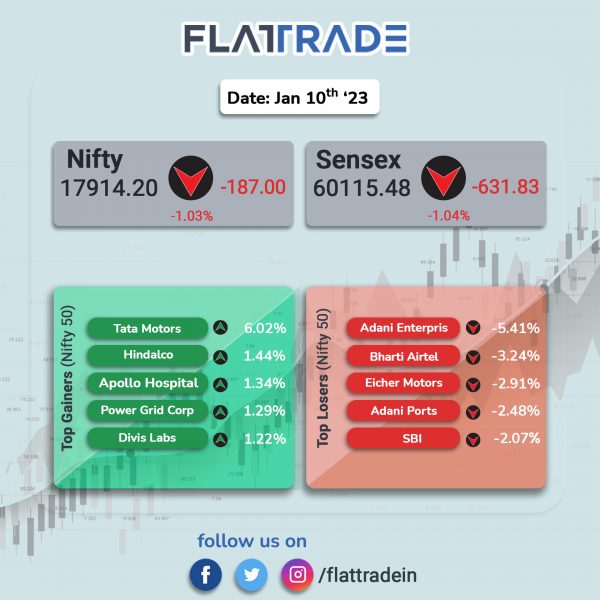

Benchmark stock indices fell over 1%, tracking Asian peers, after the Federal Reserve officials signalled more interest rate hikes amid weak foreign flows. The Sensex closed 1.04% lower and the Nifty 50 index slumped 1.03%.

In broader markets, Nifty Midcap 100 index fell 0.50% and BSE SMallcap dropped 0.46%.

Top losers were PSU Bank [-2.67%], Financial Services [-1.37%], Bank [-1.33%], Private Bank [-1.13%], Media [-0.96%]. Nifty Auto [0.28%] index was the sole gainer with Tata Motors surging 6.02% and Sona BLW Precision Forgings climbing 5.9%.

Indian rupee appreciated by 57 paise to 81.78 against the US dollar on Tuesday.

Stock in News Today

Coal India: The state-owned company has issued letters of acceptance for nine coal projects to be pursued through mine developer-cum-operator mode. These projects have production capacity of about 127 million tonnes per year. It has six remaining projects in various stages of tendering. Coal India is looking to implement 15 greenfield projects, with capacity 169 million tonnes, via MDO with an investment of Rs 20,600 crore.

Bharti Airtel: The telco announced the launch of its 5G services in Bhubaneswar, Cuttack and Rourkela. The company has also deployed the ultrafast 5G services at the Kalinga & Birsa Munda stadiums in Bhubaneswar and Rourkela respectively that will host the forthcoming Men’s FIH Hockey World Cup.

Cyient: The company’s subsidiary, Cyient DLM, has filed its draft red herring prospectus with SEBI in relation to its proposed Initial Public Offering (IPO) for listing on BSE and NSE. Cyient DLM’s proposed IPO will consists of fresh issue of new equity shares aggregating up to Rs 740 crore.

Sona BLW Precision Forgings: The company has inked a pact to acquire a 54% equity stake in sensors and software maker NOVELIC for 40.5 million euro. The acquisition is expected to be EPS accretive for Sona Comstar from the first year and offers strong growth opportunities over the medium term.

NOVELIC is a Serbia-based company that provides mmWave radar sensors, perception solutions and full-stack embedded systems. Advanced driver assistance systems (ADAS) sensors are a fast-growing category in the automotive industry, with a potential market size of around $43 billion by 2030. It is one of the very few profitable, high-tech, and fast-growing companies in the ADAS sensor space.

Jindal Worldwide: The company’s subsidiary, Jindal Mobilitric (JM), announced setting-up of an electric 2-wheeler manufacturing plant with production capacity of 2.5 lakh vehicles annually at Ahmedabad. In addition, JM is also setting-up in-house fully automated battery manufacturing plant with similar production capacity.

D B Realty: The company said that National Company Law Tribunal (NCLT) has approved Adani Goodhomes’ resolution plan for Radius Estates, a JV partner of MIG (Bandra) Realtors & Builders, a subsidiary of D B Realty. The project is expected to be completed by June 2024.

Zydus Lifesciences: The pharma company has received final approval from the USFDA for Febuxostat Tablets. The drug is used to treat high uric acid in blood of people with gout and it will be manufactured in the company’s facility at Moraiya, Ahmedabad. Febuxostat tablets had annual sales of $32 million in the US, according to IQVIA data.

Lupin: The drugmaker said it has received the USFDA approval for its new drug application Prasugrel Tablets, a generic equivalent of Effient Tablets of Cosette Pharmaceuticals. The drug will be manufactured at Lupin’s facility in Goa state. It had estimated annual sales of $18 million in the US, as per IQVIA data of September 2022.

PSP Projects: The company has secured order worth Rs 1,344 crore for construction of an office building in Surat in Gujarat. With this, the total year-to-date order inflow stood at Rs 3,292.59 crore.

Tega Industries: Manoj Kumar Agarwal, chief financial officer (CFO) and key managerial personnel of the company tendered his resignation to pursue other opportunities outside the Tega Group. Agarwal shall be relieved from the services of the company with effect from closure of business hours on 31 January 2023.

Kaushal Sureka, deputy general manager of finance & accounts, shall be in charge of the finance function. The company said that it is in the process of identifying a suitable replacement and shall inform the stock exchanges in due course.

Ducon Infratechnologies: The company announced the forming of alliances with leading EPC companies to jointly bid for many flue gas desulfurization (FGD) projects, in an attempt to increase its footprint in India’s FGD market. Ducon Infratechnologies is India’s leading fossil fuel/coal clean technology company

Glenmark Pharmaceuticals: The company has launched Bumetanide injection USP, 1 mg/4 mL (0.25 mg/mL) single-dose vials and 2.5 mg/10 mL (0.25 mg/mL) multi-dose vials. Bumetanide injection is the generic version of Bumex Injection, of Validus Pharmaceuticals. According to IQVIA sales data for the 12-month period ending November 2022, the Bumex injection market achieved annual sales of approximately $16.5 million.

Welspun Enterprises: The company said that its chief financial officer, Sanjay Sultania, resigned on Monday, 9 January 2023. Sultania is taking up other major responsibility within the Welspun Group, according to its exchange filing.

India Grid Trust: Divya Bedi Verma has resigned as Chief Financial Officer (CFO) of IndiGrid Investment Managers Limited, Investment Manager of India Grid Trust (IndiGrid) to pursue other interests and she will be relieved from her duties on or before April 10, 2023. She will continue to hold her current position of CFO till the date of relieving.

Hindware Home Innovation: The company’s Chief Executive Officer and Whole Time Director Rakesh Kaul resigned from post with effect from closing hours of Aprile 5, 2023. Kaul wishes to pursue opportunities outside the organisation, as per an exchange filing.

Zuari Industries: The company has approved scheme of amalgamation of its unit, Zuari Sugar and Power, with itself. The company will not issue and allot any shares. The paid up capital of Zuari Sugar stands cancelled and shall be affected as integral part of scheme. It also agreed to execute agreements to set up joint venture, Zuari Envien Bioenergy, with Envien International.