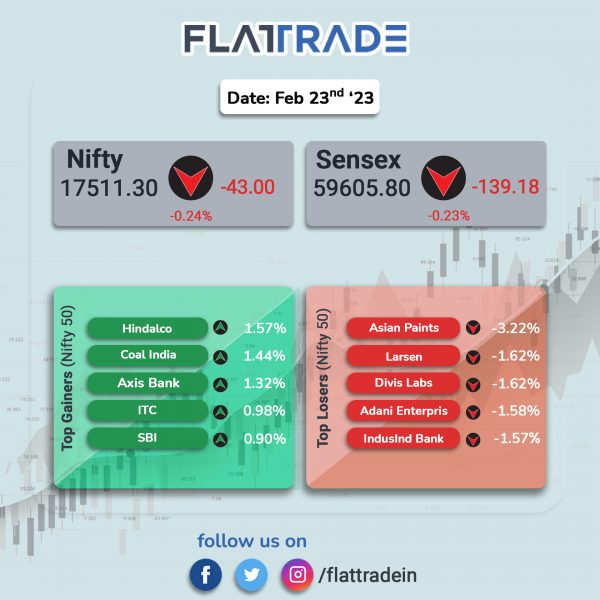

Benchmark indices fell in a volatile session after the minutes from the recent meetings of the Reserve Bank of India and the US Federal Reserve indicated that they will keep increasing the interest rates to tame inflation. The Sensex fell 0.23% and the Nifty 50 index dropped 0.25%.

In broader markets, the Nifty Midcap 100 index slipped 0.15% and the BSE Smallcap inched up 0.06%.

Top losers were Nifty Realty [-1.78%], Media [-1.77%], Energy [-0.52%], Pharma [-0.2%] and Oil & Gas [-0.17%]. Top gainers PSU Bank [0.53%], Metal [0.35%] and FMCG [0.26%].

Indian rupee gained 12 paise to 82.73 against the US dollar on Thursday.

Stock in News Today

Tata Motors: The Indian carmaker has begun talks with sovereign wealth funds and private equity investors to raise up to $1 billion via a stake sale in its electric vehicle (EV) business, Economic Times reported citing sources. The company plans to sell a significant minority stake, eyeing a valuation of about $10.5 billion, according to the news report. The funds and investors include the UAE-based Abu Dhabi Investment Authority (ADIA) and Mubadala Investment Company, the Saudi Arabia-headquartered Public Investment Fund, Singapore’s Temasek Holdings, and KKR and General Atlantic.

Infosys: The IT behemoth announced that it will expand its collaboration with Microsoft, to help accelerate enterprise cloud transformation journeys worldwide. According to the Infosys Cloud Radar, enterprises can add up to $414 billion in net new profits, annually, through effective cloud adoption. The extended collaboration between Infosys and Microsoft will benefit enterprises by bringing them the best of Infosys Cobalt cloud offerings and Microsoft’s cloud computing technologies, led by Azure, across the business value-chain.

RateGain Travel Technologies: The company signed an agreement with HotelKey, a cloud-based property management for hotels.HotelKey will integrate RateGain’s global distribution, central reservations, and pricing capabilities into its PMS platform. Through the collaboration, hotels on the HotelKey platform will see RateGain’s pricing and distribution tools on its platform. The integration will enable hoteliers to save time and achieve efficiencies, making better distribution decisions and increasing revenue.

Shipping Corporation of India (SCI): Shares of state-owned surged 8.52% in intraday trade after media reports suggested that the government has approved the demerger of the core and non-core assets of the company. According to media reports, the Ministry of Corporate Affairs, on Thursday, approved the revised demerger plan of Shipping Corporation of India, wherein Rs 1,000 crore will be transferred to the non-core assets.

Metro Brands: The footwear retailer is planning to hire between 1,500 and 2,000 workers in the country to staff the new footwear stores it plans to open by the end of 2025, its chief executive, Nissan Joseph, told Reuters news agency in an interview. The company, which had 720 stores as of end-2022 and nearly 4,000 employees overall, said last March it would add 260 new stores that sells brands such as Mochi, Walkaway and Metro, to expand in cities where it is already present and enter smaller towns.

Krsnaa Diagnostics: The company announced that it has signed an agreement with Department of Medical, Health & Family Welfare, Government of Uttar Pradesh (GOUP) for providing CT Scan services in the eight district hospitals in Uttar Pradesh. As part of the agreement, the company has inaugurated its third diagnostics center at Kanpur Nagar.

Wipro: The company’s President Rajan Kohli has resigned after a nearly three-decade career with the IT firm, The Times of India (TOI) reported. He was president of Wipro’s Integrated Digital, Engineering, and Application Services Business Line (iDEAS), and led a team of over 100,000 employees.

Sandur Manganese and Iron Ore: The company said that the Central Empowered Committee (CEC) has allowed the company to enhance the manganese ore production from 2.86 lakh tonnes to 5.82 lakh tonnes. The company is expected to receive consent for operation from the Karnataka State Pollution Board and approval from the Monitoring Committee constituted, and plans to start the operations from the next financial year, it said in an exchange filing.

Deep Industries: The company announced that it has received a Letter of Award from the Oil and Natural Gas Company (ONGC) for hiring one mobile drilling rig of 1,000 HP for an Ahmedabad asset for a period of three years. The total estimated value of the said award is about $12.93 million (~Rs 106 crore). The company will provide mobile drilling rig and equipment along with manpower in terms of roustabouts etc. for maintaining the mud systems as per the requirement of the order.

C.E. Info Systems (MapmyIndia): The company announced the launch of its new line of Mappls Gadgets for cars and two-wheelers – including advanced Vehicle GPS trackers, Dash Cameras, In-Dash Navitainment Systems & Smart Helmet Kits. Mappls Gadgets are available direct from the company’s website as well as offline through approved genuine accessory showrooms of various OEMs, and can be shipped and installed pan India. The gadgets’ prices range from Rs 4,990 to Rs 38,990.

Kolte-Patil Developers: The company’s shares surged 6.88% after the realty company announced that its board will meet on 27 February 2023 to consider the proposal to raise funds by way of issuance of debt securities on private placement basis. The fundraising is subject to approval from the shareholders of the company.

Ugro Capital: Shares of the company jumped 4.1% in intraday trade after the NBFC announced that the investment and borrowing committee of the board will consider the proposal of fund raising on 25 February 2023. The company said that the funds will be raised by way of issuance of non-convertible debentures and/or commercial papers through private placement basis.

IIFL Finance: The company’s subsidiary, IIFL Home Finance, said its net profit rose 54.77% to Rs 216.40 crore in the quarter ended December 2022 as against Rs 139.82 crore during the quarter ended December 2021. Sales rose 36.60% to Rs 680.12 crore in the quarter ended December 2022 as against Rs 497.90 crore during the quarter ended December 2021.