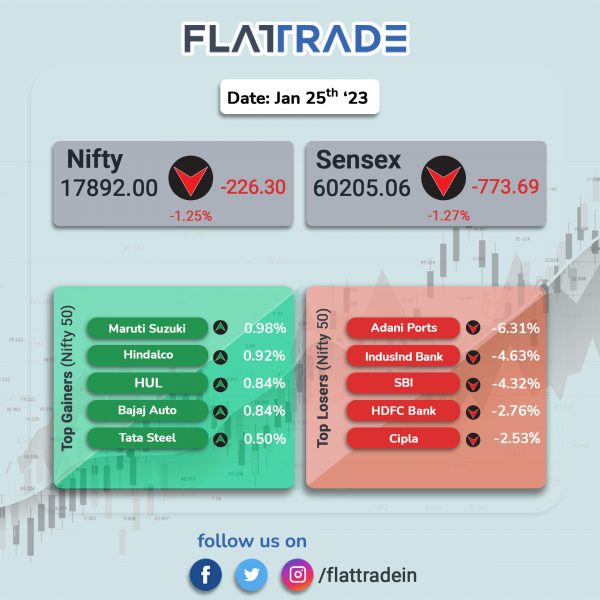

Indian equity indices plunged more than 1% as slower growth outlook by companies and weak global cues dented investors’ optimism. The Sensex plunged 1.25% and the Nifty 50 index tanked 1.25%.

Broader markets mirrored headline indices. The Nifty Midcap 100 index slumped 1.47% an the BSE Smallcap was down 0.94%.

Top losers among Nifty sectoral indices were PSU Bank [-3.58%], Bank [-2.54%], Private Bank [-2.30%], Financial Services [-2.13%] and Oil & Gas [-1.99%]. All indices closed in the red.

Indian rupee rose 13 paise to 81.59 against the US dollar on Wednesday.

Government of Indian sold Rs 8,000 crore worth of sovereign green bonds today. The RBI auctioned Rs 4000 crore of five-year bonds at a coupon rate of 7.10% and another Rs 4000 crore of 10-year bonds were auctioned at a coupon rate of 7.29%. This was India’s first sovereign green bond auction.

Stock in News Today

Cipla: The company said its consolidated revenue rose 6% to Rs 5,810 crore in Q3FY23 from Rs 5,479 crore in Q3FY22. The company’s net profit increased 10% to Rs 801 crore in the quarter under review from Rs 729 crore in the year-ago period. EBITDA was up 12% YoY to Rs 1,408 crore in Q3FY23 and the EBITDA margins were 24.2% in the reported quarter as against 22.9% in the year-ago period.

Indian Bank: The public sector lender posted a net profit of Rs 1,395.8 crore in Q3FY23 as against Rs 689.7 crore in Q3FY22. NII was up 25.1% to Rs 5,499.12 crore in Q3FY23 from Rs 4,395.1 crore in Q3FY22. The lender said its gross NPA stood at 6.5% in the quarter under review as against 7.3% in the preceding quarter. Net NPA improved to 1% in Q3FY23 from 1.5% in the prior quarter.

TeamLease Services: The company said its net profit fell 9.1% to Rs 29 crore in Q3FY23 asa against Rs 31.9 crore in the preceding quarter. Revenue rose 2.7% to Rs 2,008.3 crore in Q3FY23 from Rs 1,955.1 crore in Q2FY23. EBITDA was flat at Rs 31.7 crore and margin was also unchanged at 1.6% in the reported quarter.

RateGain Travel Technologies: The company said that Cinnamon Maldives has selected RateGain’s Engage AI product and would be implementing it at its iconic Dhonveli property to accentuate their guest engagement, provide contactless check-in/check-out and improve their ancillary revenue in a competitive market by getting access to guest analytics in real-time. Using Engage AI, Cinnamon Dhonveli Maldives will be able to provide consistent engagement to their guests starting from pre-check-in to post-check-out. All this in the guests’ preferred language.

Arvind: The company said its net profit declined 9.32% to Rs 84.12 crore in the quarter ended December 2022 as against Rs 92.77 crore during the same quarter a year ago. Its revenue declined 12.79% to Rs 1979.79 crore in the quarter under review as against Rs 2270.07 crore in the year-ago quarter. Separately, Arvind said its board has approved the appointment of Jayesh Shah, Whole Time Director as Chief Financial Officer of the company effective January 26. The board accepted the resignation of Swayam Saurabh as Chief Financial Officer of the company effective close of business hours on January 25.

Sona BLW Precision Forgings (Sona Comstar): The company reported a 23.9% YoY jump in consolidated net profit to Rs 107.10 crore and a 38.95% YoY surge in revenue from operation to Rs 675.26 crore in Q3FY23. EBITDA jumped 43% YoY to Rs 186 crore in quarter ended December 2022 and EBITDA margin was at 27.2% in Q3FY23. Battery Electric Vehicles (BEV) revenue improved to 29% YoY and contributed 26% of total revenue. The company said that its net order book increased by 16.1% to Rs 23,800 crore in Q3FY23 from Rs 20,500 crore in the preceding quarter.

Jyothy Labs: The company’s net profit jumped 77.4% to Rs 67.4 crore in Q3FY23 from Rs 38 crore in Q3FY22. Revenue was up 13.7% YoY Rs 612.7 crore in Q3FY23 from Rs 539 crore in Q3FY22. EBITDA increased 37.8% YoY in Q3FY23 to Rs 84.4 crore. EBITDA margin improved to 13.8% in Q3FY23 from 11.4% in Q3FY22.

Quick Heal Technologies: The company’s shares dropped 8.7% after the company reported a consolidated net loss of Rs 9.3 crore in Q3FY23 compared with net profit of Rs 14.3 crore in Q3FY22. Revenue from operations declined 16.1% to Rs 66.8 crore in Q3FY23 compared with Rs 79.6 crore in Q3FY22. The company reported negative EBITDA of Rs 11.4 crore in Q3 FY23 as against positive EBITDA of Rs 20.5 crore in Q3 FY22. EBITDA margin declined to 17.0% in Q3FY23 from 27.72% in Q3FY22. The company said it is witnessing signs of short-term contraction in the consumer market due to lowering of global IT spends.

Laxmi Organic Industries: The chemicals manufacturer said its consolidated net profit slumped 61.4% to Rs 27.23 crore in Q3FY23 as against Rs 70.54 crore in Q3FY22. Revenue from operations stood at Rs 654.64 crore in the quarter ended December 2022 from Rs 859.88 crore in Q3FY22, registering a decline of 23.87%.

Kamat Hotels (India): The company’s board has approved allotment of debentures worth Rs 297.50 crore to non-promoters. The company will allot 29,750, 14% secured, rated, listed, redeemable, non convertible debentures having face value of Rs 1 lakh each to four non-promoters. The said debentures will be listed on the stock exchanges.

Sonata Software: The IT company posted 20.47% YoY rise in consolidated net profit to Rs 117.66 crore and a 21.68% YoY jump in revenue from operations to Rs 2,260.78 crore in Q3FY23. Consolidated EBITDA grew by 18% YoY to Rs 172.8 crore in Q3FY23.

Vardhman Textiles: The company’s consolidated net profit declined 76.11% to Rs 102.40 crore in the quarter ended December 2022 as against Rs 428.59 crore during the previous quarter ended December 2021. Revenue declined 8.94% to Rs 2370.47 crore in the quarter ended December 2022 as against Rs 2603.18 crore during the previous quarter ended December 2021.

Go Fashion (Go Colors): The clothing retailer said its profit was up 2.6% YoY to Rs 24.3 in Q3FY23. Its revenue rose 24.4% YoY to Rs 176.7 crore in Q3FY23 as against Rs 142 crore in the year-ago period. EBITDA increased 13.4% to Rs 59.1 crore in Q3FY23 from Rs 52.1 crore in Q3FY22. EBITDA margin declined to 33.4% in Q3FY23 from 36.7% in Q3FY22.

Olectra Greentech: The company’s standalone net profit rose 3.92% to Rs 12.98 crore in the quarter ended December 2022 as against Rs 12.49 crore during the quarter ended December 2021. Its standalone revenue rose 20.04% to Rs 248.64 crore in the quarter ended December 2022 as against Rs 207.13 crore during the quarter ended December 2021.