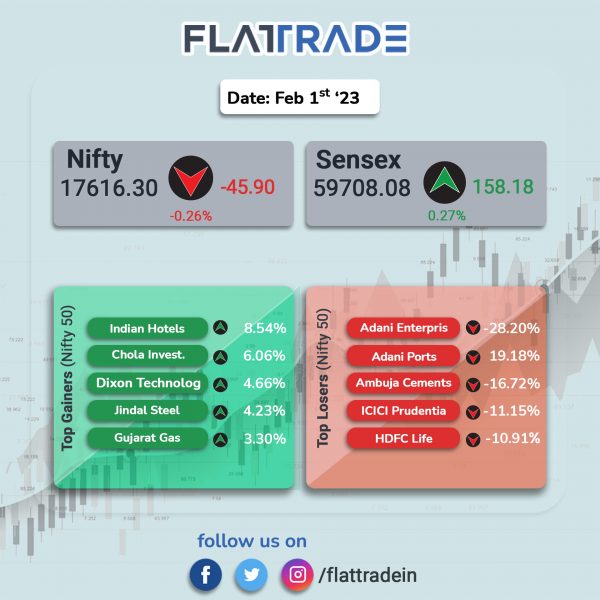

Benchmark equity indices ended mixed in a choppy session on Wednesday as the Finance Minister Nirmala Sitharaman tabled the Budget 2023 in the parliament today. Nifty ended in the red as public sector bank and metal stocks slumped. The Nifty 50 index fell 0.26%. Meanwhile, Sensex ended in the green with the index gaining 0.27%.

In broader markets, the Nifty Midcap 100 fell 0.94%, while BSE Smallcap index dropped 1.1%.

Top gainers were Nifty FMCG [1.13%] and Nifty IT [0.93%]. Top losers were PSU Bank [-5.68%], Metal [-4.5%], Media [-2.7%], Oil & Gas [-2.03%] and Energy [-1.31%].

Indian rupee stood at 81.92 against the US dollar on Wednesday

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 55.4 in January, sliding from December’s high of 57.8. Despite the fall, the headline figure remained well above the 50-mark indicating expansion of the sector.

Stock in News Today

Adani Group: Stocks of Adani Group tanked after Bloomberg reported that Credit Suisse has stopped accepting bonds of Adani companies as collateral for margin loans. All 10 stocks belonging to billionaire Gautam Adani crashed with Adani Enterprises nosediving 28.2%, Adani Port tanking 19.18%, and Adani Total Gas plunging 10%.

ACC: Shares of the company slumped 6.19% after the cement maker said its net profit declined 59.70% to Rs 113.16 crore in the quarter ended December 2022 as against Rs 280.81 crore during the quarter ended December 2021. Sales rose 7.36% to Rs 4536.97 crore in the reported quarter as against Rs 4225.76 crore in the corresponding quarter last fiscal. EBITDA declined 31.31% YoY to Rs 419 crore during the reported quarter, on cost optimization and leveraging synergies from adjacency businesses of Adani Group. EBITDA margin slipped to 9.4% in quarter under review as against 14.7% in in the year-ago period.

For the full year, net profit declined 65.14% to Rs 649.44 crore in the year ended December 2022 as against Rs 1862.99 crore during the previous year ended December 2021. Revenue rose 7.85% to Rs 17,419.27 crore in the year ended December 2022 as against Rs 16,151.67 crore during the same period last fiscal.

Maruti Suzuki India: The automaker sold a total of 172,535 units in January 2023 compared to 154,379 units in January 2022, recording a growth of 11.76%. Total sales in the month include domestic sales of 151,367 units, sales to other OEM of 3,775 units and exports of 17,393 units. The shortage of electronic components had a minor impact on the production of vehicles.

Tata Motors: The company announced that its total domestic and international sales for January 2023 stood at 79,681 vehicles, up by 10% compared with 72,485 units sold during January 2022. Total commercial vehicle (CV) sales fell by 7% to 32,780 units, while total passenger vehicles (including EV) sales jumped 18% to 48,289 units in January 2023 over January 2022.

Adani Ports and SEZ: The company has successfully concluded the acquisition of Oiltanking India GmbH’s 49.38% equity stake in Indian Oiltanking (IOTL), which is one of India’s largest developer and operator of liquid storage facilities.

Hindustan Aeronautics Limited: The company announced that the Ministry of Defence vide its Letter dated 31 January, 2023 has entrusted additional charge for the post of Chairman & Managing Director of the company to C B Ananthakrishnan, Director (Finance) of the Company, for a further period of three months from 1 February, 2023 or till further orders, whichever is earlier.

Insurance Companies: Share price of insurance companies declined after the budget announcement as the govt revised the income tax slabs during the Union Budget 2023. Ths revision in tax slabs is likely to affect the insurance firms as the taxpayer may move away from tax saving policies and schemes.

Bajaj Auto: The two-wheeler maker’s total sales declined 21% to 2,85,995 units in January 2023 compared with 3,63,443 units sold in January 2022. The company’s total domestic sales increased 16% to 1,73,270 units while exports fell 47% to 1,12,725 units in January 2023 over January 2022. The total two-wheelers sales declined 25% to 2,41,107 units in January 2023 as against 3,23,430 units sold in January 2022. While, commercial vehicles sales rose 12% to 40,888 units in January 2023 from 40,013 units sold in the same period a year ago.

TVS Motor: The two and three-wheeler manufacturer said that its total sales rose 3% YoY to 2,75,115 units in January 2023. Two-wheeler sales rose 4% YoY to 2,64,710 units. Two-wheeler exports declined 44% to 48,239 units. Its electric vehicle offering, TVS iQube, registered sales of over 10,000 units for third month in a row.

Escorts Kubota: The company’s agri machinery segment sold 6,649 tractors in January 2023, registering a growth of 16.5% as compared with 5,707 tractors sold in January 2022. Domestic tractor sales in December 2022 stood at 6,235 tractors, recording a growth of 22.2% as against 5,103 tractors sold in December 2021. Export tractor sales declined 31.5% to 414 units sold in January 2023 from 604 units sold in the same period a year ago.

Welspun Enterprises: The company’s consolidated net profit rose 3092.83% to Rs 400.70 crore in the quarter ended December 2022 as against Rs 12.55 crore during the quarter ended December 2021. Revenue surged 208.67% to Rs 692.40 crore in the quarter ended December 2022 as against Rs 224.32 crore in the year-ago period.

Chambal Fertilisers & Chemicals: The company has announced that Abhay Baijal, Chief Financial Officer of the Company, retired from the services of the Company on 31 January 2023. Accordingly, Abhay Baijal ceased to be Chief Financial Officer and Key Managerial Personnel of the Company with effect from 01 February 2023.

Sunteck Realty: The company’s consolidated net profit declined 81.37% to Rs 2.07 crore in the quarter ended December 2022 as against Rs 11.11 crore during the previous quarter ended December 2021. Consolidated revenue declined 30.27% to Rs 89.33 crore in the quarter ended December 2022 as against Rs 128.11 crore during the quarter ended December 2021.

Star Health & Allied Insurance Company: The company reported a standalone net profit of Rs 210.47 crore in the quarter ended December 2022 as against net loss of Rs 578.37 crore during the quarter ended December 2021. Standalone revenue rose 13.41% to Rs 2867.24 crore in the quarter ended December 2022 as against Rs 2528.31 crore during the previous quarter ended December 2021.

Spandana Sphoorty Financial: The company’s consolidated net profit rose 58.56% to Rs 71.37 crore in the quarter ended December 2022 as against Rs 45.01 crore during the quarter ended December 2021. Consolidated revenue rose 2.46% to Rs 354.66 crore in the quarter ended December 2022 as against Rs 346.14 crore during the quarter ended December 2021.

Max Financial Services: The company’s consolidated net profit rose 200.48% to Rs 224.94 crore in the quarter ended December 2022 as against Rs 74.86 crore during the quarter ended December 2021. Consolidated revenue rose 27.92% to Rs 8895.52 crore in the quarter ended December 2022 as against Rs 6953.99 crore during the quarter ended December 2021.

KPIT Technologies: The company’s net profit rose 43.54% to Rs 100.49 crore in the quarter ended December 2022 as against Rs 70.01 crore during the previous quarter ended December 2021. Sales rose 47.36% to Rs 917.12 crore in the quarter ended December 2022 as against Rs 622.37 crore during the quarter ended December 2021.

Cigniti Technologies: The company’s net profit rose 75.33% to Rs 46.55 crore in the quarter ended December 2022 from Rs 26.55 crore during the previous quarter ended December 2021. Sales rose 31.50% to Rs 427.99 crore in the quarter ended December 2022 as against Rs 325.46 crore during the previous quarter ended December 2021.

K E C International: The company’s net profit declined 81.20% to Rs 17.60 crore in the quarter ended December 2022 as against Rs 93.61 crore during the quarter ended December 2021. Sales rose 30.98% to Rs 4374.62 crore in the quarter ended December 2022 as against Rs 3340.02 crore in the year-ago period.

Lemon Tree Hotels: The hospitality company in an exchange filing announced its latest signing, Lemon Tree Hotel, Jabalpur, Madhya Pradesh. The property is expected to be operational by June 2024 and shall be managed by Carnation Hotels Private , a wholly-owned subsidiary of Lemon Tree Hotels. The property will feature 75 well-appointed rooms, a restaurant, a club, a bar, a banquet, a gym and other public areas. The property is 16 km away from Jabalpur Airport and 2 km away from the railway station.

Jubilant FoodWorks: Standalone revenue from operations was up 2.33% QoQ to Rs 13,166 crore. Its net profit fell 38.9% QoQ to Rs 8,857.45 crore in the reported quarter. EBITDA fell 8.1% on a quarterly basis to Rs 2,960.13.

Mahindra & Mahindra: The automaker said passenger vehicle sales rose 65% YoY to 33,040 units in January 2023. Its medium duty light commercial vehicle dispatches rose 3% to 18,101 units. Three-wheeler sales more than doubled to 6,562 units, while tractor sales rose 28% to 28,926 units.