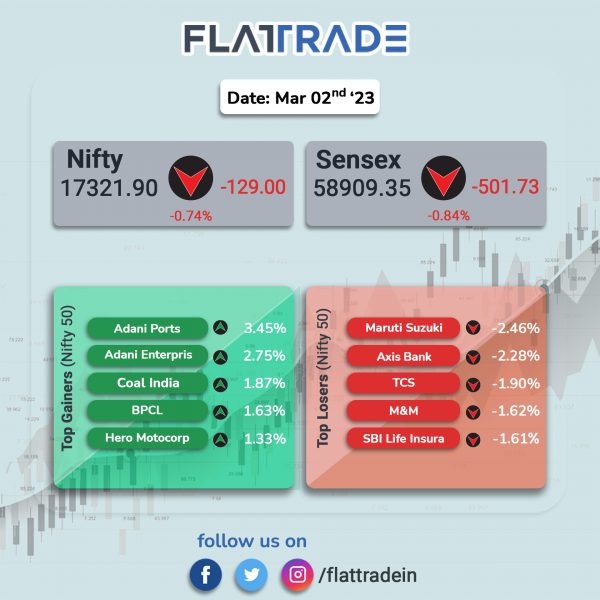

Dalal Street ended lower due to negative global cues and concerns over economic growth prospects. The Sensex fell 0.84% and the Nifty lost 0.74%.

In broader markets, the Midcap 100 index shed 0.32% and the BSE Smallcap dropped 0.22%.

Top losers were IT [-1.26%], Auto [-0.86%], Financial Services [-0.85%], Bank [-0.76%], Private Bank [-0.75%]. Top gainer was Realty [2.06%].

Indian rupee fell 9 paise to 82.59 against the US dollar on Thursday.

Consumer Price Index For Industrial Workers has gained 6.16% year-on-year, according to data released by Ministry of Labour & Employment.

Stock in News Today

Reliance Industries Ltd (RIL) and Tata Power: Solar module makers including Reliance Industries and Tata Power are among bidders for Rs 19,500 billion ($2.4 billion) in financial incentives that India is offering to expand domestic manufacturing and curb panel imports from dominant producer China, Bloomberg reported. Other companies that have shown interest include US-based firm First Solar Inc. and Indian companies JSW Energy, Avaada Group and ReNew Energy Global Plc, Bloomberg reported citing people familiar with the matter.

Reliance Industries Ltd (RIL): Mukesh Ambani’s group is getting into genetic mapping, looking to make a health care trend led by disruptive US startups like 23andMe more affordable and widespread in India’s growing consumer market, Bloomberg reported. The conglomerate will roll out a comprehensive 12,000-rupee ($145) genome sequencing test, according to Ramesh Hariharan, CEO of Strand Life Sciences, which has developed the product and acquired by RIL in 2021. RIL owns about 80% of Strand Life Sciences. The genome test, which is about 86% cheaper than other offerings available locally, can reveal a person’s predisposition to cancers, cardiac and neuro-degenerative ailments as well as identify inherited genetic disorders, he said.

Adani Group: The Supreme Court has set up an expert committee which includes former SBI chairman OP Bhatt, Justice JP Devadhar, KV Kamath, Nadan Nilekani and advocate Somasekhar Sundaresan to examine regulatory mechanisms, after massive losses in shares of Adani Group companies due to a report by a US short seller Hindenburg Research. The committee will be monitored by former Supreme Court judge AM Sapre. The panel shall file its report in a sealed cover in two months.

State Bank of India (SBI): The lender may lower its stake in Yes Bank after a lock-in period ends on March 6 which was put in place by the Reserve Bank of India as a part of the lender’s restructuring, Reuters reported citing two sources. SBI would trim its holdings, albeit in phases, one of the sources told Reuters. The percentage of equity dilution that the bank intends to do will have to be placed before the RBI in due course. SBI held 26.14% stake in Yes Bank as of December 31, according to stock exchange data.

Larsen and Toubro (L&T): The Union Cabinet has accorded approval to sign a contract with engineering and construction conglomerate Larsen & Toubro Limited (L&T) for the acquisition of three cadet training ships at an overall cost of Rs 3,108.09 crore. The Defence Ministry said the delivery of ships is scheduled to commence from 2026. The ships will be indigenously designed, developed and constructed at L&T shipyard in Kattupalli, Chennai, it said.

Sun Pharmaceutical Industries: The company has informed the exchange regarding an “information security incident” and the company has isolated the impacted IT assets. The incident has not impacted company’s core systems and operations. Sun Pharma added that it is taking appropriate containment and remediation actions in a controlled manner to address the incident.

HDFC: The National Company Law Appellate Tribunal (NCLAT) has dismissed a petition by HDFC which sought to stop the sale of IL&FS headquarters in Mumbai’s Bandra Kurla Complex (BKC) to Brookfield Asset Management. HDFC had sanctioned a loan of Rs 400 crore to IL&FS as a lease rental discounting transaction in 2018. However, the National Company Law Tribunal initiated corporate insolvency proceedings thereby staying recovery, foreclosure or enforcement of any security. IL&FS initiated the sale process of the said property in October 2020. The property was put up for sale as part of IL&FS new management’s efforts to recover money to pay off dues.

EKI Energy Services: The company has signed an MOU with UK-based Inclusive Energy to further digital carbon MRV (Measurement, Reporting, and Verification) for energy projects in the voluntary carbon market. The purpose of the MoU is to deepen and strengthen the strategic partnership to further digital carbon monitoring, reporting and verification (MRV) for energy projects in the voluntary carbon market, EKI Energy said.

Tata Steel: The company has bought 7.4 crore non-convertible, non-participating, redeemable preference shares (NCRPS) of face value Rs 10/- each of TRF, a listed associate company of Tata Steel, aggregating to Rs 74 crore (NCRPS Series – 2), on private placement basis. The funds will be used by TRF to meet working capital requirements, repayment/prepayment of the whole or a part of the existing debt and other corporate purposes.

Dreamfolks Services: The company said that its board has approved a proposal to acquire 60% equity shares of Vidsur Golf for an aggregate cash consideration of Rs 1.50 crore. Vidsur Golf is an aggregator which ties up golf clubs directly or indirectly including through master aggregators and offers the golf course game and lesson access to its clients which are primarily network providers and card issuers for their end users.

Best Agrolife: The company announced that its board has appointed Sanjeev Kharbanda as chief financial officer (CFO) and key managerial personnel with effect from 1 March 2023. Sanjeev Kharbanda is a finance professional with a total experience of 28 years in management and business leadership.

Ramco Systems: Etihad Airways Engineering has partnered with Ramco Systems to implement Aviation Suite V5.9. The project was officially announced at the 2023 edition of MRO Middle East, held at Dubai World Trade Centre, Dubai. In addition, Ramco’s digital tools such as Ramco Anywhere mobile apps, dashboards, and integrated customer portals, will seamlessly digitise Etihad Airways Engineering’s operations, enhance process efficiencies, and help them go paperless.

Zydus Lifesciences: The company has received final approval from the USFDA for Acyclovir Cream, which is used to treat cold sores on the face or lips. The product will be launched shortly in the US market and it had an annual sales of $16.9 million in the US, according to IQVIA MAT December 2022.

Kalpataru Power Transmission: The company announced that it has been selected as one of the preferred proponents to deliver the HumeLink transmission project in Australia. The company as been selected along with Acciona Construction Australia and Genus Plus Group, as the preferred proponent to deliver Transgrid’s HumeLink (East) transmission line project in Australia. The value of the project will be determined post conclusion of early contractor involvement (ECI) stage-2 process.

Kilburn Engineering: The company announced that it has received orders totaling Rs 82.74 crore since 1 February 2023. The company has bagged an order worth Rs 68.60 crore for rotary calciners with accessories for intermediates of active pharmaceutical ingredients (API). It has also received an order for vibrating fluid bed dryer for Tea Industry worth Rs 1.65 crore.

Ramkrishna Forgings: The company plans to install a 7.82 MW capacity roof-top solar project at its existing forging plants in Seraikela and Dugni at Jamshedpur. Upon completion of the project, the power generated will be used for its captive consumption, reducing the company’s dependence on grid power. The project will help the company to achieve its environmental, social, and governance (ESG) vision and contribute to the larger goal of achieving a sustainable future. The total cost of the project is estimated to be about Rs. 35 crore, which will be financed by a mix of debt and equity.

Dilip Buildcon: The company has executed a contract agreement with the Gujarat Metro Rail Corporation for the Rs 723.45 crore project entailing construction of 7.553 kms elevated viaduct and seven number of stations, which includes E&M, architectural finishing, roofing, plumbing, signage, etc. The construction is from Sector- 1 to Mahatma Mandir in connection with Ahmedabad Metro Rail Project, Phase-2.