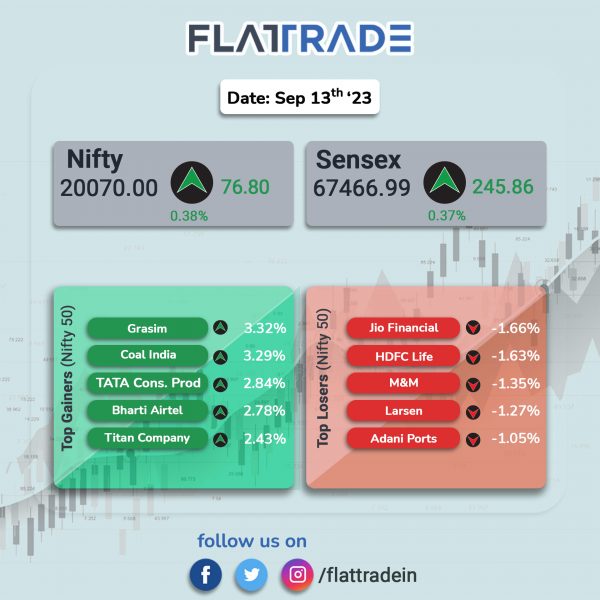

Sensex, Nifty closed higher as investors’ sentiments were boosted after retail inflation in August eased to 6.83% from 7.44% in July. The Sensex rose 0.36% and the Nifty 50 index gained 0.38%.

In broader markets, the Nifty Midcap 100 rose 0.19% and the BSE Smallcap jumped 0.84%.

Top gainers were PSU Bank [4.23%], Media [1.53%], Oil & Gas [0.96%], bank [0.87%], and Pharma [0.78%]. Top losers were Auto [-0.46%] and IT [-0.28%].

The Indian rupee fell by 5 paise to 82.98 against the US dollar on Wednesday.

Stock in News Today

Aditya Birla Fashion and Retail (ABFRL): The company has joined hand with Christian Louboutin SAS (CL SAS) to establish CLI Footwear and Accessories. CLI Footwear and Accessories, with an authorized capital of Rs 10,00,00,000 and a paid-up capital of Rs 1,00,00,000, is a 50%-50% partnership between Aditya Birla Fashion and Retail and CL SAS. The newly formed company will focus on the distribution and sale of CL SAS’s luxury products in India.

Rail Vikas Nigam (RVNL): The company said that its joint venture (JV) with MPCC has emerged as the Lowest Bidder (L1) for a contract awarded by the Vadodara Division of Western Railway worth Rs 245.71 crore. The project involves all civil engineering works and supply of 50 mm machine crushed stone ballast, complete track works including linking of track works in connection with gauge conversion work between Nadiad- Petlad (37.26 kms) of Vadodara Division of Western Railway. The project is expected to be executed within a period of two years.

KEC International: The company’s transmission & distribution (T&D) business secured a turnkey order of Rs 1,145 crore. The order entails design, supply and installation of 380 kilovolt (kV) overhead transmission line in the Kingdom of Saudi Arabia (KSA). Vimal Kejriwal, MD & CEO commented, “Our YTD order intake has now surpassed Rs 7,500 crore, a robust growth of 30% YoY. With this order, Saudi Arabia continues to be a major growth driver in the Middle East region.”

Texmaco Rail & Engineering: The company informed that its board will meet on Friday, September 15, to consider and approve the proposal of raising of funds through issuance of equity shares or any other eligible securities. The proposal is subject to approval from shareholders and regulatory authorities.

GMR Power & Urban Infrastructure: The company’s step down subsidiary, GMR Smart Electricity Distribution (GSEDPL), has received a letter of award (LoA) from Dakshinanchal Vidyut Vitran Nigam to implement smart metering project. GSEDPL will implement smart meter project in Agra and Aligarh zone) area of Uttar Pradesh (UP). It will install, integrate and maintain 25.52 lakh smart meters and the implementation tenure is expected to be 27 months from the date of execution of the contract and an operating period of 93 months. The total contract value is about Rs 2,469.71 crore. Shares closed 9.9% higher.

IRB Infrastructure Developers (IRBIDL): The company informed that CRISIL Ratings has assigned its ‘CRISIL AA-/Stable’ rating to the Rs 258 crore non-convertible debentures (NCDs) and Rs 1,000 crore bank facilities of the company. The agency has also reaffirmed its rating on the Rs 1,200 crore bank facilities at ‘CRISIL AA-/Stable/CRISIL A1+’. CRISIL said that the ratings continue to reflect IRBIDL’s strong financial risk profile, supported by strong operating performance, adequate order book and stable working capital cycle.

Zydus Lifesciences: The company announced the receipt of EIR report from the USFDA for the inspection conducted at the injectables manufacturing facility at Zydus Biotech Park, Changodar, Ahmedabad. The inspection carried out between 5th and 13th of June 2023, was a cGMP Inspection and had ended with NIL observations.

Exide Industries: The company said that its arm, Chloride Metals, has entered into share subscription & shareholders agreement with Cleantech Solar India OA 2 and Zillica Renewables for purchase of solar energy from the captive power plant to be set up by Zillica. Further, the company has also entered into share subscription agreement with Zillica Renewables to subscribe equity shares comprising up to 26.33% of the issued and paid up share capital of Zillica aggregating upto Rs. 1.76 crore.

HPL Electric & Power: The company announced that it has entered into a strategic partnership with Wirepas Oy, a global leader in RF mesh technology, to accelerate smart metering roll-outs in India. The company has an order book exceeding Rs 2000 crore.