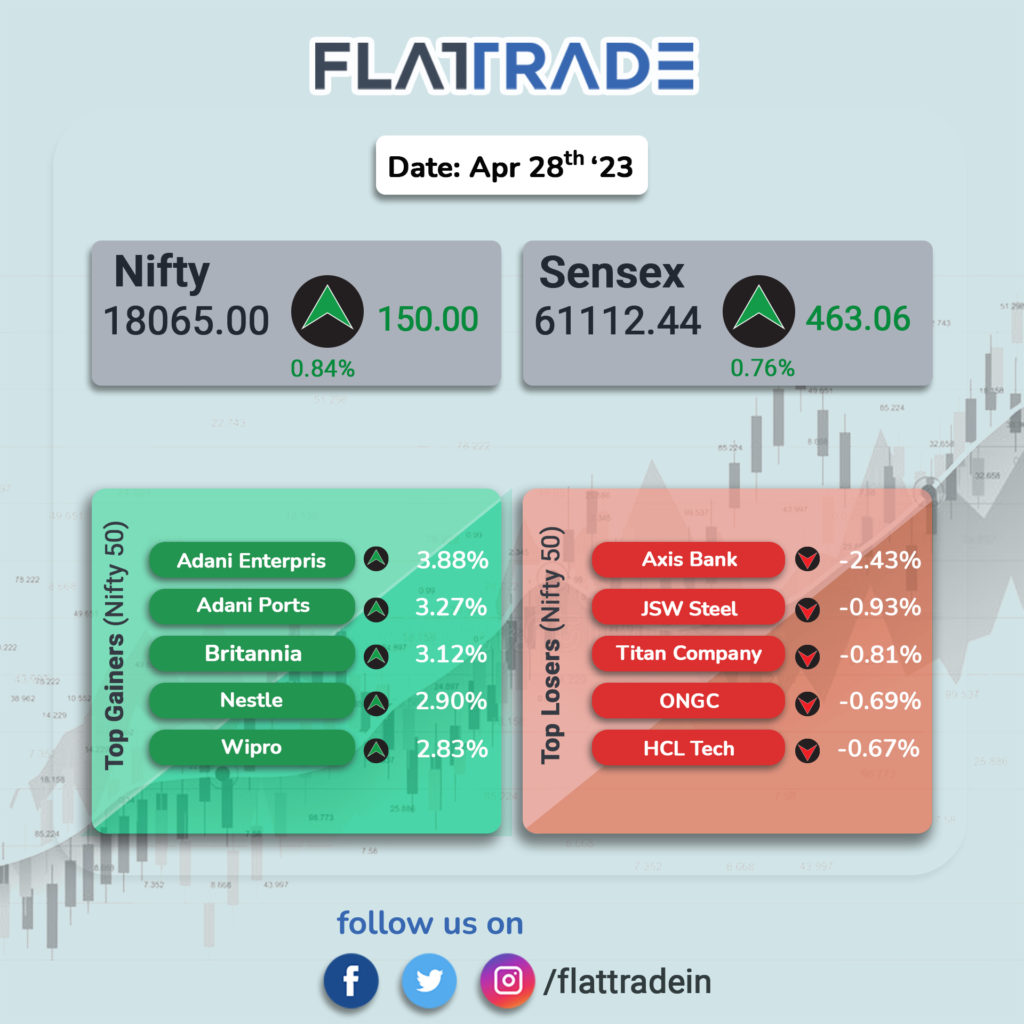

Dalal Street closed higher as risk appetite improved and due to healthy buying by foreign institutional investors. The Sensex rose 0.76% and the Nifty 50 index jumped 0.84%.

In broader markets, the Nifty Midcap 100 index surged 1.24% and the BSE Smallcap advanced 0.91%.

Top gainers among Nifty sectoral indices were PSU Bank [2.45%], Media [1.81%], IT [1.29%], Energy [1.24%] and FMCG [0.96%]. All Nifty indices closed in the red. BSE Consumer Durables was the only index which fell 0.33%.

Indian rupee rose 1 paise to 81.8250 against the US dollar on Friday.

Stocks To Watch

Shriram Finance: Shares of the company fell 5.2% after the company reported its quarterly results. The company reported 20.5% YoY rise in standalone net profit to Rs 1,308.31 crore and its total income rose 52.7% YoY to Rs 7,769.15 crore in Q4FY23 over Q4 FY22. Net interest income soared 69.19% to Rs 4,445.9 crore in Q4FY23 as against Rs 2,627.8 crore recorded in Q4FY22. Total assets under management (AUM) for the quarter ended March 2023 stood at Rs 1,85,682.86 crore as compared to Rs 1,27,040.86 crore as on 31 March 2022 and Rs 1,77,498 crore as on 31 December 2022. The firm’s return on assets (ROA) and return on equity (ROE) stood at 2.47% and 12.21%, respectively in the quarter ended 31March 2023.

IndiaMART InterMESH: The e-commerce player said its net profit fell 2.8% YoY to Rs 55.8 crore in Q4FY23 as against Rs 57.4 crore in Q4FY22. Revenue rose 33.5% to Rs 268.8 crore in Q4FY23 from Rs 201.4 crore in Q4FY22. EBITDA was up 15.6% YoY to Rs 66.1 crore in Q4FY23. The company shares closed 2.18% higher.

Tata Metaliks: The company posted a net profit of Rs 55.6 crore in Q4FY23, up 5.9% YoY from Rs 52.5 crore in the year-ago period. Its revenue was up 14.6% YoY to Rs 926 crore in the quarter under review. EBITDA rose 62% YoY to Rs 94 crore in the reported quarter.

RateGain Technologies: The company has appointed Yogeesh Chandra as chief strategy officer. Chandra has worked at the company for over 12 years, playing multiple roles in setting up high-performance teams, go-to-market strategy, customer success, and product management with P&L ownership.

Tinplate Company of India: The company reported 50.6% YoY fall in net profit to Rs 56.56 crore in Q4FY23 and a 16% YoY decline in net sales at Rs 929.52 crore in Q4FY23. The company recorded 59.5% drop in net profit to Rs 142.82 crore on a 7.6% fall in net sales to Rs 3,569.38 crore in FY23 over FY22.

Glenmark Life Sciences: The company’s net profit jumped 48% YoY to Rs 146.36 and revenue from operations rose 20.9% YoY to Rs 621.32 crore in Q4FY23. EBITDA stood at Rs 209.3 crore in Q4FY23, registering the growth of 42.1% as compared with Rs 147.3 crore recorded in Q4FY22. On capex front, the company said that the brownfield expansion for the Generic API products at Dahej facility is completed with 240 KL capacity. On a full year basis, the company’s consolidated net profit increased by 12.3% YoY to Rs 351.58 crore and net sales rose 22.6% to Rs 1,885.17 crore in FY23 over FY22.

S.J.S. Enterprises: The company announced that its board has approved the acquisition of 90.1% stake in Walter Pack Automotive Products India (WPI) for a total cash consideration of Rs 239.3 crore. With this acquisition, the company will collaborate with Walter Pack Spain and one of its minority shareholders, Antolin.

Datamatics: The company said its net profit was up 31% to Rs 59.7 crore for the quarter ended March 2023 as against Rs 45.6 crore in the year-ago period. Revenue rose 32.9% YoY to Rs 416.3 crore in Q4FY23 from Rs 313.3 crore in the year-ago period. EBITDA jumped 63.3% YoY to Rs 84.1 crore in the reported quarter.

Atul: The company’s net profit fell 31.4% YoY to Rs 93.6 crore in Q4FY23 from Rs 136.3 crore in the same period last fiscal. Revenue fell 12.8% YoY to Rs 1,195.1 crore in Q4FY23 from Rs 1,370.4 crore in Q4FY22. EBITDA fell 27.2% YoY to Rs 149.3 crore in Q4FY23 as against Rs 205.1 crore in Q4FY22.

Supreme Industries: The company’s net profit was up 10.9% YoY to Rs 359.4 crore in Q4FY23 as against Rs 324 crore in Q4FY22. Its revenue was up 1.6% YoY to Rs 2,598.3 crore in Q4FY23 as against Rs 2,557 crore in Q4FY22. EBITDA climbed 22.7% YoY to Rs 479.9 crore in Q4FY23 from Rs 391.2 crore in Q4FY22.

Orient Cement: The company’s net profit fell 7.9% YoY to Rs 67.4 crore in Q4FY23 as against Rs 73.2 crore in the year-ago period. Revenue was up 9% YoY to Rs 876 crore in Q4FY23 as against Rs 803.9 crore in Q4FY22. EBITDA was down 9.1% YoY to Rs 139.4 crore in Q4FY23 as against Rs 153.4 crore in Q4FY22.

CSB Bank: The Kerala-based private sector lender said its net profit was up 19.6% YoY to Rs 156.3 crore in Q4FY23 as against Rs 130.7 crore in Q4FY22. NII was up 14.8% YoY to Rs 348.5 crore in Q4FY23 as against Rs 304 crore in Q4FY22. The company said its net NPA stood at 0.35% in the reported quarter as against 0.42% in the preceding qaurter.