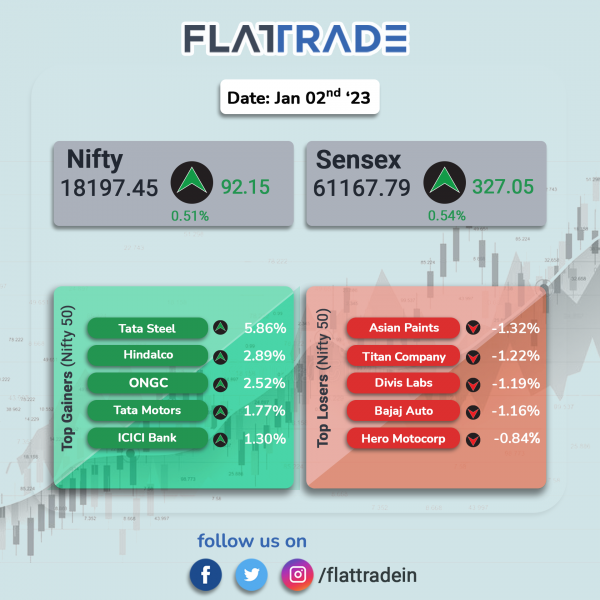

Indian indices closed positively in the first sessions of calendar year 2023, led by gains in metals, realty and banking stocks. The Sensex closed 0.54% higher and the Nifty 50 index was up 0.51%.

In broader markets, Nifty Midcap 100 index rose 0.88% and the BSE Smallcap gained 0.84%.

Top gainers among Nifty sectoral indices were Metal [2.43%], Realty [1%], PSU Bank [0.7%], Private Bank [0.63%] and Energy [0.62%]. Nifty Pharma index closed 0.37% lower.

Indian rupee fell 2 paise to 82.73 against the US dollar on Monday.

India manufacturing Purchasing Managers’ Index rose to 57.8 in December 2022 from 55.7 in November 2022, according to S&P Global survey. A reading above 50 indicates expansion of the manufacturing sector.

The gross GST revenue collected during December 2022 is Rs 1,49,507 crore, of which CGST is Rs 26,711 crore, SGST is Rs 33,357 crore, IGST is Rs 78,434 crore (including Rs 40,263 crore collected on import of goods) and Cess is Rs 11,005 crore (including Rs 850 crore collected on import of goods).

Stock in News Today

Bharat Forge: The company announced that its step-down subsidiary, J S Auto Cast Foundry India (JS Auto) has inked a pact with Indo Shell Mould (ISML) for acquiring their SEZ Unit in SIPCOT, Erode. The SEZ has a capacity of 42,000 million tonnes per annum (MTPA), supplies fully machined critical castings to clients in the automotive industry.

Hero MotoCorp: The two-wheeler manufacturer sold 3,94,179 units in December 2022, down 0.15% compared to the year-ago period. The company’s motorcycle sales stood at 3,56,749 units (down 5.34% YoY) and scooters sales at 37,430 units (up 108.98% YoY) in December 2022. Total domestic rose 1.84% YoY to 3,81,365 units while total exports dropped 36.84% YoY to 12,814 units in December 2022.

Mahindra & Mahindra (M&M): The company said that its overall auto sales for the month of December 2022 stood at 56,677 vehicles, registering a growth of 44.74% as against 39,157 vehicles sold in December 2021. On a sequential basis, M&M’s total auto sales declined 2.79% in December 2022 as against 58,303 units sold in November 2022.

The Passenger Vehicles segment, which includes UVs, cars and vans, witnessed a sale of 28,445 vehicles in December 2022, up 61% year on year (YoY) from 17,722 units sold in December 2021. The company sold 20,080 units of commercial vehicles (LCV+MHCV) in December 2022 as against 15,938 units sold in December 2021, recording a growth of 26%. Exports for the month stood at 3,100 vehicles (up 3% YoY).

NMDC: The state-owned iron ore miner has increased prices of lump ore and fines, effective from January 1, 2023. The prices of lump ore have been increased by 4.88% to Rs 4,300 per ton. The prices of iron ore fines have been raised by 17.18% to Rs 3,410 per ton.

Ashok Leyland: The company’s total sales for December 2022 stood at 18,138 units, up by 45% as against 12,518 units in December 2021. Total domestic sales for December 2022 stood at 17,112 units, from 11,493 units for December 2021. Total vehicle exports rose 0.1% YoY to 1,026 units in December 2022.

Indian Overseas Bank: The public sector lender said that the centre has appointed Ajay Kumar Srivastava as the managing director (MD) and chief executive officer (CEO) of the bank. The bank said that Partha Pratim Sengupta has demitted office as MD & CEO of the bank on December 31 2022, which was the date of his superannuation.

Bajaj Auto: The two-wheeler maker has achieved total sales of 2,81,486 units in December 2022 compared to 3,62,470 units sold in the year-ago period. Total sales include domestic sales of 1,48,555 units, higher by 2% YoY and exports of 1,32,931 units, a decline of 39% YoY.

TVS Motor: The company said its total vehicle sales fell 3.6% YoY to 242,012 units. The company’s motorcycle sales dropped 6.7% YoY to 1,24,705 units and exports declined 23% to 79,402 units on a yearly basis.

Bikaji Foods International: The company announced that Hanuman Agrofood Private Limited (HAPL) has become the subsidiary of the company with effect from January 1, 2023. The acquisition was done by conversion of 28,13,050 compulsorily convertible cumulative preference shares into 28,13,050 equity shares.

Steel Strips Wheels: The company has achieved a net turnover of Rs 334.41 crore in December 2022 compared to 234.54 crore in December 2021, registering 42.58% growth. The company gross turnover rose 45.08% to 413.76 crore in December 2022. Truck segment turnover recorded highest growth of 113% followed by tractor segment at 73% and alloy wheels segment at 69%. Exports declined 45% in December 2022.

Capacite Infraprojects: The company said that it has received contract worth Rs 203 crore from Ashar Ventures for construction of their residential project Ashar Pulse, which is a 60-storied tower at Thane. Capacite Infraprojects is primarily engaged in the business of engineering, procurement and construction.

Escorts Kubota: The company sold 5,573 tractors in December 2022, a growth of 18.7% as compared with 4,695 tractors sold in December 2021. On a sequential basis, tractor sales tumbled 30% in December 2022 from 7,960 units sold in November 2022. Domestic tractor sales in December 2022 stood at 4,979 tractors, recording a growth of 22% as against 4,080 tractors sold in December 2021. Rural sentiments continue to remain favorable on account of good kharif procurement, rabi sowing and better water level in reservoirs, the company said. Export tractor sales declined 3.4% to 594 units sold in December 2022 from 615 units sold in the same period a year ago.

Persistent Systems: Shares of the company rose in intraday trade after it announced that it will utilise the Microsoft Viva platform to enhance employee experience, utilising the advanced analytics baked into the platform.

Jindal Poly Films: The company said that a fire accident occurred at its subsidiary, JPFL Films’ plant at Mundhegaon, Igatpuri, Nashik, Maharashtra on Sunday. The company stated that the fire was controlled, but production operation at part of the said plant is disturbed temporarily. The company added that there is adequate insurance coverage for said plant and intimation to insurance company has already been made.

JTL Industries: The company said that it had recorded quarterly sales volume of 45,934 MT in Q3FY23, registering a growth of 35% over Q3FY22 and 13% over Q2FY23. JTL recorded a total volume of 1,20,065 MT in the first nine months of FY23 as against 1,03,457 MT reported in the same period last year. Export sales during the period under review amounted to 4,529 MT, which is higher by 48% as compared with Q3 FY22. Exports sales contributed about 10% to total sales volume for Q3 FY23.

NCC: The company announced that it has received five new orders aggregating to Rs 3,601 crore in the month of December 2022. Out of the five orders, two orders of Rs 1,871 crore were related to water division, two orders valued Rs 993 crore were related to electrical division and one order of Rs 738 crore were related to irrigation division. These orders are received from the state government agencies and does not include any internal orders, said the company.

Mishtann Foods: The company announced that its board approved raising of funds by way of issue of equity shares on a rights issue basis aggregating up to Rs 150 crore. The company said that the issue is subject to receipt of necessary approvals from regulatory authorities.

Aster DM Healthcare: The hospital chain said that it has entered into a hospital operation and management agreement (O&M) with Vritika Hospitals (VHPL) & Bharathi Education Trust, for operating and managing G. Madegowda Super Specialty Hospital.

Knowledge Marine & Engineering Works (KMEW): The company has received an additional work order of Rs 16.50 crore from DCI under a contract. The contract entails capital dredging in hard rock at Mangrol Fishing Harbour facility. The additional work order increases the target estimated dredging quantity from 110,150 cubic meters to 136,937 cubic meters.

Engineers India: The company has signed a Memorandum of Agreement (MoA) with Numaligarh Refinery (NRL) to jointly develop technology for production of aqueous ammonia from Ammonia rich sour gases and demonstrate at NRL site. The company said that the agreement will showcase the technologies jointly developed by EIL and NRL.

Hindustan Construction Company: Shares of the company rose after CARE Ratings revised the rating of the company to B+ from D with stable outlook. The company’s shares closed 4.7% on Monday.