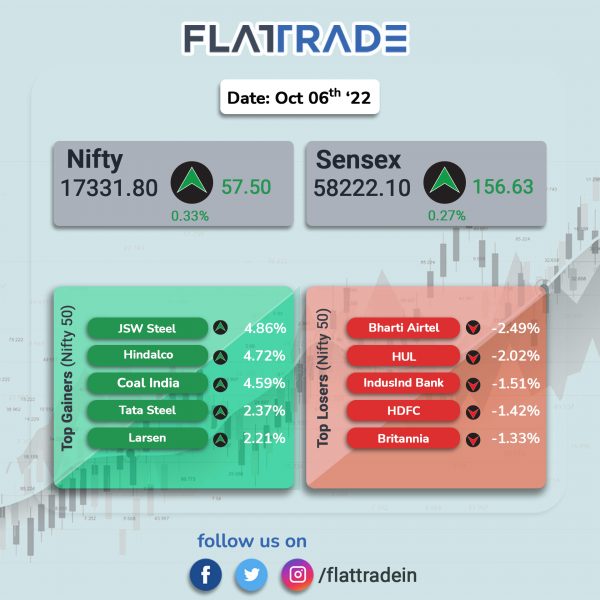

Domestic shares ended higher helped by gains in metal, realty and IT stocks. The Sensex gained 0.27% and the Nifty 50 index rose 0.33%.

The broader market outperformed headline indices. The Nifty Midcap 100 index surged 1.26% and the BSE Smallcap jumped 1.30%.

Top gainers among Nifty sectoral indices were Metal [3.25%], Media [2.73%], Realty [2.08%], IT [1.57%] and PSU Bank [0.81%]. Top losers were FMCG [-0.43%] and Pharma [-0.34%].

Indian rupee lose 36 paise to 81.88 against the US dollar on Thursday.

The seasonally adjusted S&P Global India Services PMI Business Activity Index showed a reading of 54.3 in September signalling growth for the fourteenth consecutive month. However, services activity in September declined from 57.2 in August and it was the the weakest rate of expansion since March 2022.

Stock in News Today

Larsen & Toubro (L&T): Shares of the company rose over 2% after the company said that the buildings & factories business has secured an order from a leading automobile major to construct a state-of-the-art manufacturing facility in Haryana. The value of the significant project is between Rs 1,000 crore and Rs 2,500 crore. The scope involves design & execution of civil, structural & architectural works including external development works.

Viacom18: The Reliance Industries-backed media company will stream the FIFA World Cup tournament, which will start on November 18 in Qatar, on its Jio Cinema app for free. Viacom18 clinched the deal to stream FIFA matches in India last year.

Macrotech Developers (Lodha): The realty firm reported a 57% increase in its sales bookings during the July-September quarter to Rs 3,148 crore aided by strong housing demand. It reported a pre-sales of Rs 2,003 crore in the year-ago period. The company’s sales bookings have reached Rs 6,004 crore, which is 52% of its guidance of Rs 11,500 crore for the current financial year.

Persistent Systems: Shares of the company rose 8.23% in intraday trade after global brokerage firm JPMorgan said in a report that the company had a relatively defensive portfolio with exposures to software tech, BFSI and medical clients and has the highest exposure to US-based clients who are relatively better placed on tech spending as opposed to Europe clients. The report said that the company derives the highest share of its revenues in dollars, which has been strengthening against the Indian currency. The broker expects Persistent Systems to clock the highest earnings CAGR of 25% over FY22-25E.

Bharat Forge Ltd: Shares of the company jumped 9.34% in intraday trade after ACT Research said that preliminary class 8 truck orders in North America reached a record high on a monthly basis. Over the past 12 months, 249,000 class 8 orders have been booked, ACT research said. The report attributed the strong growth to original equipment manufacturers (OEMs) opening their order boards for 2023 earlier than normal.

HFCL: The company in an exchange filing said that it has entered into an agreement with Qualcomm Technologies for design and development of 5G outdoor small cell products. The company said that it is expanding its 5G Radio Access Network portfolio by launching product development of 5G outdoor small cell products for India and international markets.

Poonawalla Fincorp: The company’s consolidated assets under management (AUM) grew by 21% year-on-year to Rs 18,550 crore at end of September 2022. Total disbursement for Q2FY23 stood at approximately Rs 3,720 crore, up 44% YoY, and it was the highest-ever quarterly and monthly disbursement during Q2FY23 and September 2022 respectively. The management has also estimated a 30% YoY growth for the year.

Shriram City Union Finance: The two-wheeler financier is offering an attractive rate of interest as low as 5.5% to its borrowers. The company said that on timely repayment of EMIs, the customer stands to get a refund on one EMI. The scheme offers instant approval, zero processing fees, no documentation charges, and zero advance EMI, with no hidden costs. It added that all festive offers are valid till 30 November.

RBL Bank: The lender said that total deposits rose 5% to Rs 79,407 crore during the July-September 2022 quarter from Rs 75,588 crore registered in the same period last year. CASA deposits stood at Rs 28,718 crore during the end of second quarter, registering a growth of 7% YoY. CASA ratio improved to 36.2% in Q2FY23 compared with 35.4% in Q2FY22. It gross advances stood at Rs 64,677 crore, recording a growth of 12% YoY. Retail advances grew 5% YoY, while wholesale advances grew 20% YoY.

Ujjivan Small Finance Bank: The lender’s gross loan book jumped 44% to Rs 20,938 crore at the end of second quarter as against Rs 14,514 crore recorded at the end of September 2021. The bank witnessed sustained growth in disbursement, which improved to Rs 4,867 crore as on September 30, 2022, up 56% YoY. During the period, total deposits rose 45% YoY to Rs 20,389 crore, driven by strong momentum in retail deposits. CASA deposits increased 73% YoY to Rs 5,492 crore at the end of second quarter of FY23.

Mahindra Lifespace Developers: The company said that it has entered into an agreement with Actis to establish a joint venture platform for developing industrial and logistics real estate facilities across India. Under the joint venture, the companies will acquire up to 100 acre of land with ready infrastructure in the two Mahindra World Cities, offering a built-up space of over two million square feet, subject to requisite approvals.

Ashiana Housing: The company said that it sold 583 units of saleable area of 8,22,357 square feet with a saleable value of Rs 392.23 lakhs during the first half of FY23. The company sold 323 units for Rs 226.78 crore in the second quarter compared to 260 units for Rs 165.45 crore.

Indian Energy Exchange (IEX): The company announced that it has recorded 8,160 MU volume in September 2022, registering 5% MoM growth. This comprised 7118 MU in the conventional power market, 454 MU in the Green Power Market, and 588 MU (5.88 lac Certificates) in the Renewable Energy Certificate (REC) market. The company said that the supply side constraints continued due to high prices of e-auction coal, imported coal and gas.

Glenmark Pharmaceuticals: The drugmaker has launch Thiazolidinedione Lobeglitazone (Lobeglitazone) in India for the treatment of type 2 diabetes in adults. With this launch, the company aims to improve glycemic levels in uncontrolled diabetics and create a new pathway to treat insulin resistance in India, the drug maker said in a press release.