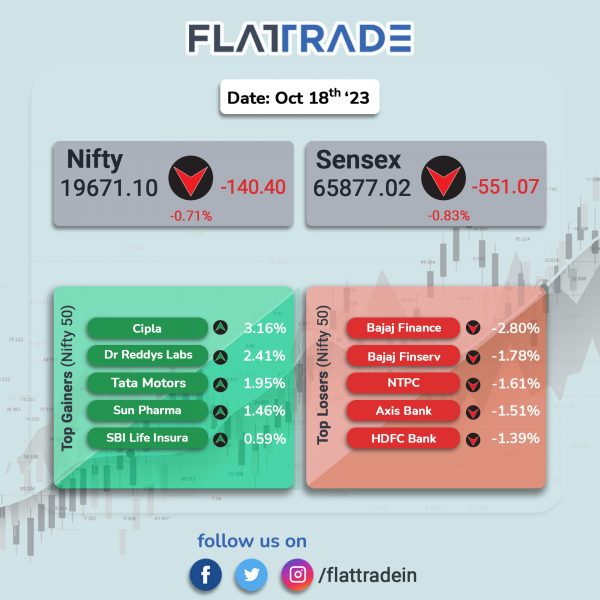

Dalal Street ended lower as investors were worried over the escalating war between Israel and Hamas amid a surge in crude oil prices. The price of crude oil rose over 3% after Reuters reported that Iranian Foreign Minister called members of the Organisation of Islamic Cooperation (OIC) to impose an oil embargo and other sanctions on Israel. The Sensex fell 0.82% and the Nifty lost 0.71%.

In broader markets, the Nifty Midcap 100 index tanked 0.9% and the BSE Smallcap shed 0.31%.

Top losers were PSU Bank [-1.67%], Financial Services [-1.28%], Bank [-1.17%], Private Bank [-1.17%], and Oil & Gas [-0.85%]. Top gainers were Pharma [0.78%] and Media [0.27%].

The Indian rupee closed at 83.26 against the US dollar on Wednesday.

Stock in News Today

Bharti Airtel: The company announced the launch of Airtel CCaaS (Contact Center as a Service) – an omni-channel cloud platform that offers a unified experience for all contact center solution required by an enterprise. The CCaaS will enable enterprises to reduce these investments significantly, as the platform unifies Voice-asa-service (VaaS), cloud and the best of contact center software from leading providers including Genesys. Separately, Airtel has extended 5G coverage to 33 districts of Telangana empowering 30 lakh customers. Airtel’s 5G service is now available across all districts and union territories in the country.

Biocon: The company said Biocon Sdn Bhd., a step-down subsidiary of Biocon Biologics, has received a communication from the USFDA which inspected insulin manufacturing facility at Johor, Malaysia. The USFDA has determined the inspection classification as “OAI” (Official Action Indicated). The OAI status may cause delay and/or withholding of pending product approvals or supplements from the facility. Shares of the company tanked 6.38% on Wednesday.

BSE: The company said its board has approved the appointment of Balaji Venketeshwar as Chief Information Security Officer and Key Management Personnel) with effect from November 1, 2023, in place of Shivkumar Pandey. The board also approved an investment of Rs 30 crore in the company’s wholly owned subsidiary BSE Investments Limited.

NHPC: The company said that the expected quantum of loss caused due to flash flood in Teesta Basin is approximately Rs 233.56 crore. The company further said that it anticipates a delay of at least six months and consequent cost-overrun with respect to Teesta-VI HE Project.

BLS International Services: The company’s subsidiary, BLS E-Services, has signed a master business correspondent agreement with Kotak Mahindra Bank for an initial period of 3 years, with the possibility of extension for an additional year, to bring accessible and affordable banking services to the underserved and unbanked segments of the population. Under this partnership, BLS E-Services will offer a wide array of banking solutions including credit facilities.

Polycab India: The wires and cables manufacturer reported consolidated profit of Rs 426 crore in Q2FY24, up 59% from Rs 268 during the corresponding quarter of FY23. Revenue from operations of the company during the report quarter rose 26.5% to Rs 4,218 crore in Q2FY24 from Rs 3,332 crore in the year-ago period. The company’s Ebitda increased to Rs 608.7 crore during the quarter under review from Rs 427.6 crore in the year-ago period.

Birlasoft: The company announced the appointment of Selvakumaran Mannappan as Chief Operating Officer (COO) effective October 18. Selvakumaran has over 29 years of experience in the IT industry, and a proven track record of delivering innovative and scalable solutions to customers across the globe. In his previous role, he was the delivery head of BFSI‐Americas (Banking, Financial Services & Insurance) at Cognizant Technology Solutions.

Heritage Foods: The company’s consolidated net profit was up 18% at Rs 22.4 crore in Q2FY24 as against Rs 19.04 crore in Q2FY23. Its consolidated revenue rose 20% at Rs 978.55 crore in Q2FY24 as against Rs 816.15 crore in Q2FY23. Ebitda jumped 18% to Rs 47 crore in the reported quarter from Rs 40 crore in the year-ago period.

Huhtamaki India: The packaging company said that its consolidated revenue fell 13.86% to Rs 662.48 crore for the quarter ended September 2023. Consolidated net profit stood at Rs 32.27 crore in the reported quarter as against Rs 4 lakh in the year-ago period. Ebitda jumped 99.34% YoY to Rs 45.75 crore in July-September 2023.

CIE Automotive India: The automotive components supplier reported a consolidated net profit of Rs 375.41 crore in Q2FY24, up 119.07% YoY as against a net profit of Rs 171.36 crore in the same quarter of last year. Its revenue from operations rose to Rs 2,279.41 crore, up 2.24% from Rs 2,229.42 crore in the year-ago period. Ebitda was up 17.7% to Rs 345.37 crore in Q2FY24 from Rs 293.43 crore in Q2FY23.

Glenmark Pharmaceuticals: The company said it has received final approval from the USFDA for Apremilast Tablets, which is a generic version of Amgen’s renowned Otezla. According to IQVIA annual sales data, the said tablets generated annual sales of approximately $3.7 billion as of August 2023.

ICICI Prudential: The company’s standalone net profit rose 23% YoY to Rs 244 crore for the quarter ended September 2023 as against Rs 199 crore in the year-ago period. Net premium income in the quarter under review increased 5% to Rs 10,022 crore in Q2FY24 from Rs 9581 crore in the same quarter of last year. The Value of New Business (VNB) stood at Rs 1,015 crore with a VNB margin of 28.8% for the first half of the current fiscal. The total annualised premium equivalent (APE) for the company stood at Rs 3,523 crore.

Syngene International: The company reported a 14.22% rise in consolidated net profit at Rs 116.5 crore in Q2FY24 compared with a consolidated net profit of Rs 102 crore in the year-ago period. Consolidated revenue from operations rose to Rs 910.1 crore in the quarter under review from Rs 768.1 crore in the year-ago period. Shares plunged over 6% the company cut its revenue guidance to a mid-teen level in the second half of the year.

CanFin Homes: The housing finance company reported an 11.5% YoY rise in net profit to Rs 158 crore for the second quarter ended September 2023. The company had posted a net profit of Rs 141.7 crore in the corresponding quarter last year. Net interest income (NII) rose 26% to Rs 316.8 crore in the quarter under review from Rs 251.2 crore in the corresponding quarter of FY23. Net NPA stood at 0.43% in the reported quarter as against 0.34% in the preceding quarter. quarter-on-quarter.