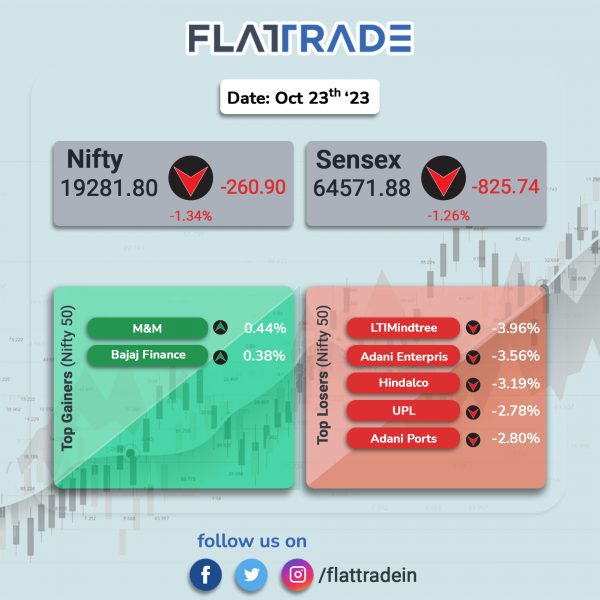

Dalal Street ended deep in the red as investors were worried over global economic uncertainty amid rising US Treasury Yields which soared over 5% on Monday. In addition, the Israel-Hamas conflict and higher-for-longer interest rates dented investor optimism. The Sensex tanked 1.26% and the broader Nifty 50 index tumbled 1.34%.

Broader markets underperformed headline indices. The Nifty Midcap 100 index plunged 2.665 and the BSE Smallcap plummeted 4.17%.

All indices closed in the negative zone. Top losers were Media [-4.98%], PSU Bank [-3.77%], Metal [-3.26%], Realty [-2.49%], an IT [-1.97%].

The Indian rupee weakened by 7 paise to close at 83.19 against the US dollar on Monday.

Stock in News Today

Laurus Labs: The pharma company reported a consolidated net profit of Rs 37 crore, down by 84% year-on-year from Rs 233.39 crore in the year-ago period. Its consolidated revenue from operations for the quarter under review stood at Rs 1,224 crore, down by 22% YoY. Ebitda stood at Rs 188 crore, down by 58% YoY and the EBITDA margins were at 15.4% in the reported quarter.

Hindustan Foods: The company has executed a Share Purchase Agreement with KNS Shoetech Private Limited to acquire 100% share capital for Rs 3.71 crore. The company will also takeover the debt of the KNS including its bank loans as well as unsecured loans. The contract manufacturer in the FMCG and consumer goods sector further said it plans to invest up to Rs. 100 crore to set up, acquire and invest in the area of sports shoes manufacturing. This strategic move marks a significant bet on the thriving sports shoes space in India.

Aurobindo Pharma: The company announced that Eugia Pharma Specialities has received final approval from the USFDA to manufacture and market Testosterone Cypionate Injection. The approved drug is a bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Depo-Testosterone Injection of Pfizer Inc. The product is expected to be launched in November 2023. The approved product has an estimated market size of US$ 226.8 million for twelve months ending August 2023, according to IQVIA.

Samvardhana Motherson: The company’s board has approved acquisition of 73.05% in Irillic Private Limited through combination of primary infusion and secondary acquisition. Post acquisition, Irillic will become subsidiary of the company. Irillic is engaged in design, development, manufacturing, and distribution of real time Fluorescence Imaging and Laparoscopy Imaging systems for the medical device ecosystem.

Genus Power Infrastructures: The company said that its wholly owned subsidiary has received a letter of award (LOA) worth Rs 3,121.42 crore for appointment of advanced metering infrastructure service providers (AMISPs). The contract includes design of advance metering infrastructure (AMI) system with supply, installation and commissioning with FMS of 36.27 lakhs smart prepaid meters, system meters including DT Meters with corresponding energy accounting on DBFOOT basis.

Mahindra Holidays: The company said its consolidated revenue from operations rose by 10% YoY to Rs 655.27 crore in Q2FY24. Total expenditure increased by 11% to Rs 636.32 crore in Q2FY24 over Q2FY23. Ebitda was up 16.84% at Rs 136.09 crore in Q2FY24 as against Rs 116.47 crore in the year-ago period. Consolidated net profit fell 48.22% to Rs 21.43 crore in Q2FY24 from Rs 41.39 crore in Q2FY23.

Finolex Industries: The company reported a consolidated net profit of Finolex Industries reported to Rs 97.96 crore in the quarter ended September 2023 as against net loss of Rs 95.38 crore during the previous quarter ended September 2022. Sales declined 6.16% to Rs 883.15 crore in the quarter ended September 2023 as against Rs 941.13 crore during the previous quarter ended September 2022.

Ceinsys Tech: The company has secured work allocation order from State Water and Sanitation Mission (SWSM), Water Supply and Sanitation Department (WSSD), Government of Maharashtra, amounting to Rs 248.39 crore for appointment of system integrators (SI’s) for IoT deployment including design, implementation & maintenance with centralized IoT platform for Jal Jeevan Mission Projects in Maharashtra.