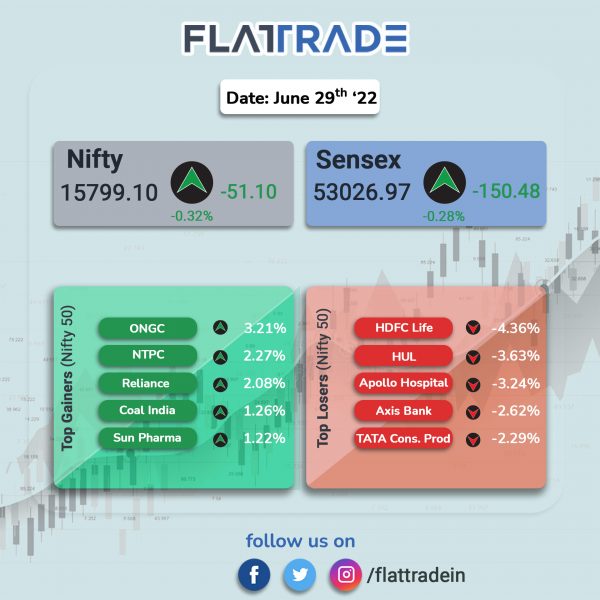

Major equity indices fell, dragged by losses in IT, bank, and FMCG stocks. The Nifty 50 index fell 0.32% and the Sensex slid 0.28%.

The broader markets followed the headline indices. The Nifty Midcap 100 index fell 0.44% and and the BSE Smallcap lost 0.18%.

Top Nifty sectoral losers were IT [-1.29%], FMCG [-1.27%], Private Bank [-1.12%], Bank [-1.11%] and Financial Services [-0.96%]. Top gainer was Energy [2.02%].

Indian rupee lost 20 paise to 78.97 against the US dollar on Wednesday.

Stock in News Today

Hindalco Industries: The company has bought a 26% stake in Cleanwin Energy for Rs 71.5 lakh. Hindalco said it is exploring various avenues for reducing energy costs and one of the options available is through open access from renewable energy generators in captive mode.

AU Small Fianance Bank (AU SFB): Shares of the company fell 3% after investment bank Credit Suisse initiated coverage of the stock with an ‘underperform’ rating, citing potential rise in credit costs. The target price is set at Rs 510 per equity share.

Tejas Networks: Japan’s Renesas Electronics Corporation announced a strategic partnership with Tata Motors and Tejas Networks. The deal with the two Tata group companies pertains to the design, development and manufacturing of Renesas’ semiconductor solutions. Renesas will collaborate with Tejas for implementing next-generation wireless network solutions, including the design and development of semiconductor solutions for radio units used in telecom networks.

NMDC: The company said that the shareholders and creditors of NMDC have approved the demerge of Nagarnar Steel plant. Sumit Deb said, “We have got the shareholders and creditors approval for the demerger.” NMDC is in the process of setting up a 3 million tonne per annum steel plant in Nagarnar in Chhattisgarh at an estimated cost of Rs 23,140 crore.

Ultratech: Brokerage firm Nirmal Bang has maintained ‘buy’ rating and kept the target price at Rs 6,772. Nirmal Bang expects the possibility of further time correction as well as pressure on H1FY2022-23 earnings, given the high pet coke prices and weak realisations.

Bajaj Finserv: The NBFC has acquired 9.54% stake in Perfios Account Aggregation Services. The development comes after news reports said that SBI, HDFC, ICICI have acquired stakes in Perfios.

TTK Healthcare: Shares of the company jumped over 9% in intraday trading after the company announced the launch of its online portal for the sale of pleasure products. LoveDepot stocks its racks with international brands such as plusOne, We-Vibe, etc. as well as the company’s own brands.

SIS Ltd: The company’s board has approved share buyback worth Rs 80 crore. The company approved buyback of 14,54,545 equity shares having face value of Rs 5 each at Rs 550 per share, not exceeding Rs 80 crore. The buyback size represents 0.99% to the total paid-up capital of the company. The process, record date, timelines and other details of the buyback will be announced soon, the company said in an exchange filing.