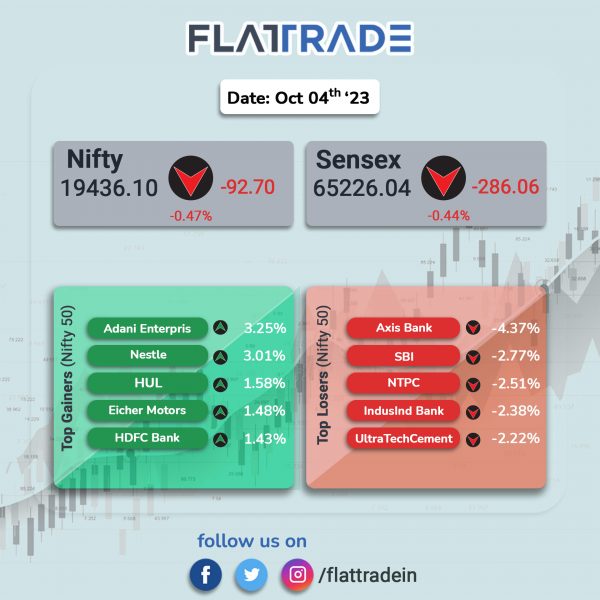

Dalal Street ended in the red as investors remained cautious amid rising US Treasury yields and appreciating US dollar. The Sensex fell 0.43% and the Nifty ended 0.47% lower.

Broader markets underperformed headline indices. The Nifty Midcap 100 index tanked 1.38% and the BSE Smallcap tumbled 0.95%.

Top losers were PSU Bank [-2.83%], Realty [-1.73%], Pharma [-1.4%], Auto [-1.3%], Metal [-1.06%]. Top gainers were IT [0.3%] and FMCG [0.22%].

The Indian rupee fell 2 paise to 83.24 against the US dollar on Wednesday.

Stock in News Today

Reliance Industries Limited (RIL): UK-based Superdry plc announced that it has signed an IP joint venture agreement with Reliance Brands Holding UK Ltd (RBUK), and agreements for the sale of Superdry’s intellectual property assets, including the SUPERDRY brand and related trademarks in India, Sri Lanka, and Bangladesh to the joint venture company. RBUK and Superdry will own 76% and 24% of the joint venture company, respectively. RBUK is held by Reliance Retail Ventures Limited (RRVL) through its subsidiary Reliance Brands Limited (RBL). The sale deal was was for £40 million and Superdry will receive gross cash proceeds of £30.4 million.

HDFC Bank: The lender said that its gross advances aggregated to about Rs 23,545 billion for the quarter ended September 2023, up 57.7% from Rs 14,933 billion in the year-ago period. The bank’s deposits aggregated to about Rs 21,730 billion in Q2FY24, up 29.9% over Rs 16,734 billion in the year-ago period. The bank’s CASA deposits aggregated to Rs 8,175 billion in Q2FY24, a rise of 7.6% over Rs 7,597 billion in the year-ago period. The bank’s CASA ratio stood at around 37.6% as of September 30, 2023, compared to 45.4% as of September 30, 2022, and 42.5 percent as of June 30, 2023.

Larsen & Toubro (L&T): The engineering conglomerate said its power business arm has secured an order worth up to Rs 2,500 crore from the West Bengal Power Development Corporation Limited. The company said the orders fall under “significant” category, which ranges between Rs 1,000 crore and Rs 2,500 crore, as per its classification of contracts. The order pertains to setting up of wet Flue Gas Desulphurization (FGD) systems for its Thermal Power Plant at Sagardighi in the state of West Bengal.

Tata Consultancy Services (TCS): The company announced a multi-year partnership with British retail giant ASDA to support its digital transformation and to implement a new organisation-wide IT operating model, following its divestiture from Walmart. The strategic partnership will leverage TCS’ cloud, AI, and security solutions to help ASDA deliver the divestiture smoothly, on-time and securely.

Bajaj Finance: The company’s new loans booked during Q2FY24 grew by 26% to 8.53 million as against 6.76 million in Q2FY23. Assets under management (AUM) grew by 33% to Rs 290,200 crore in Q2FY24 compared to Rs 218,366 crore in Q2FY23. Its deposits book stood at Rs 54,800 crore in Q2FY24 compared to Rs 39,422 crore in the year-ago period.

IndusInd Bank: The lender announced that it has introduced a hyper-personalized financial super-app named ‘INDIE’. The new app offers a completely differentiated experience to customers who are digitally savvy and looking for a superlative digital experience. The app leverages advanced analytics to provide personalized insights to its customers. Using the INDIE app, eligible customers can avail an instant line of credit of up to Rs 5 lakhs which is ultra flexible unlike a standard personal loan.

Nestle India: The FMCG company said that its board of directors will meet on October 19 to consider declaring second interim dividend for the year 2023. The company is also considering the option of a stock split of existing equity shares with a face value of Rs. 10 each, fully paid up, as may be determined by the board.

Vedanta: The mining company announced that its total aluminum production jumped 2% to 5,94,000 tonnes in Q2FY24 as compared with 5,84,000 tonnes in Q2FY23. The company stated that the alumina production at Lanjigarh refinery increased 17% QoQ and 2% YoY to 4,64,000 tonnes. The cast metal aluminium production increased by 3% QoQ from 5,79,000 tonnes.

AU Small Finance Bank: The bank’s gross advances stood at Rs 65,029 crore as of end of September 2023 as against Rs 52,452 crore in the year-ago period. In Q2FY24, the bank’s total deposits stood at Rs 75,743 crore compared with Rs 58,335 crore in the corresponding quarter last fiscal. CASA deposits increased by 4% YoY to Rs 25,666 crore in Q2FY24. CASA deposit ratio declined to 33.9% in Q2FY24 from 42.3% in Q2FY23.

Alembic Pharmaceuticals: The company informed that manufacturing operations at its facility in Namthang, South Sikkim, was disrupted due to flash floods in Teesta river because of cloud burst. The company added that there is no loss or harm caused to any personnel.

Updater Services: The company has a tepid stock market debut. Its shares got listed at Rs 285 apiece on the NSE, 5% lower to its IPO price of Rs 300. Shares hit a high of Rs 298.65 and a low of Rs 282. The closing price was at Rs 283.90.

Dodla Dairy: The company announced that Orgafeed has commenced new manufacturing of cattle feed plant at Kuppam, Chittoor district, Andhra Pradesh. The capacity of the new plant is 12,000 tons per month. With this, the overall capacity of Orgafeed is 14,400 tons per month (Kadapa Plant Capacity is 2,400 tons per month and Kuppam Plant Capacity is 12,000 tons per month). Orgafeed is a wholly owned subsidiary of Dodla Dairy and operates the company’s feed business.

Easy Trip Planners (EaseMyTrip): The company and the Government of Uttarakhand have signed an MoU to transform tourism in the state and the deal size is worth Rs 250 crore. Under the partnership, extensive series of joint marketing campaigns will be launched that are strategically designed to target diverse markets such as the UK/Europe, Middle East, Asia, USA/Canada, and other geographies.

Sasken Technologies: Shares of the company surged over 13% after the company announced collaboration with US-based Qualcomm Technologies, through Qualcomm’s IoT Accelerator Program. The collaboration aims to address the challenges faced by various industries in their IoT endeavors, such as achieving seamless integration, scalability, and security.