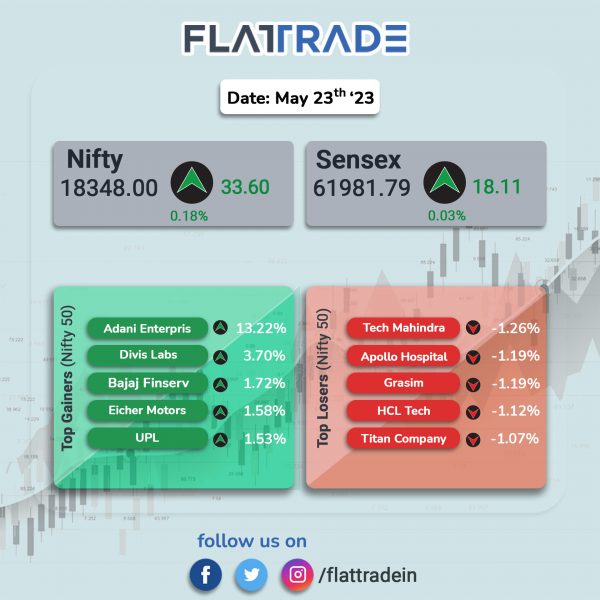

The Nifty 50 index closed higher as Adani Enterprises shares surged and auto stocks made significant gains, while Sensex closed flat. The Nifty 50 index was up 0.18% and the Sensex was up 0.03%.

In broader markets, the Nifty Midcap 100 index rose 0.63% and the BSE Smallcap advanced 0.11%.

Top gainers among Nifty sectoral indices were Metal [2.59%], Media [1.12%], Oil & Gas [0.72%], Auto [0.66%], and Pharma [0.57%]. Top loser was IT [-0.46%].

Indian rupee strengthened by 3 paise to 82.80 against the US dollar on Tuesday.

Stock in News Today

Adani Group: Veteran investor Rajiv Jain’s GQG Partners LLC has raised its stake in billionaire Gautam Adani’s conglomerate by about 10%, Bloomberg reported. Further, the report said GQG will take part in the conglomerate’s future fund raising, doubling down on what Jain calls “the best infrastructure assets available in India.” “Within five years, we would like to be one of the largest investors in Adani Group depending on the valuation, after the family,” Jain, GQG’s chief investment officer, said in an interview.

JSW Steel: The steel major announced that NCLT-Mumbai has approved Rs 621-crore resolution plan submitted by its subsidiary, JSW Steel Coated Products (JSWSCPL) for National Steel and Agro Industries (NSAIL). The acquisition of NSAIL is proposed to be completed within 30 days from the effective date as contemplated in the resolution plan. The company said that the acquisition will bring synergy in terms of operations, procurement, marketing and sales of the business.

ITI: The company bagged Rs 3,889 crore advance purchase order from BSNL Bengaluru for 4G rollout. The project entails planning, engineering, supply, installation, commissioning, and AMC of the 4G network for 23,633 sites in the west zone of the BSNL network for nine years. ITI will manufacture the Radio Access Network, with a supply period of 18-24 months.

Unichem Laboratories: The company said its net loss stood at Rs 44.3 crore in Q4FY23 as against a net profit of Rs 71.5 crore in Q4FY22. Revenue was up 8.7% at Rs 402.1 crore in Q4FY23 as against Rs 370 crore in Q4FY22. EBITDA was down 75.9% YoY at Rs 16.5 crore in Q4FY23 as against Rs 68.5 crore in Q4FY22.

Bajaj Electricals: The company said its net profit was up 31.8% YoY at Rs 51.8 crore in Q4FY23 as against Rs 39.3 crore in Q4FY22. Revenue was up 11.7% at Rs 1,490.1 crore in Q4FY23 as against Rs 1,334.3 crore in Q4F22. EBITDA jumped 35.7% to Rs 85.6 crore in Q4FY23 as against Rs 63.1 crore in Q4FY22.

TVS Srichakra: The company’s net profit jumped to Rs 22.3 crore in Q4FY23 as against Rs 8 crore in Q4FY22. Revenue was up 1.9% at Rs 682.8 crore in Q4FY23 as against Rs 670.3 crore in Q4FY22. EBITDA surged 59.7% to Rs 55.2 crore in Q4FY23 as against Rs 34.6 crore in Q4FY22.

Escorts Kubota: The tractor manufacturer announced that its Agri Machinery Business Division shall be increasing the prices of tractors effective from 1 June 2023. The price hike is to partially offset the impact of cost inflation, said the tractor maker. The increase in prices would vary across models/variants and geographies.

SpiceJet: The carrier plans to bring back four of 25 grounded planes into service by June 15. The four planes are two Boeing 737s and two Q400s aircraft. It also said the airline will bring more aircraft back to operations in the following weeks. It will also start a slew of flights including two international UDAN flights by June end.

Varroc Engineering: The company said its profit from continuing operations stood at Rs 40 crore in Q4FY23 as against loss of Rs 32.5 crore in Q4FY22. The comapny’s revenue was up 2.3% YoY at Rs 1,690 crore in Q4FY23 as against Rs 1,651.9 crore in Q4FY22. EBITDA was up 45.9% YoY at Rs 156 crore in Q4FY23 as against Rs 107 crore in Q4FY22.

Indo National: The company reported a net loss of Rs 2.6 crore in Q4FY23 as against a net loss of Rs 6.7 crore in Q4FY22. Revenue was up 18% YoY at Rs 143 crore in Q4FY23 as against Rs 121 crore in Q4FY22. EBITDA stood at Rs 5 crore in Q4FY23 as against an EBITDA loss of Rs 6 crore in the year-ago period.

J.kumar Infraprojects: The company’s net profit was flat year-on-year at Rs 74 crore in Q4FY23. Revenue was up 1.8% YoY at Rs 1,134.2 crore as against Rs 1,114.4 crore in Q4FY23. EBITDA was up 0.5% YoY at Rs 159.5 crore in Q4FY23 as against Rs 158.7 crore in Q4FY22.

Dreamfolks: The company’s net profit stood at Rs 25.3 crore in Q4FY23 as against Rs 9 crore in Q4FY22. Revenue was up at Rs 237.7 crore in Q4FY23 as against Rs 99.1 crore in Q4FY22. EBITDA was at Rs 34 crore in Q4FY23 as against Rs 12.2 crore in Q3FY22.

Kaveri Seeds: The company’s net loss stood at Rs 16 crore in Q4FY23 as against a net loss of Rs 11.8 crore in Q4FY22. Revenue was up 10.7% YoY at Rs 73.7 crore in Q4FY23 as against Rs 66.6 crore in Q4FY22. EBITDA loss stood at Rs 16.7 crore in Q4FY23 as against an EBITDA loss of Rs 10.9 crore in the same period last fiscal.

Prakash Pipes: The company’s net profit was up 50% YoY at Rs 19.8 crore in Q4FY23 as against Rs 13.2 crore in Q4FY22. Revenue slipped 10.8% to Rs 156 crore in Q4FY23 as against Rs 174.8 crore in Q4FY22. EBITDA fell 27.6% to Rs 19 crore in Q4FY23 as against Rs 22.1 crore in Q4FY22.

Indoco Remedies: The company’s net profit was down 36.1% at Rs 25.8 crore in Q4FY23 as against Rs 40.4 crore in Q4FY22. Revenue was up 4.7% YoY at Rs 428.2 crore in Q4FY23 as against Rs 409.1 crore in Q4FY22. EBITDA was down 19% at Rs 64.8 crore in Q4FY23 as against Rs 80.4 crore in Q4FY22.

Dhanlaxmi Bank: The private sector lender has reported profit at Rs 38.2 crore for quarter ended March FY23, growing 63% over a year-ago period due to tax write-back against tax expenses in the same period. Fall in provisions and contingencies YoY also supported bottomline. Net interest income grew by 19.4% to Rs 115.15 crore compared to corresponding quarter of previous fiscal.

EIH: The luxury hotel chain has recorded a 469% year-on-year growth in consolidated profit at Rs 84.4 crore for quarter ended March FY23. Revenue from operations grew by 112% to Rs 637 crore compared to same period last year. Board announced a final dividend of Rs 1.10 per share for FY23.

Fusion Micro Finance: The company’s profit after tax increased by 767.93% YoY to Rs 114.52 crore for quarter ended March FY23 as impairment of financial instruments declined 48.36% YoY to Rs 69.2 crore in the same period. Net interest income grew by 62.4% YoY to Rs 273.75 crore in Q4FY23.

Spencer’s Retail: The retail store company has increased its consolidated loss to Rs 61.23 crore for March FY23 quarter, from Rs 42.5 crore in same period last fiscal due to tepid revenue growth and lower other income. Revenue from operations for the quarter at Rs 543.4 crore grew by 0.3% over year-ago period. Shares closed 1.97% lower.

Borosil Ltd.: The company’s consolidated net profit for the quarter stood at Rs 22.34 crore, down by 35% YoY from Rs 34.18 crore in the year-ago period. Borosil’s revenue jumped 18% YoY to Rs 264.32 crore, while its total cost rose 12% to Rs 235.69 crore during the quarter under review. For fiscal 2023, the growth in net profit was 6 percent to Rs 90.20 crore from Rs 85.23 crore last year, while revenue increased 22 percent on-year to Rs 1051.91 crore. Shares tanked 8.43%.

Kirloskar Industries: The company reported a consolidated net profit of Rs 93.09 crore in Q4FY23 as against a net loss of Rs 44.20 crore in Q4FY22. Its consolidated revenue from operations jumped 52% YoY to Rs 1574.79 crore in Q4FY23. The board recommended a dividend of Rs 11 per share for FY23.

Akzo Nobel India: The company’s consolidated net profit jumped 27.71% to Rs 95.4 crore in Q4FY23 from Rs 74.7 crore in Q4 FY22. Consolidated revenue from operations rose 9.72% to Rs 951.4 crore in Q4FY23 as compared with Rs 867.1 crore in Q4FY22. Meanwhile, the board has recommended a final dividend of Rs 40 per equity share for FY23. The record date is fixed as on Thursday, 27 July 2023. The dividend will be paid on or after 24 August 2023. On full year basis, the company’s consolidated net profit jumped 15.51% to Rs 335.1 crore on 20.76% rise in net sales to Rs 3,802.1 crore in FY23 over FY22.

Matrimony.com: The company shares rose 5.43% in intraday trade after investment management firm Carnelian Asset Advisors bought 0.61% stake in the company via bulk deal on Monday. As per the bulk deal data on the NSE, Carnelian Asset Advisors bought 1,35,495 shares of Matrimony.com at Rs 560 per share.