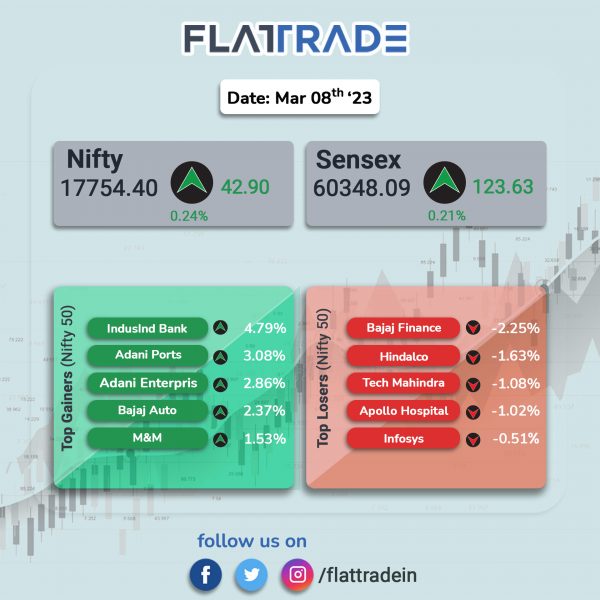

Benchmark indices closed higher as gains in auto, energy and banks offset losses in IT and pharma stocks. The Sensex closed 0.21% higher and the Nifty was up 0.24%.

In broader markets, the Nifty Midcap 100 index rose 0.51% and the BSE Smallcap gained 0.28%.

Top gainers were Auto [0.85%], Energy [0.83%], Oil & Gas [0.81%], PSU Bank [0.69%], and Private Bank [0.68%]. Top losers were Realty [-0.68%], Pharma [-0.49%] and IT [-0.38%].

Indian rupee fell 14 paise to 82.05 against the US dollar on Wednesday.

Stock in News Today

State Bank of India (SBI): The lender has raised funds worth Rs 3,717 crore at a coupon rate of 8.25% through additional tier-1 (AT-1) bonds, Business Standard reported citing sources. The coupon rate is the highest for any of SBI’s AT-1 bond issued so far in the current financial year, the report said.

Jindal Stainless (JSL) and Jindal Stainless (Hisar) (JSHL): Shares of both the companies rose ahead of their amalgamation. JSHL has fixed Thursday (March 9) as the record date for its merger with JSL. JSHL board had approved its into JSL with a swap ratio of 1: 1.95. In other words, for each share held in JSHL, a shareholder will get 1.95 shares of JSL.

Adani Group: Shares of Adani Group companies rose after the group said its promoters have prepaid debt worth of Rs 7,374 crore, backed by shares of four group companies, ahead of its latest maturity in April 2025. A total of 23.3 crore shares will be released as part of the latest prepayment, the group said. The prepayment will be against financing from various international banks and Indian financial institutions.

Natco Pharma: The pharma company announced that its board has approved a share buyback of up to Rs 210 crore at a price not exceeding Rs 700 per equity share through open market route. The maximum buyback price of Rs 700 per equity share represents a 23.64% premium to Monday’s closing price of Rs 566.15 on the BSE. The indicative maximum number of equity shares bought back would be 30 lakh shares which is 1.64% of the total number of paid-up equity shares.

Sugar Producers: Shares of sugar manufacturers rose up to 19.2% (Mawana Sugars) after a food ministry official said India can export an additional one million tonnes of the commodity if the domestic output reaches an estimated 33.6 million tonne this year, PTI reported. The government will take a call next month on allowing more quantities of sugar exports, after assessing domestic production, PTI reported citing the official.

Jubilant Pharmova: The company shares rose 3.24% after the USFDA classified the company’s Nanjangud facility as Voluntary Action Indicated (VAI). The USFDA had inspected company’s API manufacturing facility at Nanjangud from 5 December 2022 to 13 December 2022. Upon completion, the USFDA issued eight observations on 14 December 2022. However, the USFDA accepted the company’s response to its observations.

Aurobindo Pharmaceuticals: The drugmaker announced that its wholly-owned subsidiary, Eugia Pharma Specialities, has received a final approval from the USFDA to manufacture and market Lenalidomide capsules, which is used for treatment of adult patients with Multiple myeloma, in combination with Dexamethasone. The drug is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Revlimid Capsules, which is produced by Bristol-Myers Squibb. The drug maker said that the product is expected to be launched in October 2023 (volume specific launch).

KPI Green Energy: Shares of the company rallied after the company signed hybrid power purchase agreement (PPA) with Garrison Engineer, Military Engineer Services, Air Force Station, Jamnagar for 1.845 MWac capacity. The company has signed 20 years long term PPA for 1.845 MWAc capacity with Garrison Engineer, Military Engineer Services, Air Force Station, Indian Armed Forces (Government of India) in Jamnagar under independent power producer (IPP) segment.

Zydus Lifesciences: The company has received final approval from the USFDA for Lenalidomide capsules, 2.5 mg and 20 mg. Lenalidomide capsules are used to treat various types of cancers. It works by slowing or stopping the growth of cancer cells. It is also used to treat anemia in patients with certain blood/bone marrow disorders and may lessen the need for blood transfusions. The drugs will be manufactured at the group’s formulation manufacturing facility in SEZ, Ahmedabad.

Sundaram-Clayton: The company announced that the National Company Law Tribunal, Chennai Bench, has sanctioned the composite scheme of arrangement amongst Sundaram-Clayton, TVS Holdings, VS Investments, and Sundaram-Clayton DCD and their respective shareholders and creditors.

Alembic Pharmaceuticals: The drugmaker announced that it has received final approval from the USFDA for its abbreviated new drug application (ANDA) Prazosin Hydrochloride capsules. The approved ANDA is therapeutically equivalent to the reference listed drug product (RLD), Minipress capsules of Pfizer Inc. Prazosin Hydrochloride capsule is indicated for the treatment of hypertension to lower blood pressure. Prazosin Hydrochloride capsules has an estimated market size of $50 million for twelve months ending December 2022, according to IQVIA.

PVR: The cinema theatre chain announced the opening of 11 screen multiplex at Phoenix Marketcity in Chennai. The new multiplex in Chennai will strengthen the company’s foothold in Tamil Nadu with 136 screens in 22 properties. With this opening, the merged entity has strengthened its growth momentum and has opened 159 screens across 28 properties in 22 cities in this fiscal. With this launch, merged entity now operates the largest multiplex network with 1,674 screens at 358 properties in 114 cities (India and Sri Lanka).

Caplin Point Laboratories: The company’s subsidiary, Caplin Steriles, has received approval from the USFDA for its abbreviated new drug application (ANDA) Thiamine Hydrochloride injection. The said drug is generic therapeutic equivalent version of reference listed drug (RLD), Thiamine Hydrochloride injection of Fresenius Kabi USA LLC.

Ramkrishna Forgings: The company has received an upgrade in credit ratings from India Ratings and Research for its bank facilities. The company’s fund based working capital received ‘IND A+/ Stable/ IND A1’ rating, non fund based working capital limits received ‘IND A1’ and long term loans got ‘IND A+/ Stable’. Shares of the company rose 3.62%.

Vardhman Special Steel (VSSL): Shares of the company rose 8.28% on the BSE after the company said it started mass production of steel for forging companies of Aichi Steel Corporation (ASC) based in South East Asia for some grades that the company had received approvals. VSSL said the sales of these products for FY2023- 24 will be about 10,000 MT. It will further increase with the receipt of more approvals in next 2-3 years.