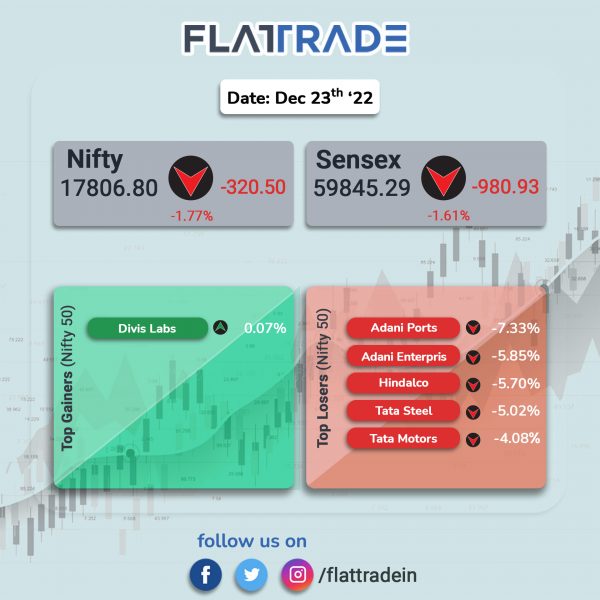

Domestic equity indices plunged as investors were worried that rising cases of Covid-19 would lead to global economic slowdown. The Sensex tanked 1.61% and the Nifty 50 index plummeted 1.7%.

In broader markets, Nifty Midcap 100 index nosedived 3.76% and the BSE Smallcap was down 4.11%.

Top losers among Nifty sectoral indices were PSU Bank [-6.06%], Media [-5%], Metal [-4.47%], Oil & Gas [-3.89%] and Energy [-3.86%]. All other indices closed in the red.

Indian rupee fell 10 paise to 82.86 against the US dollar on Friday.

Stock in News Today

Vedanta: The company said that it has been declared as the ‘preferred winner’ for the block I of Bicholim mineral block in Goa. The Bicholim Mineral Block has resources of 84.92 million ton, according to its regulatory filing. The granting of mining lease by the Government of Goa is subject to making necessary payments, completion of other terms and conditions of the tender document, obtaining necessary approvals from various government departments and execution of necessary agreements/deeds in the matter.

Bharat Heavy Electricals (BHEL): The company said that it has entered into a long-term technology license agreement (TLA) with Sumitomo SHI FW, Finland (SFW) for CFBC Boilers. The agreement is for the design, engineering, manufacturing, erection, commissioning and sale of subcritical as well as supercritical Circulating Fluidised Bed Combustion (CFBC) Boilers in India and in overseas territories.

Life Insurance Corporation of India (LIC): The insurer said that it has increased its stake in Info Edge (India) to 5.008% from 4.988% and in Gail (India) to 6.833% from 4.815% earlier. LIC bought 26,000 shares of Info Edge (India) at an average cost of Rs 4,790.76 via open market purchase. Meanwhile, LIC bought 13,27,25,837 shares, or 2% equity of Gail (India) at an average cost of Rs 93.01 via open market purchase during the period from July 7, 2020 to December 21, 2022.

Godrej Properties: The company announced that it has entered into an agreement for development of 14.27 acres of land in Gurugram, Haryana to strengthens its presence in the city. The development will comprise predominantly of premium residential apartments and the site is strategically located with easy access to National Highway 48 and Northern Peripheral Road. The proposed development will have an estimated revenue potential of about Rs 3,000 crore.

Greaves Cotton: The company said its e-mobility business, Greaves Electric Mobility, has adopted the Siemens Xcelerator portfolio of software and services to design and develop its electric 2 & 3-wheeler vehicles for the Indian market. The company said that the initiative re-affirms the group’s vision to popularize EV adoption and bring affordable, sustainable, last-mile mobility to India’s rapidly burgeoning EV ecosystem.

Bharti Airtel: The telco announced the launch of its cutting edge 5G services in Pune. Airtel 5G Plus services will be available to customers in a phased manner as the company continues to construct its network and complete the roll out. Airtel said customers with 5G enabled devices will enjoy high speed Airtel 5G Plus network at no extra cost until the roll out is more widespread.

Shriram Finance: The company announced that the AUM of the company in Andhra Pradesh (AP) and Telangana (TG) combined touched Rs 33,000 crore. The growth has been on the back of an economic turnaround, rural markets revival and pick up in infrastructural activity. These factor have driven up demand for financing of commercial vehicles, micro, small and medium enterprises (MSME) and two-wheelers.

Granules India: The company’s board approved appointment of Mukesh Surana as chief financial officer (CFO) with effect from December 30 , 2022. Mukesh Surana is a chartered accountant and currently working with Garware Technical Fibres as President & CFO.

Indus Towers: The company’s board has approved the appointment of Prachur Sah as an Additional Director as well as Managing Director and Chief Executive Officer (MD & CEO) of the Company with effect from January 3, 2023, for a period of five years.

Welspun Enterprises: The company announced that it has complied with all necessary Conditions Precedents (CP) and has obtained all necessary regulatory & statutory approvals for First Closing including National Highways Authority of India (NHAI), Public Works Department of Government of Maharashtra (PWD) and lenders for divestment of 100% stake in HAM assets and 49% stake in BOT-Toll asset. The divestment of the remaining 51% stake in BOT-Toll asset shall be undertaken upon obtaining necessary regulatory and statutory approvals. The cumulative enterprise value for the entire transaction stands at Rs 5,853 crore after considering the net current assets and other closing parameters.

Rail Vikas Nigam (RVNL): The PSU said that it has received a contract worth Rs 198 crore for construction of Bhesan Depot and workshop from Gujarat Metro Rail Corporation (GMRC). The work order entails construction of Bhesan Depot and workshop including DDC, BCC and associated electrical and mechanical (E&M) works under corridor – C2, Bhesan to Saroli, for Surat Metro Rail Project Phase-1, DC 2. The project is expected to be executed within 20 months.

Spandana Sphoorty Financial: The company has received a binding bid from an Asset Reconstruction Company (ARC), amounting to Rs.95 crore, on Security Receipt consideration basis, for the written-off portfolio with outstanding of Rs 323.08 crore as on September 30, 2022. The company will follow Swiss Challenge method for bidding, and decision of sale shall be taken as per extant guidelines governing Swiss Challenge Method and the relevant policy of the company.

G R Infraprojects: The company announced that it has completed the construction of eight lane access-control expressway carriageway, from Miyati Village to MP-Gujarat Border under Bharatmala Pariyojana in Madhya Pradesh. The completion certificate has been issued by the authority’s engineer on December 22, 2022 and the project is fit for entry into commercial operation with effect from 30 November 2022. The contract price of the project stood at Rs 996.27 crore.

Godawari Power & Ispat: The company’s board has decided to enhance the capacity for manufacturing high grade iron ore pellets from its existing 2.7 million tons to 5.40 millions tons per annum by setting up additional Pellet plant with a capacity of 2.7 million at existing plant location at Siltara Industrial Area, Raipur, subject to necessary regulatory approvals. The company’s board has also approved enhancement of exiting iron ore mining capacity at Ari Dongri mines from 2.35 million tors to 6 million tons per annum with setting up of iron ore beneficiation plant with a capacity 6 Millions tons per annum.

Sarda Energy & Minerals: The company announced that its wholly owned subsidiary, Sarda Metals & Alloys, has successfully completed the installation of third Ferro Alloys furnace of 36 MVA under the expansion project at its existing facility at Visakhapatnam.

Solar Industries India: The company will issue 600 NCDs having a face value of Rs 10 lakh for an aggregate amount of Rs 60 crore. The NCDs are proposed to be listed on Wholesale Debt Market segment of BSE Ltd. The tenor of these NCDs will be for three years from the date of allotment.

Axiscades Technologies: The company has completed the acquisition of Mistral Solutions, a leader in semiconductor, embedded electronics, defence and product engineering capabilities. The acquisition, which was initiated in the year 2017, was executed over four phases at a cost of Rs 296 crore. With this acquisition, the company has strengthened its position as a technology leader, providing cutting-edge product design and development services to its customers for a wide range of applications.

Meghmani Organics: The company said that its wholly owned subsidiary, MCNL, has entered into a licensing agreement with one of leading domestic fertiliser manufacturer for producing nano urea fertilizer by using their domestically developed patented technology. Nano urea is a liquid fertilizer and it is effective in enhancing the nutritional quality, crop’s productivity as well as environmentally safe. Meghmani Crop Nutrition (MCNL) will incur a capex of Rs 150 crore for setting up a plant in Gujarat and its annual capacity is estimated at 5 crore bottles (approximately 500 ml) per year. MNCL is expected to commence the commercial production by Q4FY24.

Vardhman Holdings: The company announced that its chief financial officer, Poorva Bhatia, has resigned with effect from December 21, 2022. According to the exchange filing, Bhatia due to personal reasons.

Ingersoll-Rand: Shares of the company surged more than 6% after the company announced that its board has approved setting up a new manufacturing plant in Gujarat to increase its manufacturing capacity of the existing products and also to manufacture new products. The new plant would raise the company’s capacity to 15,000 units per month from current 10,000 units per month and would help in catering to demand from domestic as well as export markets. The project requires an investment of Rs 170 crore and the required investment would be financed from internal accruals.

Abans Holdings: The company made a weak stock market debut. The shares opened at Rs 273 on the NSE against an issue price of Rs 270 apiece. The shares hit a high of Rs 273 apiece and the shares closed at Rs 218.40 per share which was also it lowest prices on its first day of trading.

Landmark Cars: The company made a weak stock market debut. The shares opened at Rs 471 against the issue price of Rs 506. The shares hit a high of Rs 481.15 and a low of Rs 446.2 apiece. The shares recouped some losses and closed at Rs 458.4 apiece.

3i Infotech: The company said that it has secured a digital infrastructure managed services contract worth Rs 10.25 crore from Eureka Forbes for three years. The scope of contract includes managed services for end user services, data centre services, and network & security services along with IT service management & automation tools. The contract is for three years starting from February 1, 2023, to January 31 ,2026, with the option to extend the contract with mutual agreement.

Indus Towers: The company’s board has appointed Prachur Sah as an additional director as well as managing director and chief executive officer (MD & CEO) of the company with effect from January 3, 2023, for a period of five years. The appointment of Sah will be subject to the approval of shareholders in accordance with the applicable laws, said the company. Sah is an Electrical Engineer from Indian Institute of Technology, Mumbai and MSc in Management from Heriott Watt University, Edinburgh. Further, Sah has an overall experience of more than 22 years and he is, currently, working as the CEO of Oil & Gas vertical of Vedanta.

Rajratan Global Wire: The company announced that it has received an approval under Production Linked Scheme (PLI) from Government of India for specialty steel (tyre bead wire). The company will receive incentives and it would be payable on incremental production over the base year production as defined in the PLI Scheme. The incentive is subject to terms and conditions as approved by the Government of India from time to time, the company said in a statement.