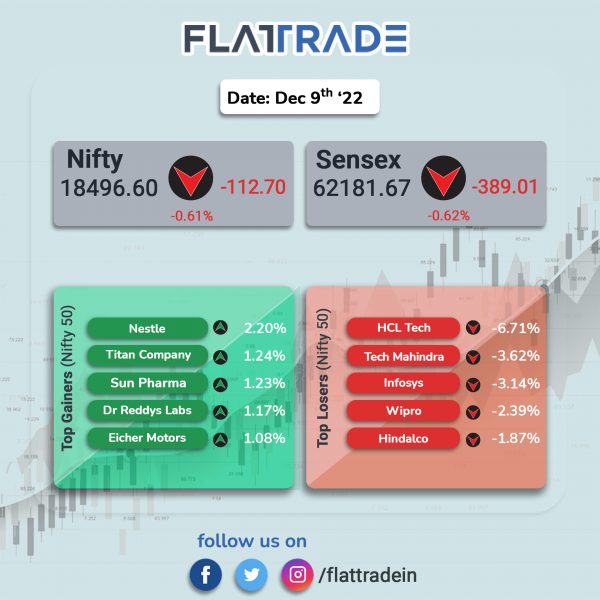

Dalal Street fell due to heavy selling in IT, state-owned bank and realty stocks as well as negative global sentiments. The Sensex fell 0.62% and the Nifty dropped 0.61%.

In broader markets, the Nifty Midcap 100 index fell 0.40% and the BSE Smallcap tanked 1%.

Top losers among Nifty sectoral indices were IT [-3.14%], PSU Bank [-1.77%], Realty [-1.5%], Metal [-1.12%] and Oil& Gas [-1.1%]. Top gainers were FMCG [0.86%] and Pharma [0.36%].

Indian rupee strengthened to 82.27 against the US dollar on Friday.

Stock in News Today

HCLTech: Shares of the company tanked over 7% in intraday trade after the company management indicated that growth for FY23 will come in at the lower end of the 13.5-14.5% range. The company said furloughs have been far greater than what it had anticipated. Moreover, brokerage firm Credit Suisse expects India’s top four Indian IT companies to witness a 10-27% valuation-led correction and high risk of revenue downgrades due to weak global macroeconomic conditions.

Maruti Suzuki: The company is offering discounts on its Arena lineup — Alto K10, Wagon R, Celerio, Swift and Dzire — for December with savings of up to Rs 52,000. Brokerage firm Nomura said that the rising discount on small cars is a sign of weak demand for such models.

State Bank of India (SBI): The lender will seek approval for raising Additional Tier 1 (AT-1) capital by way of issuance of Basel III compliant debt instruments in INR or any other convertible currency. The fund raising will be done through a public offer or private placement to Indian or overseas investors up to 31st March, 2024.

Vedanta: The mining conglomerate has approved the issuance of NCDs up to Rs 800 crore. The NCD sale will have a base issue size of Rs 500 crore and green shoe option of Rs 300 crore.

Hero MotoCorp: The company’s head of Strategy, M&A and Global Product Planning, Malo Le Masson, has resigned to pursue opportunities outside of the company. CFO Niranjan Gupta has been given the additional charge of heading strategy and M&A. Vikram Kasbekar, executive director, has been given the responsibility to head Global Product Planning as an interim charge.

Marico: The FMCG company has entered into a definitive agreement to acquire Beauty X Joint Stock Company for Rs 172 crore. The firm owns personal care brands such as ‘Purité de Prôvence’ and ‘Ôliv’ in Vietnam. The deal is expected to be completed by the end of March 2023, subject to approvals.

Larsen & Toubro (L&T): The company will acquire a minority stake in US-based technology firm Opro.AI for $1 million (about Rs 8.2 crore). Opro.AI builds deep learning optimization software for process industries such as chemicals and oil and gas to help achieve higher yields and reduced emissions.

Bajaj Consumer: The company’s board has approved a buyback plan of 33.7 lakh shares at a price of up to Rs 240 each aggregating to about Rs 80.89 crore.

Metropolis Healthcare: The company has named Surendran Chemmenkotil as Chief Executive Officer starting January 2, 2023. Chemmenkotil was managing director and CEO for Airtel Networks, Nigeria and served as CEO for several circles in India as well.

Ethos: The luxury watch retailer has signed an exclusive retail partnership with Tutima to introduce the revered Glashte-based brand in India. With this partnership, Ethos will exclusively retail their sporty and performance-driven timepieces across the country. From early 2023, watches from M2 collection, Saxon One, Grand Flieger, and Patria will be available in India.

DigiSpice Technologies: The company said that Chandrachur Ghosh, CEO, designated as whole-time key managerial personnel of the company, has tendered his resignation from the said position on December 8. Ghosh will be serving his notice period till January 31, 2023.

GMM Pfaudler: The company’s subsidiary, Pfaudler GmbH, has entered into an agreement to acquire Mixel France SAS and its wholly owned subsidiary Mixel Agitator for a total consideration of 7 million euro. The funding to complete the deal will be through a mix of internal accruals and debt.