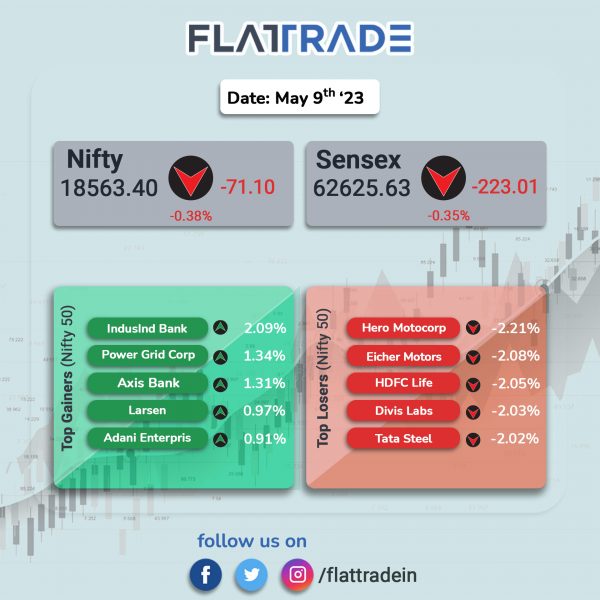

Domestic markets ended lower due to selling pressure across most sectors amid weak global cues. The Sensex fell 0.35%, while the Nifty 50 index dropped 0.38%.

In broader markets, the Nifty Midcap 100 fell 0.14% and the BSE Smallcap inched up 0.02%.

Top losers were PSU Bank [-1.21%], FMCG [-0.92%], Media [-0.83%], IT [-0.82%], and Oil & Gas [-0.48%]. Top gainer was Private Bank [0.23%].

Indian rupee appreciated by 12 paise to 82.46 against the US dollar on Friday.

Oil prices rebounded from earlier losses after the US and Iran denied a report that they were close to a nuclear deal. WTI Crude oil was trading at $71.27 per barrel, while Brent Crude was trading ar $75.99 per barrel.

Stock in News Today

State Bank of India (SBI): The largest lender in India said that it will raise up to Rs 50,000 crore through debt instruments from Indian as well as overseas markets in the current fiscal. SBI board has given the approval for raising funds in INR or any other convertible currency by issue of debt instruments including Long Term Bonds, Basel III compliant Additional Tier 1 Bonds, Basel III compliant Tier 2 Bonds, up to an amount of Rs 50,000 crore through private placement mode to Indian and/or Overseas investors during FY24, according to its exchange filing.

One 97 Communications (Paytm): Shares of the company rose 5.48% higher after the company got a ratings upgrade from Bank of America Securities. BofA Securities upgraded Paytm to ‘Buy’ from ‘Neutral’ and increased the target price to Rs 885 per share from Rs 780 earlier on the back of strong revenue momentum and operational leverage. BofA said that Paytm well positioned to continue to dominate the SME merchant landscape where the subscription model via Soundbox is improving merchant stickiness.

Indian Energy Exchange (IEX): Shares of the company tanked 15% in intraday trade on NSE, following media reports that the Power Ministry of India has directed CERC to initiate the process of market coupling. The proposed changes could potentially erode IEX’s competitive edge by reducing its trading volumes. Shares of the company closed 10.15% lower at Rs 122.6 apiece.

Greenlam Industries: Shares of the company surged 18.27% on Friday after it announced the opening of a new plant in Tindivanam, Tamil Nadu. The greenfield plant at Tindivanam district will be a manufacturing facility for the plywood and allied products, operated by its subsidiary HG Industries Ltd., with an estimated investment of Rs 125 crore. The facility has an installed capacity of 18.9 million square meter per annum and has a potential to generate revenue of Rs 400 crore per annum on full capacity utilization. The total capex incurred for the project stands at approximately Rs 130 crore till commencement of the commercial production.

Hindustan Zinc: The company said that CRISIL Ratings has reaffirmed its ‘CRISIL AAA/Stable/CRISIL A1+’ ratings on the bank facilities and debt programmes of the company. CRISIL said that the ratings continue to reflect the company’s dominant position in the domestic zinc market, efficient and integrated operations, and strong financial risk profile.

Zydus Lifesciences: The company announced that it has started phase-IV real world data registry trial ‘Evidences- XI’ for Saroglitazar Magnesium in non-alcoholic fatty liver disease (NAFLD) patients with comorbidities. The phase IV Evidences- XI trial will enrol approximately 1500 male and female NAFLD patients with comorbidities (either obesity, type 2 diabetes mellitus, dyslipidemia or metabolic syndrome- 200 patients each). The study duration is approximately 56 weeks.

Allcargo Logistics: The company said that it has completed acquisition of 30% stake in Gati‐Kintetsu Express (GKEPL) for Rs 406.71 crore. The deal includes purchasing 1.3 lakh shares (26 %) from KWE‐Kintetsu World Express (S) (KWE Singapore) and 20,000 shares (4%) from KWE Kintetsu Express India. With the conclusion of this transaction, Allcargo, along with Gati, now holds 100% stakes in GKEPL and assumes complete control.

Schneider Electric Infrastructure: The company informed that it’s managing director & chief executive officer (MD & CEO), Sanjay Sudhakaran, has tendered his resignation on 8 June 2023. Sudhakaran resigned to pursue his career outside the organization. He shall be relieved from the services of the company with effect from the closure of business hours on 30 June 2023. The company said that it is in the process of identifying a suitable replacement and shall inform the stock exchanges in due course.

Manappuram Finance: The NBFC said that its board may consider raising funds through debt securities during the month of June 2023. The funds could be raised by issuance of various debt securities in onshore / offshore securities market by public issue, on private placement basis or through issuing commercial papers.

Indoco Remedies: The company has received EU GMP (good manufacturing practice) certificate from German Health Authority (Berlin) for its manufacturing facility (Plant III) located at Baddi facility. The agency conducted an inspection at Indoco’s manufacturing facility for oral dosage form (Baddi -III), from 22 May to 25 May 2023. The EU certification will support supplies of drug products registered in Europe, from this manufacturing site.

Sarda Energy & Minerals: The company announced that the resolution professional of SKS Power Generation (Chhattisgarh) (SKS) has declared the company as the successful resolution applicant for SKS. SKS was incorporated for development of a 1200 MW (4 x 300 MW) thermal power project in two phases of 600 MW each in Raigarh District of Chhattisgarh. As on the date, 600 MW capacity is in operation with infrastructure of 1200 MW. The remaining capacity of 600 MW is yet to be installed.

KPI Green Energy: The company obtained the commissioning certificate from Gujarat Energy Development Agency (GEDA) for capacity of 7.20 MW wind-solar hybrid power project under its Captive Power Producer (CPP) segment. The project comprises of 4.20MW wind and 3MWdc solar capacity for the company’s client Nouveau Jewellery LLP, Surat.

PTC Industries: The company’s board has approved the issuance of equity shares aggregating up to Rs 45 crore, on preferential basis to Dymon Asia Multi-Strategy Investment (Singapore) Pte. Ltd. Meanwhile, PTC Industries shares got listed on the National Stock Exchange (NSE) on Friday after it received approval for the same. The stock opened at Rs 3,090 per share on the NSE and hit an intraday high of Rs 3,149.95 and a low of Rs 2950 on NSE. Shares closed at Rs 3070.15 apiece.

Best Agrolife (BAL): The company announced that it has has received the registration for the indigenous manufacturing of Trifloxystrobin-Difenoconazole-Sulphur combination product. With this, BAL will become the first Indian agrochemical company to manufacture the said combination product in soluble (liquid) concentrate (SC) form in India. The company will launch this product in July with the brand name Tricolor and it will be the company patented product.

Maan Aluminium: The company’s board has approved 2-1 stock split and 1:1 issue of bonus shares. The firms’s board has approved sub-division of 1 equity share having face value of Rs 10 each into 2 equity shares having face value of Re 5 each. Maan Aluminum stated that the split is to enhance the liquidity of equity shares and widen the shareholders base by making the equity shares more economical to the investors. The firm added that the sub-division is expected to be completed within two months from the date of board’s approval. The company’s board has also approved issuing one bonus equity share for every one existing equity shares held on record date. The firm said it would credit/dispatch bonus shares within two months from the date of the board meeting.

Hazoor Multi Projects: The company has received an approval to start the construction of Samruddhi Expressway in Nasik (Maharashtra) for Rs 119.18 crore. The project will be on EPC mode, according to its exchange filing.