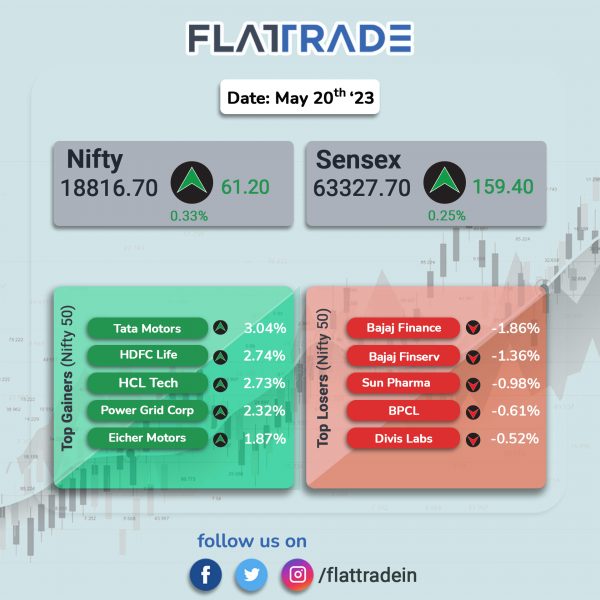

Benchmark equity indices rebounded from the day’s lows to close higher, supported by gains in IT, auto and metal stocks. The Sensex gained 0.25% and the Nifty rose 0.33%.

In broader markets, the Nifty Midcap 100 index rose 0.49% and the BSE Smallcap jumped 0.4%.

Top gainers were IT [0.78%], Auto [0.74%], Metal [0.70%], Realty [0.49%], and Energy [0.49%]. Top losers were Media [-1.22%] and Pharma [-0.19%]

Indian rupee fell 17 paise to 82.12 against the US dollar on Tuesday.

Stock in News Today

Bharti Airtel: The company and Matter Motor Works have announced a strategic partnership to deploy Airtel’s IoT solution in Matter AERA, India’s first and only geared electric motorbike. As part of the partnership, Airtel will enable advanced automotive grade E-Sims on all Matter AERA bikes. In the first phase, 60,000 Matter bikes will be enabled with Airtel E- Sims with advanced IOT features. Matter plans to produce over 3,00,000 such bikes over the next three years. Airtel’s advanced IoT platform will help with the real time tracking of these vehicles, monitoring performance with advanced analytics while maintaining extremely high reliability augmented by telco grade security.

Subros: Shares of the company were locked in a 20% upper circuit after Union Minister for Road Transport and Highways Nitin Gadkari said that he has approved the proposal for making ACs compulsory in all truck cabins. With this development, all truck cabins will have to be mandatorily air-conditioned starting in 2025.

Yes Bank: The lender’s board will meet on Friday (23 June 2023) to consider and approve the proposal of borrowing or raising funds. The board will consider borrowing or raising funds in Indian/foreign currency by issue of debt securities including but not limited to non-convertible debentures, bonds, medium term note (MTN) etc., subject to necessary approvals from shareholders/ regulators, as applicable.

NBCC: The civil construction company announced that it has received a work order aggregating to Rs 50.67 crore from Navodaya Vidyalaya Samiti for a construction project in Bihar, Jharkhand, and Uttar Pradesh. The scope of the project entails construction of MP Hall at Jawahar Navodaya Vidyalaya (JNV) in various location of Bihar, Jharkhand and UP. The company said that the order is expected to be executed in 12 months.

Dev Information Technology: The company announced that LT1, a wholly owned step down subsidiary of Lilikoi Holdings, (USA), has acquired a 51% stake in DEV IT in an all cash deal. Through acquisitions and in-house expertise, Lilikoi is creating a unique ecosystem to design, engineer, manufacture, and support their internet of things (IoT) devices, edge devices, base stations, repeaters, and seamlessly integrate various technologies and solutions.

Manappuram Finance: The NBFC said that its board has approved the re-appointment of V P Nandakumar as the managing director & chief executive officer (MD & CEO) of the company, with effect from 1 April 2024 up to 31 March 2029. Meanwhile, the company’s board has appointed Issac E A as the chief compliance officer, for a period of three years, effective from 20 June 2023. Further, the company’s board has also granted an approval to apply for right issue of Asirvad Micro Finance, subsidiary of the company.

Delta Corp: The company informed that its board of directors re-appointed Ashish Kapadia as managing director (MD) of the company for a period of five years effective from 27 April 2024. Kapadia has been managing director of Delta Corp since April 2009.

Aurionpro Solutions: Shares of the company were locked in the 5% after the company’s board approved issue of equity shares and warrants to Malabar India Fund. Aurionpro plans to raise Rs 26.4 crore through an issue of 3 lakh equity shares at a price of Rs 880 per share on a preferential basis. It also plans to issue 5 lakh warrants, each carrying a right to subscribe to one equity share at an exercise price of Rs 880 per share, to raise around Rs 44 crore, according to the company’s regulatory filing.

Dharmraj Crop Guard: The company had launched the two new insecticides products in the domestic market with brand name ‘OLEPPO’, it said in an exchange filing.

Innovators Facade Systems: The company has received work orders for Design, Supply, Fabrication and Installation of Facade Work for The Prestige – Tower D, Mumbai, worth Rs. 29.73 and IKEA GMP Project, Gurgaon, worth Rs. 97.84 excluding taxes.