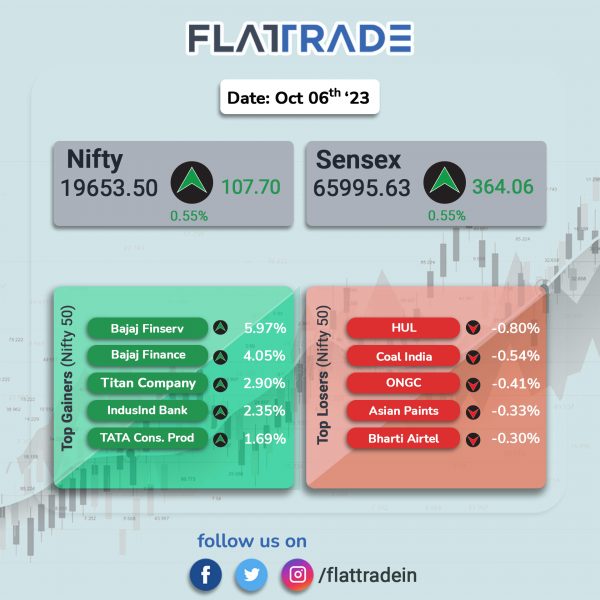

Dalal Street rallied on Friday as the Reserve Bank of India kept the repo rate unchanged at 6.5% and maintained GDP growth and CPI inflation forecast for FY24 at 6.5% and 5.4%, respectively. The Sensex rose 0.55% and the Nifty gained 0.55%.

In broader markets, the Nifty Midcap 100 index 0.6% and the BSE Smallcap climbed 0.56%.

Top gainers were Realty [3.08%], Pharma [0.71%], Financial Services [0.71%], IT [0.67%], Metal [0.53%]. Nifty Media slipped 0.02%.

The Indian rupee closed at 83.25 against the US dollar on Friday.

Stock in News Today

ONGC: The board has approved extension of back stopping support to investors for Compulsorily Convertible Debentures (CCDs) of Rs 5,615 crore issued by ONGC Petro additions (OPaL), a joint venture of the company, and providing Letter of Comfort (LOC) for raising additional debt by OPaL up to Rs 5,400 crore subject to approval of shareholders of the company.

Vodafone Idea: The telecom firm said that the Department of Telecommunication (DoT) has disposed-off the company’s representation with respect to license fee demand aggregating to Rs 3,273 crore. The company said that it has in the past written to DoT to correct the errors in demands up to FY 2016-17 which DoT has not acted upon so far.

Kalyan Jewellers: The company recorded a consolidated revenue growth of about 27% for the recently concluded September quarter compared to the same period in the previous financial year. The revenue growth in the first half of the current financial year rose 29% YoY. Its Indian operations during Q2FY24 grew 32% YoY, led by robust operating momentum on the ground with healthy same-store-sales growth across all the key markets in the country.

Sun Pharmaceutical: The company said the United States Food and Drug Administration (USFDA) has accepted its New Drug Application (NDA) for deuruxolitinib for the treatment of adults with moderate to severe alopecia areata, an autoimmune disorder that can lead to hair loss. In the NDA, Sun Pharma has submitted 8mg twice daily regimen of deuruxolitinib for FDA review.

Zydus Lifesciences: The company has received final approval from the United States Food and Drug Administration (USFDA) for Sugammadex Injection, which is used for the reversal of neuromuscular blockade induced by rocuronium bromide and vecuronium bromide in adults undergoing surgery. Sugammadex Injection Single Dose Vial had an annual sales of USD 986 million in the United States, according to IQVIA MAT August 2023.

NLC India: The company’s board has approved incorporation of a wholly owned subsidiary to undertake the future renewable projects of the company with the name and style of NLC India Green Energy.

Manappuram Finance: The company has allotted secured, rated, listed, redeemable, non-convertible debentures of face value of Rs 1 lakh each for an amount of Rs 600 crore on private placement basis. The net proceeds from the subscription of the NCDs shall be utilized for general corporate purpose, repayment/re-financing of existing debt and deployment in business and growth of asset book.

Cressanda Solutions: The company has entered into a share purchase agreement to acquire 51% stake in Mastermind Advertising.

TajGVK Hotels & Resorts: The company announced that the rating of company’s long term loans aggregating to Rs 32.15 crore is upgraded to ICRA A from ICRA A- by the credit rating agency and the short term credit facilities aggregating to Rs 30 crore is retained at ICRA A2+. The outlook on long term rating is Stable.

Ram Ratna Wires: The company has invested Rs 14.80 crore in its joint venture subsidiary, Epavo Electricals (Epavo), and has been allotted 1.48 crore equity shares of Rs 10 each on rights basis. The board of Epavo at its meeting held on October 5, 2023, has approved allotment of two crore equity shares of Rs 10 each aggregating Rs 20 crore on rights basis.

Valiant Laboratories: Shares of the company opened at Rs 162.15 per share against the IPO issue price of Rs. 140apiece. Shares hit a high of Rs 170.25 and closed at the same price.

PB Fintech: SoftBank is likely to sell 2.54% stake in PB Fintech worth nearly Rs 874 crore via a block deal, CNBC-TV18 reported citing sources. The report said that the Indicative price for block deal in PB Fintech is likely around Rs 752-767 per share.