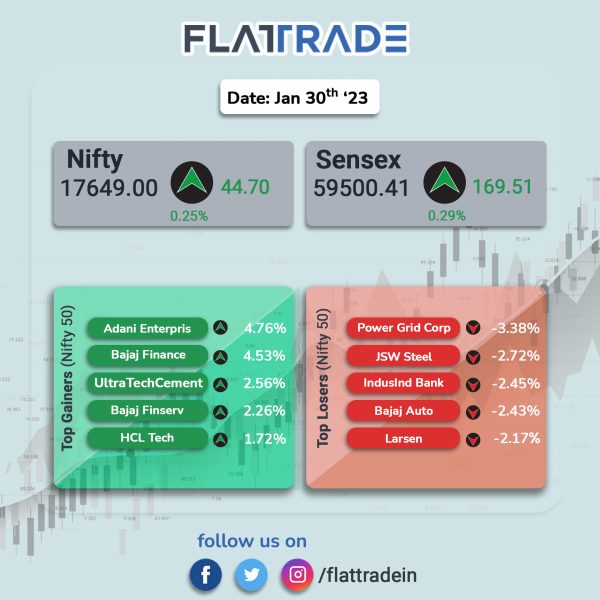

Benchmark stock indices closed in the green amid a volatile session as gains in IT and PSU Bank stocks offset losses in Energy and FMCG stocks. The Sensex closed 0.29% higher and the Nifty index rose 0.25%.

In broader markets, Nifty Midcap 100 index fell 0.19% and the BSE Smallcap was down 0.10%.

Top gainers were IT [1.1%], PSU Bank [0.55%] and Financial Services [0.33%]. Top losers were Oil & Gas [-3.57%], Energy [-3.04%], FMCG [-0.6%] and Metal [-0.28%].

Indian rupee rose 3 paise to 81.50 against the US dollar on Monday.

Stock in News Today

Bajaj Finserv: The financial services company reported a consolidated net profit of Rs 1,782 crore in Q3FY23, up 42% from Rs 1,256 crore Q3FY22. Total income during the quarter rose 23% to Rs 21,755 crore as compared to Rs 17,620 crore a year ago. Segment wise, income from interest rose 26% to Rs 10,430 crore during the third quarter as against Rs 8,266 crore in the previous year period. Among the subsidiaries, Bajaj Finance recorded highest ever quarterly consolidated PAT of Rs 2,973 crore, up 40% YoY, while Bajaj Allianz General Insurance Company witnessed its profit declining 9% to Rs 278 crore.

Gas Authority of India Ltd (GAIL): The company posted a 92% year-on-year decline in standalone net profit at Rs 245 crore for the quarter ended December 2022. Its net profit stood at Rs 3,287 crore in the year-ago period. On a sequential basis, net profit was down 84% from Rs 1,537 crore. Revenue from operations increased 37.2% YoY to Rs 35,380 crore. At EBIT level, Natural Gas Marketing posted a loss of Rs 86 crore, petrochemicals registered loss of Rs 348 crore and LPG & Liquid Hydrocarbons posted a loss of Rs 29 crore.

Punjab National Bank (PNB): The state-owned bank reported a net profit of Rs 628.9 crore in Q3FY23, down 44.2% from Rs 1,126.8 crore in Q3FY22. Its net interest income (NII) was up 17.6% at Rs 9,179.4 crore in the reported quarter as against Rs 7,803.2 crore in the correspoding quarter last fiscal. The lender’s net NPA stood at 3.30% in the quarter under review as against 3.80% in the preceding quarter.

CARE Ratings: The company reported 44% YoY rise in standalone net profit to Rs 21.40 crore and 18% YoY increase in total income to Rs 65.68 crore in Q3FY23. Total expenses increased by 8% YoY to Rs 38.30 crore in Q3FY23. Operating profit rose by 49% to Rs. 22.25 crore in the third quarter from Rs. 14.93 crore in the same period last year. The board of directors have declared an interim dividend of Rs 10 per share for the third quarter of FY23.

Sun Pharmaceuticals: The drugmaker announced that it has acquired three brands Disperzyme, Disperzyme-CD, Phlogam from Aksigen Hospital Care. All the brands are approved by the drugs controller general of India (DCGI) for post-operative inflammation in patients undergoing minor surgery and dental procedures. Aksigen is a Mumbai-based research driven healthcare entity with more than two decades of experience in the healthcare field.

Laurus Labs: The pharma firm said its consolidated net profit jumped 32.08% YoY to Rs 203.04 crore and its revenue from operations rose 50.16% to Rs 1,544.82 in Q3FY23. EBITDA grew 39% YoY to Rs 404 crore in the quarter ended December 2022. EBITDA margin declined to 26.1% in Q3FY23 as compared to 28.2% in the same period a year ago.

Exide Industries: The battery manufacturer reported a net profit of Rs 198.1 crore, up 11.1% from Rs 178.3 crore. Revenue rose 7% to Rs 3,538 crore in Q3FY23 as against Rs 3,312 crore Q3FY22. EBITDA increased 5% to Rs 400 crore in the quarter under review from Rs 381 crore in the year-ago period.

Data Patterns (India): The company’s net profit surged 271.88% YoY to Rs 33.32 crore and 155.04% YoY net sales to Rs 111.81 crore in Q3FY22. The company’s EBIDTA increased by 202% YoY to Rs 47.04 crore in Q3FY22 from Rs 15.59 crore in the year-ago period. The company said that orders in hand stood at Rs 890.40 crore.

Welspun India: The company has announced its brand licensing agreement with The Walt Disney Company for the EMEA region. The license will give the company the rights to design, develop, manufacture and distribute complete range of home textiles products leveraging Disney’s vast franchises and characters across Disney, Pixar, Marvel and Lucas brands.

VRL Logistics: The company’s net profit fell 18.7% YoY to Rs 49.2 crore in Q3FY23 as against Rs 60.5 crore in Q3FY22. Revenue was up 13.3% to Rs 681.5 crore as against Rs 601.4 crore in the year-ago period. EBITDA fell 12.3% to Rs 103.1 crore in the qurter under review from Rs 117.5 crore in the same perios last year. EBITDA margin stood at 15.1% in Q3FY23 as against 19.5% in Q3FY22.

Transport Corporation of India: The company’s net profit was up 4.7% to Rs 85.8 crore in Q3FY23 as against Rs 81.9 crore in Q3FY22. Revenue was up 15.4% YoY to Rs 966.7 crore in the reported quarter from Rs 837.7 crore in the year-ago quarter. EBITDA increased by 4.8% to Rs 114.4 crore in Q3FY23 from Rs 109.2 crore in Q3FY22.

LT Foods: The company said its net profit rose 33.5% to Rs 95.3 crore in Q3FY23 from Rs 71.4 crore in Q3FY22. Revenue climbed 30% to Rs 1,778.5 crore in Q3FY23 as against Rs 1,368.2 crore in Q3FY22. EBITDA jumped 10.2% to Rs 165.8 crore in the reported quarter as against Rs 150.5 crore in the same period last fiscal.

CSB Bank: The Kerala-based private lender has posted a rise of 5% in net profit to Rs 156 crore in Q3FY23, from Rs 148 crore in Q3FY22. The lender’s total income rose to Rs 681.95 crore in the reported quarter from Rs 579.81 in the year-ago period. In Q3FY23, the bank’s net interest income (NII) stood at Rs 350 crore as against Rs 303 crore in Q3 FY22, up 15%. Its asset quality improved sequentially, with gross NPA and net NPA ratios falling to 1.45% and 0.42%, respectively.

Steel Strips: The company’s net profit was up 2.6% at Rs 43.8 crore in Q3FY23 as against Rs 42.7 crore in Q3FY22. Revenue rose 9.1% to Rs 938.4 crore in Q3FY23 from Rs 860.5 crore in Q3FY22. EBITDA increased 1.1% to Rs 108 crore in the quarter under review from Rs 106 crore in the year-ago period.

Zen Technologies: The company reported a consolidated net profit of Rs 9.44 crore in Q3FY23 as against a net loss of Rs 0.18 crore in Q3FY22. Revenue from operations zoomed 222.8% to Rs 52.49 crore in the quarter ended December 2022 as against Rs 16.26 crore posted in same quarter last year. The total expenses surged 132.16% YoY to Rs 39.42 crore.

Five Star Business Finance: The company reported a 28% YoY rise in net profit to Rs 151 crore and a 22% YoY increase in total income to Rs 388.7 crore in Q3FY23 over Q3 FY22. Its net interest income (NII) for the period under review was Rs 325.6 crore, up 33% YoY. Net interest margin stood at 13.79% in Q3FY23 as compared with 13.46% in Q3FY22.

DCB Bank: The lender’s net profit jumped 51.1% YoY to Rs 113.85 crore and total income rose 17.1% YoY to Rs 1,167.15 crore in Q3FY23. Net interest income grew 29.28% to Rs 446 crore in Q3FY23 as against Rs 345 crore in Q3FY22. Net interest margin stood at 4.02% during the quarter as compared with 3.61% in corresponding quarter last year. Advances grew 21% YoY to Rs 32,966 crore in Q3FY23, while deposits advanced 23% YoY to Rs 39,506 crore in Q3FY23. Net NPA was at 1.37% in Q3FY23 as compared with 2.55% same quarter previous year.

Ajmera Realty: The company reported a net profit of Rs 10.6 crore in Q3FY23 from Rs 9.7 crore in Q3FY22. Revenue rose 15% to Rs 80.6 crore in Q3FY23 from Rs 70.1 crore in Q3FY22. EBITDA was up 12% to Rs 23.5 crore in the quarter under review from Rs 21 crore in the year-ago period.