Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.17% higher at 18,366.5, signalling that Dalal Street was headed for positive start on Tuesday.

Asian shares were mixed amid reports that President Joe Biden and House Speaker Kevin McCarthy had a productive talk on the US debt ceiling. The Nikkei 225 index was up 0.64% and the Topix index gained 0.38%. The Hang Seng fell 0.27% and the CSI 300 index lost 0.70%.

Indian rupee declined by 17 paise to close at 82.83 against the US dollar on Monday.

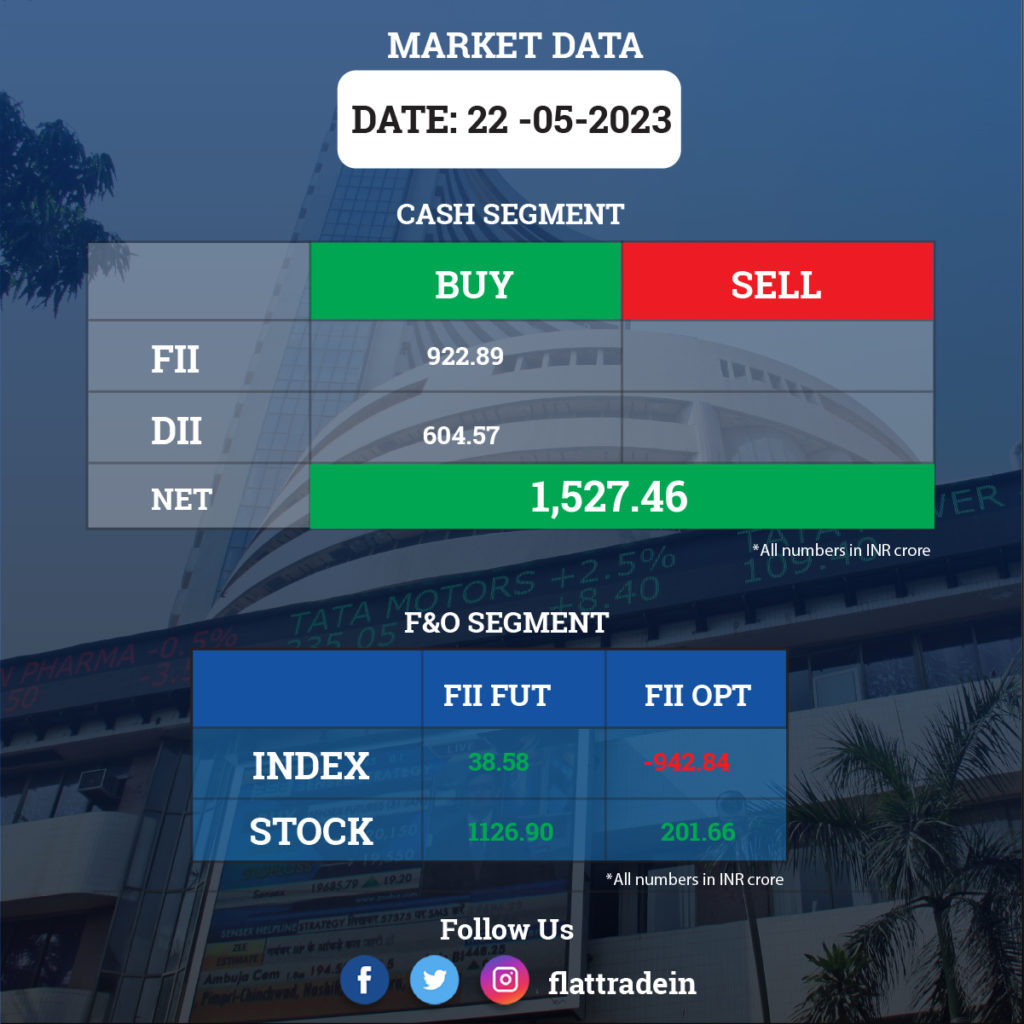

FII/DII Trading Data

Upcoming Results

Ashok Leyland, NMDC, Biocon, Dixon Technologies (India), JSW Energy, Amara Raja Batteries, Bajaj Electricals, Metro Brands, Bikaji Foods International, CMS Info Systems, Varroc Engineering, Galaxy Surfactants, GE T&D India, Fortis Healthcare, Akzo Nobel India, Sequent Scientific, Thyrocare Technologies, Gabriel India, Johnson Controls-Hitachi Air Conditioning India, Somany Ceramics, Sudarshan Chemical Industries, Indoco Remedies, Kaveri Seed Company, Agarwal Industrial Corporation, Dreamfolks Services, Genus Power Infrastructures, GMR Power and Urban Infra, Jayaswal NECO Industries, J Kumar Infraprojects, Kirloskar Industries, Maithan Alloys, MSTC, Nirlon, NMDC Steel, Polyplex Corporation, Roto Pumps, Schneider Electric Infrastructure, Steelcast, Timex Group India, TTK Healthcare, TVS Srichakra, Dishman Carbogen Amcis, and Unichem Laboratories.

Stocks in News Today

Shree Cement: The cement manufacturer has recorded a 15.3% year-on-year decline in standalone profit at Rs 546.2 crore for the March FY23 quarter, due to steep rise in power and fuel costs. The standalone revenue for the quarter grew by 16.7% to Rs 4,785 crore compared to the year-ago period. The board has declared an interim dividend of Rs 55 per share for the fiscal 2023. The record date for the dividend is June 1 and it will be paid from June 13.

Bharat Petroleum Corp (BPCL): The state-owned refiner said its consolidated revenue was up 8% YoY at Rs 1,33,419.56 crore in Q4FY23. Ebitda was up 85.42% YoY at Rs 11,084.79 crore in Q4FY23. Consolidated net profit was up 168.46% YoY at Rs 6,870.47 crore in Q4FY23. The company will pay a dividend of Rs 4 per share for the fiscal 2022-23, subject to shareholders’ approval.

PB Fintech: The company which operates Policybazaar and Paisabazaar platforms has reduced its net loss significantly to Rs 8.9 crore for the quarter ended March FY23, from Rs 219.6 crore in the same period last year. The operating revenue grew by 61% to Rs 869 crore compared to the corresponding period last fiscal. The insurance premium at Rs 3,586 crore for the March FY23 quarter increased by 65% and credit disbursal at Rs 3,357 crore grew by 53% over a year-ago period.

Relaince Jio, Airtel, Vodafone Idea: Reliance Jio added 30.5 lakh net subscribers in March. Airtel gained 10.3 lakh subscribers and Vi lost 12.1 lakh, according to the data released by the Telecom Regulatory Authority of India. The number of mobile phone users in urban areas rose 0.19% to 62.754 crore, while the number of mobile phone users in rural areas rose 0.15% to 51.638 crore. The wireless tele-density in India stood at 82.46% in February 2023.

JSW Steel: The company and Japan-based JFE Steel agreed to establish a cold rolled grain-oriented electrical steel (CRGO) manufacturing joint venture in India. The 50:50 joint venture company will be able to manufacture the entire range of CRGO products at its proposed facilities at Vijayanagar in Karnataka. The resolution plan submitted by its subsidiary JSW Steel Coated Products for National Steel & Agro Industries has been approved by NCLT.

SJVN: The company’s consolidated revenues was up 55.93% YoY at Rs 503.77 crore in Q4FY23. Ebitda surged 116.71% YoY to Rs 308.94 crore in Q4FY23. Consolidated net profit was up 129.77% YoY at Rs 17.21 crore in Q4FY23. The company declared a final dividend of Rs 0.62 per share for the fiscal 2023.

ITI: The multi-technology public sector firm has bagged an advance purchase order (APO) from BSNL worth Rs 3,889 crore for its 4G rollout. The scope of work includes planning, engineering, supply, installation & commissioning and AMC of the 4G mobile network for 23,633 sites in the west zone of the BSNL network.

Astra Microwave Products: Astra Rafael Comsys, the joint venture company, has bagged Rs 158 crore worth of orders from defence public sector undertaking (DPSU) for the supply of software-defined radio (SDR).

HEG: The graphite electrode manufacturer has registered a 23% year-on-year decline in consolidated profit at Rs 99.72 crore for the March FY23 quarter, impacted by lower topline and operating numbers. Revenue from operations for the quarter at Rs 616.88 crore fell by 8.3% compared to the corresponding period last fiscal. The company announced a final dividend of Rs 42.50 per share. HEG board has approved further investment of up to Rs 90 crore in one or more tranches, in its subsidiary TACC.

Finolex Industries: The company’s consolidated revenues was down 28.44% YoY at Rs 1,141.06 crore in Q4FY23. Ebitda was down 17.85% YoY at Rs 217.43 crore in Q4FY23. Consolidated net profit fell 66.37% YoY at Rs 166.5 crore in Q4FY23. The company had benefited from exceptional gains to the tune of Rs 376.06 crore in the year-ago period. The board declared a final dividend of Rs 1.50 per share for the fiscal 2023.

Gujarat Alkalies and Chemicals: The company’s consolidated revenue slipped 0.29% to Rs 1,138.12 crore in Q4FY23. Ebitda fell 30.76% YoY at Rs 242.58 crore in Q4FY23. Consolidated net profit was down 67.81% YoY at Rs 71.04 crore in Q4FY23. The board recommended a dividend of Rs 23.55 per share for the fiscal 2023.

Xpro India: The company’s consolidated revenue was down 12.98% Yoy at Rs 124.27 crore in Q4FY23. Ebitda was up 11.79% YoY at Rs 19.25 crore in Q4FY23. Consolidated net profit was down 75.54% YOY at Rs 4.27 crore in Q4FY23. The board recommended a dividend of Rs 2 per share for the fiscal ended March 2023.

Sansera Engineering: The company’s consolidated revenue was up 7.36% YoY at Rs 616.57 crore in Q4FY23. Ebitda was up 0.7% YoY at Rs 94.16 crore in Q4FY23. Consolidated net profit was down 5.87% YoY at Rs 35.42 crore in Q4FY23. The company will pay a dividend of Rs 2.50 per share for the fiscal 2022-23.

Garware Technical Fibres: The company’s consolidated revenue was up 3.98% YoY at Rs 370.49 crore in Q4FY23. Ebitda was up 8.63% YoY at Rs 79.70 crore in Q4FY23. Consolidated net profit was up 10.73% YoY at Rs 59.67 crore in Q4FY23. The company has announced a dividend of Rs 3.50 per share.

Thangamayil Jewellery: The company said its revenue was up 26.68% YoY at Rs 771.54 crore in Q4FY23. Ebitda was up 179.75% YoY at Rs 58.72 crore in Q4FY23. Condsolidated net profit was up 288.85% YoY at Rs 31.03 crore in Q4FY23. The board has recommended a final dividend of Rs 6 per share.

Indiabulls Housing Finance: The financial services company said its consolidated interest income was down 11.43% YoY at Rs 1,692.55 crore in Q4FY23. Consolidated net profit was down 14.39% YoY at Rs 262.61 crore in Q4FY23. Net NPA ratio stood at 2.48% during the reported quarter as against 2.97% in the year-ago period.

Torrent Power: The company’s board of directors of the company will meet on May 29 to consider raising funds via the issuance of non-convertible debentures up to Rs 3,000 crore through a private placement basis. The board will also consider financial results for the quarter and year ended March 2023, and recommendation of final dividend, if any, for FY23.

Asian Hotels (East): The promoters of Hyatt group of hotels reported a turnaround in Q4FY23 with a net profit of Rs 5.73 crore as against a net loss of Rs 1.80 crore in Q4FY22. Total income rose by 73.5% YoY to Rs 28.72 crore in the quarter under review from Rs 16.55 crore in the same period last fiscal.