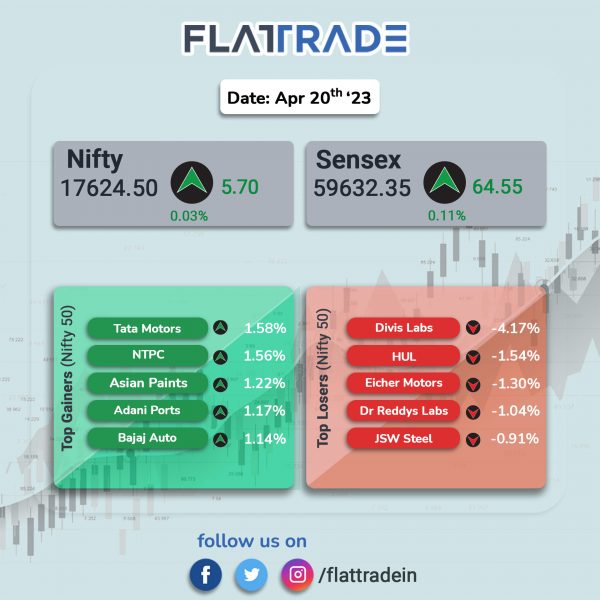

Sensex, Nifty ended marginally higher as gains made by bank and auto stocks were capped by losses in pharma and realty shares. The Sensex rose 0.11% and the Nifty inched up 0.03%.

In broader markets, Nifty Midcap 100 inched up 0.03% and the BSE Smallcap gained 0.1%.

Top losers among Nifty sectoral indices were Pharma [-1.11%], Realty [-0.43%], Metal [-0.39%], FMCG [-0.36%], and Oil & Gas [-0.24%]. Top gainers were Private Bank [0.31%], Bank [0.27%], Auto [0.23%], nd Media [0.2%].

Indian rupee rose 8 paise to 82.15 against the US dollar on Thursday.

Stock in News Today

Vedanta: The company has pledged about 10.32 crore shares, or 2.44% stake, of its unit Hindustan Zinc Ltd. for a term loan. The pledge is created through depository system for a loan amount of Rs 150 crore ($182 million). The loan is for general business purposes including repayment of existing debt, capital expenditures and operating expenses.

Ion Exchange (India): The company announced that its board has approved a 10-for-1 stock split. The company’s board has approved the sub-division of one equity share having a face value of Rs 10 each into ten equity shares of Re 1 each, subject to regulatory approvals and approval of company’s shareholders. The company said that the rationale behind the split is to enhance the liquidity in the capital market, to widen shareholder base and to make the shares more affordable to small investors. The firm added that the sub-division is expected to be completed within three months from date of shareholder’s approval.

Separately, the company’s board has also approved the proposal to invest and takeover, MAPRIL – Produtos Químicos e Maquinas Para a Industria, Lda which is located in Portugal.

Fortis Healthcare: The company said that it has signed definitive agreement with Medeor Hospital and VPS Health Care to acquire multi-speciality hospital, Medeor Hospital Manesar for Rs 225 crore. The company will acquire Medeor Hospital Manesar along with all the structures and buildings as well as the movable assets present at Medeor Hospital Manesar. The company said that the acquisition fits well with the company’s strategic approach of expanding its presence in focus geographic clusters, including Delhi NCR.

TTK Healthcare: The company said it will voluntarily delist from NSE as well as BSE, and the price is set at Rs 1,051.31 per share. The company will acquire 35,94,493 fully paid-up equity shares of the company, having a face value of Rs 10/- each, representing 25.44% of the paid-up capital held by the public shareholders of the company.

ITC: Shares of ITC touched a fresh all-time high intraday on Thursday after scaling new levels on Tuesday (April 18). Shares of the company rose as much as 0.98% intraday to hit a fresh high of Rs 402.65 apiece. The previously scaled all-time high was Rs 402 apiece on Tuesday.

HDFC Bank: The private lender said that the Reserve Bank of India (RBI) has approved the appointment of Kaizad Bharucha as the deputy managing director (MD) of the bank, for a period of three years effective from 19 April 2023. Bharucha is a career banker with more than 35 years of experience and has been associated with the bank since 1995.

Titagarh Wagons: Shares of the company surged 9.94% after the name of Mahima Stocks, a firm backed by veteran investor Madhusudan Kela, appeared in the public shareholding pattern of the company. Mahima Stocks held 19,67,710 shares in Titagarh Wagons as of 31 March 2023, representing a 1.65% stake.

SEPC: The company announced that it has been declared as the lowest bider (L1) by Konkan LNG, Maharashtra for an order amounting over Rs 300 crore. The scope of work involves supply and services of ambient air heating systems for a period of 22 months. SEPC is engaged in providing end-to-end solutions to engineering challenges, offering multi disciplinary design, engineering, procurement, construction and project management services.

Zydus Lifesciences: The company announced that it has received a final approval from the USFDA to manufacture and market Metoprolol Tartrate tablets. Metoprolol is used with or without other medications to treat high blood pressure (hypertension). This medication is also used to treat chest pain (angina) and to improve survival after a heart attack. The drug will be manufactured at the group’s formulation manufacturing facility in Baddi, Himachal Pradesh, (India). Metoprolol Tartrate tablets USP, 25 mg, 50 mg, and 100 mg had annual sales of $45.2 million in the United States, according to IQVIA MAT February 2023.

Torrent Power: The company announced that it has incorporated a wholly owned subsidiary named Torrent Urja 12 (TU12). Torrent Power incorporated TU12 with a share capital of Rs 1 lakh. The new company is incorporated with the purpose of carrying out the business of generation, transmission, distribution, purchase, procurement, sale, trading, import, export or otherwise deal in all forms of electrical power and energy including non-conventional and renewable sources of energy.

Emkay Global Financial Services: The company announced the receipt of in-principle approval from SEBI for sponsoring a mutual fund. In an exchange filing, the company said that it has received an in-principle approval from the Investment Management Department of the Securities and Exchange Board of India (SEBI) for sponsoring a mutual fund under the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996.

Gravita India: The company said that it has increased capacity of its existing recycling unit situated at Mundra, Gujarat. The existing capacity for lead recycling has been increased by 40,500 million tonne per annum (MTPA) and as on date the total capacity of this unit for Lead recycling is 60,000 MTPA. Further, the company has also started commercial production of red lead and plastic granules with a capacity of 4,800 MTPA and 7,500 MTPA respectively. Gravita is expecting an increase in share of higher-margin business from the key overseas market across lead, red lead and plastic recycling segments.

Shakti Pumps (India): The company announced the commencement of operations in Uganda to supply solar powered water pumping system. The company also said that it has received the pending $1 million for the project from EXIM bank on behalf of Government of Uganda.

Alok Industries: Share of the company tumbled over 9% in intraday trade after the company reported a net loss of Rs 297.55 crore in Q4 of FY23 as against a net loss of Rs 26.76 crore in Q4 FY22. Net sales declined 22.35% year-on-year to Rs 1,561.50 crore in Q4FY23. In the year ended March 2023, the net loss reported was Rs 880.46 crore, up from net loss of Rs 208.60 crore in the previous year. Sales declined to Rs 6,937.29 crore, down 5.09% from Rs 7,309.50 crore in the previous year.

PNC Infratech: The civil engineering company company said that it has received provisional completion certificate for aBihar-based national highway project awarded by NHAI on engineering, procurement and construction (EPC) mode effective from 18 April 2023. The contract price of the project amounts to Rs 825.17 crore plus escalation amount as per the contract.