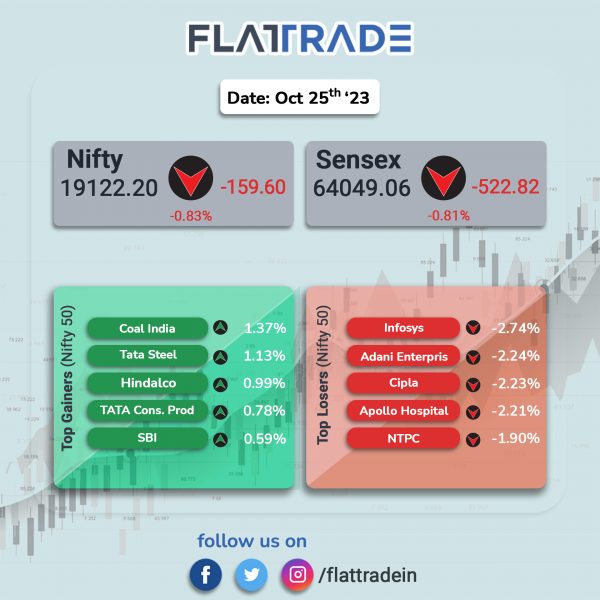

Dalal Street ended lower as investors’ sentiments were dampened due to subdued earnings, strengthening dollar, and concerns over higher-for-longer interest rates. The Sensex fell 0.8% and the Nifty 50 index tanked 0.83%.

In broader markets, the BSE Smallcap tumbled 0.76% and the Nifty Midcap 100 index lost 0.65%.

Top losers were Media [-1.66%], IT [-1.03%], Private Bank [-0.99%], Realty [-0.96%], Financial Services [-0.93%]. Top gainers were PSU Bank [0.17%] and Metal [0.15%].

The Indian rupee appreciated by 2 paise to 83.18 against the US dollar on Wednesday.

Stock in News Today

IndusInd Bank: The lender announced a strategic collaboration with Viamericas Corporation to offer digital inward remittance services to Non Resident Indians (NRIs) in the US through IndusInd Bank ‘Indus Fast Remit’, a remittance service platform. This collaboration will enable NRIs to benefit from highly competitive exchange rates for digital inward remittances to India. Viamericas Corporation will use its existing IndusInd Bank Vostro relationship to credit the beneficiary account in India using the RDA scheme of RBI.

Welspun India: The company said that it achieved a quarterly revenue of Rs 2542.4 crore in Q2FY24, a rise of 19% YoY. EBITDA for Q2FY24 was up 158% YoY at Rs 391.3 crore. Profit After Tax jumped multifold times year-on-year to Rs 196.7 crore in Q2FY24 from Rs 8.7 crore in the year-ago period. Net Debt stood at Rs 1573.4 crore as on 30th September 2023 as against Rs 1815.3 crore in the year-ago period.

Separately, the company’s board has approved an investment of up to Rs 56.40 Crore in a Special Purpose Vehicle (SPV) for supply of 47 MW Renewable Energy Round-The-Clock (RE-RTC) basis for Anjar operations at the most competitive rates. This will make the company’s Anjar Unit about 80% RE by the financial year 2026. Further, the board has appointed Murali Sivaraman as an Independent Director of the company for a period of four years starting from November 01, 2023 to October 31, 2027.

TVS Motor Company: The two-wheeler manufacturer announced that it has deepened its collaboration with ION Mobility through Project Dynamo. The said project is ION Mobility’s conceptual adaptation of the TVS X, TVS Motor’s premium flagship crossover EV, which was launched earlier this year. Through this project, ION aims to capture the needs of Indonesian riders who prioritize performance and speed while improving the advantages of efficient and environmentally friendly electric vehicles.

TV18 Broadcast: The company reported a 22% YoY rise in consolidated revenue from operations at Rs 1,794 crore in Q2FY24 as against a consolidated revenue at Rs 1,473 crore in Q2FY23. The rise in revenue was attributed to performances of news business, movie studio, and sports verticals. Its Ebitda loss widened to Rs 198 crore in Q2FY24 as compared to Rs 40.6 crore in the year-ago period. The company registered a net loss of Rs 29 crore in Q2FY24 compared with a profit of Rs 5.7 crore in Q2FY23.

Wonderla Holidays: The company said that it has successfully obtained all the necessary approvals/ clearances/ NOCs from the Government of Tamil Nadu for its Chennai project and the company is poised to commence the construction of the project. The amusement park will be situated in Illalur village, 45 kilometers away from Chennai, in Thiruporur taluk of Chengalpet district spanning across a sprawling 62-acre. The company plans to invest of Rs 400 crore to develop the amusement park. Shares closed 6.62% higher on Wednesday.

Network18 Media & Investments: The company reported that its consolidated operating revenue for the July-September quarter jumped 20% YoY to Rs 1,866 crore from Rs 1,549 crore in the year-ago period. The net loss widened to Rs 60.99 crore in Q2FY24 from Rs 36.49 crore in Q2FY23. Consolidated operating Ebitda loss stood at Rs 218 crore in the quarter under review compared to a Ebitda profit of Rs 32 crore in the corresponding quarter of the previous year.

Zydus Lifesciences: The pharmaceutical company announced that it has received permission from Central Drugs Standard Control Organisation (CDSCO), India, to initiate the Phase II clinical study of NLRP3 inhibitor “ZYIL1” in patients with Amyotrophic Lateral Sclerosis (ALS). ALS patients experience neuroinflammation and rapid neurodegeneration leading to steady loss of the ability to move, speak, eat and eventually breathe. ALS results in loss of motor neurons in the brain and spinal cord which controls voluntary muscle movement.

Gensol Engineering: The company informed that it has received an order worth Rs 301.54 crore from Maharashtra State Power Generation Co. Ltd. (MAHAGENCO). The order pertains to conceptualisation, engineering, provisioning, installation, testing, and commissioning of a 62-MWAC Crystalline Solar PV Technology Grid Interactive Solar PV Power Plant.

Delta Corp.: The company said that the Bombay High Court has considered the writ petitions filed by the company and its subsidiaries on 23rd October, 2023, and directed the tax authorities not to pass any final orders on the show cause notices without the prior permission of the High Court. The company further said that the dates have been fixed for completion of pleadings, and the hearing and final disposal of such writ petitions. The show cause notices were pertaining to Rs 16,195 crore tax notice received from the Directorate General of GST Intelligence, Hyderabad.

CarTrade Tech: The company said that Sobek Auto India Private Limited, a wholly owned subsidiary of the company has made a strategic decision to shut down their own C2B operations of Auto transaction business considering the challenges faced with its units economics. However, Sobek will continue to grow its classified business which includes both auto and non-auto verticals.

Lloyds Metal and Energy: The company’s consolidated revenue jumped 61.97% to Rs 1,091.31 crore in Q2FY24 from Rs 673.76 crore in the year-ago period. Ebitda rose 82.45% at Rs 286.31 crore in Q2FY24 from Rs 156.92 crore in Q1FY23. Consolidated net profit surged 62.04% to Rs 231.25 crore in Q2FY24 from Rs 142.71 crore in Q2FY23.