bhattacharyya as chief financial officer and key managerial personnel of the company with effect from 9 August 2023.

ITD Cementation India: The company’s joint venture with Transrail Lighting secured a contract worth approximately $205 million from Power Grid Company of Bangladesh (PGCB). The contract entails design, supply, installation, testing and commissioning of Jamuna river crossing portion of Bogura-Kaliakair 400 kV double circuit transmission line on turnkey basis in Bangladesh.

3M India: The company’s shares rose after the company’s revenue was up 11.2% at Rs 1049.65 crore in Q1FY24 as against Rs 943.59 crore in Q1FY23. Ebitda was up 48.5% YoY at Rs 172.96 crore in Q1FY24 as against Rs 116.45 crore in Q1FY23. Net profit jumped 53.4% to Rs 129.21 crore in Q1FY24 from Rs 84.25 crore in Q1FY23.

Dr. Reddy’s Laboratories: The pharma company has launched Saxagliptin and Metformin Hydrochloride tablets in the US. The tablets are used to treat high sugar levels.

Godrej Consumer Products: The company has signed an MoU for setting up a manufacturing plant with an investment of Rs 515 crore. The company plans to manufacture Cinthol, Godrej Expert Rich Crème and Goodknight products in the said manufacturing plant.

Samvardhana Motherson International: The company’s revenue was up 27.2% at Rs 22,462.18 crore in Q1FY24 as against Rs 17,654.49 crore in Q1FY23. Ebitda jumped 72.3% to Rs 1924.62 crore in Q1FY24 from Rs 1116.6 crore in Q1FY23. Net profit at Rs 648.12 crore in Q1FY24 as against Rs 181.55 crore in the year-ago period.

Alkem Laboratories: The company’s consolidated revenue was up 15.2% at Rs 2967.72 crore in Q1FY24 as against Rs 2576.38 crore in Q1FY23. Consolidated Ebitda climbed 91.5% at Rs 389.18 crore in Q1FY24 as against Rs 203.24 crore in Q1FY23. Consolidated net profit soared 124.6% at Rs 286.7 crore in the quarter under review as against Rs 127.64 crore in the year-ago period.

Jupiter Wagons: The consolidated revenue was up 155% YoY at Rs 753.19 crore in Q1FY24 as against Rs 295.40 crore in Q1FY23. Ebitda was up 222.1% YoY at Rs 96.81 crore in Q1FY24 as against Rs 30.05 crore in Q1FY23. Consolidated net profit soared to Rs 62.85 crore in Q1FY24 from Rs 12.81 crore in the year-ago period.

Granules India: The pharma company’s consolidated net profit tumbled 62.5% to Rs 47.90 crore in Q1FY24 as against Rs 127.57 crore recorded in Q1FY23. Revenue from operations fell 3.3% to Rs 985.52 crore in Q1FY24, from Rs 1,019.56 crore reported in the same period a year ago. Ebitda tumbled 35% to Rs 136.8 crore in Q1FY24 as against Rs 211.5 crore posted in Q1FY23.