Market Opening - An Overview

GIFT Nifty on the NSE IX were trading 0.15% higher at 19,534, signalling that Dalal Street was headed for positive start on Thursday.

Asian shares were trading higher, tracking the US markets overnight, as risk-on sentiments improved. The Nikkei 225 index gained 0.43% and the Topix rose 0.25%. The Hang Seng jumped 1.24% and the CSI 300 index rose 0.52%.

The Indian rupee appreciated by 25 paise to 82.69 against the US dollar on Wednesday.

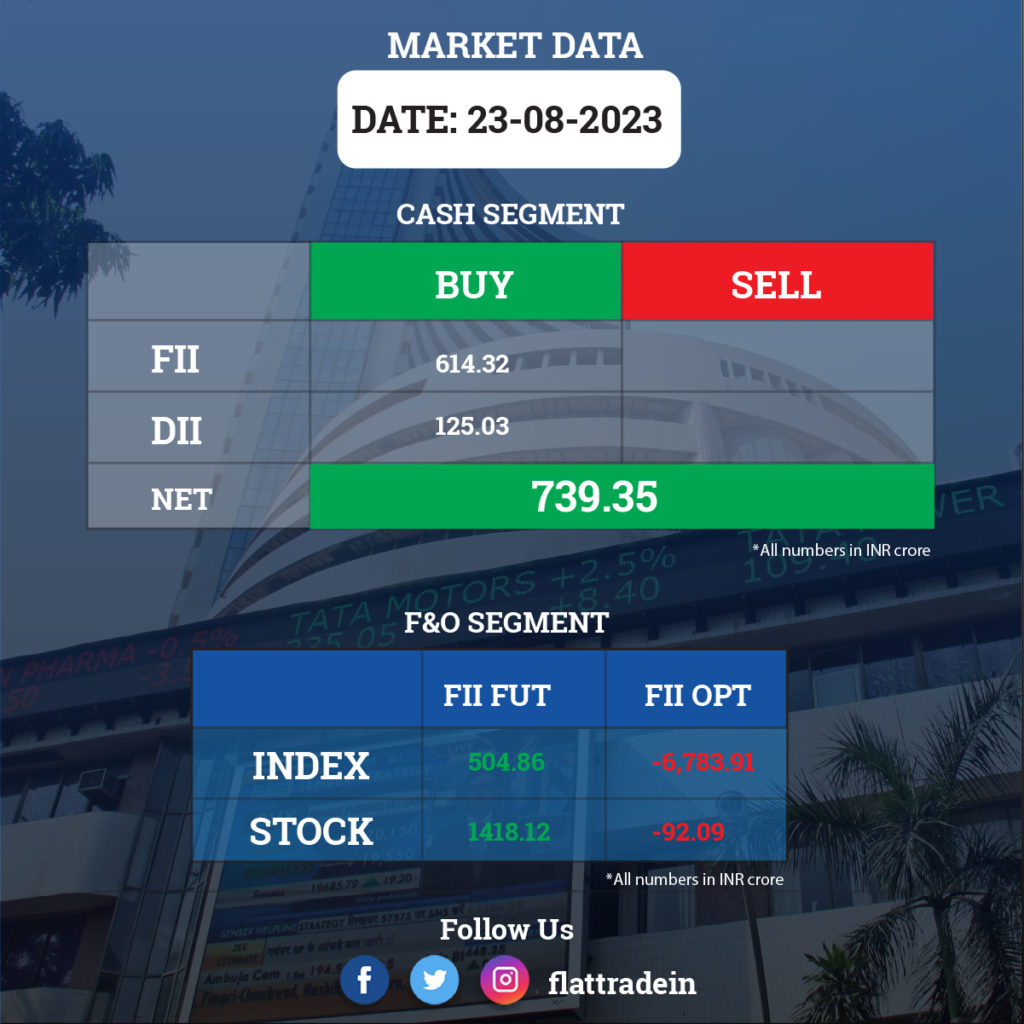

FII/DII Trading Data

Stocks in News Today

Reliance Industries (RIL): The Qatar Investment Authority will invest $1 billion in Reliance Retail Ventures (RRVL), a subsidiary of Reliance Industries, for a stake of 0.99%. The investment values the company at a pre-money equity value of $100 billion.

Coforge: Promoter Hulst BV plans to sell its entire 26.63% stake in the IT firm via a block deal, CNBC Awaaz reported citing sources. The floor price has been fixed at Rs 4,550 per share, which is a 7.4% discount to Wednesday’s closing price of Rs 4,913. The Netherlands-registered Hulst BV will sell 1.62 crore shares, taking the deal size to around Rs 7,400 crore, sources said.

NHPC: The state-owned company has signed an MoU with Andhra Pradesh Power Generation Corporation for renewable energy projects. Under the MoU, the two entities can form a JV to implement techno-commercially viable pumped storage hydropower projects and other renewable energy projects allotted by the state.

Vascon Engineers: The construction company has received a Letter of Acceptance amounting to Rs 605.65 crore from Bihar Medical Services & Infrastructure Corporation, for the construction of Lohia Medical College & Hospital including a hospital and residential building, Supaul. The project is expected to be completed within 36 months from the date of receipt of the Letter of Acceptance.

Procter & Gamble Health: The FMCG company has reported a net profit of Rs 29.8 crore for the quarter ended June FY23 (Q4FY23), falling 28% compared to the year-ago period due to higher material cost and one-time employee cost. Revenue from operations grew by 1.8% YoY to Rs 301.2 crore during the quarter under review. The company announced a final dividend of Rs 50 per share for the financial year ended June 2023.

Borosil: The company’s subsidary, Klass Pack, has executed a share purchase agreement to acquire an additional 4.56% in Goel Scientific for Rs 91.12 lakh. The development comes after KPL’s 90.17% acquisition of Goel Scientific, for which the acquisition price has been agreed at Rs 21.5 crore. KPL’s stake will increase to 94.73% after the said transaction.

Redtape: The company’s promoter Yasmin Mirza has acquired by way of gift 15.96% from Shahid Ahmad Mirza, 16.03% from Tauseef Ahmad Mirza, and 14.11% from Tasneef Ahmad Mirza. Yasmin’s stake increased to 50.27% from 4.18%, while the other three promoters’ stakes have become nil.

Avantel: The company has received a purchase order worth Rs 13.30 crore from Bharat Electronics for the supply of PA modules.

SJS Enterprises: Promoter Evergraph Holdings sold 29.53% of its stake in the company via an open market transaction. With this, its stake has been reduced to 4.63%.

Paramount Communications: The board has approved the acquisition of a 100% stake in Valens Technologies for Rs 1.97 crore. The deal gives PCL a strong position in the telecom business while also adding market and product diversity in terms of the water pipeline business.