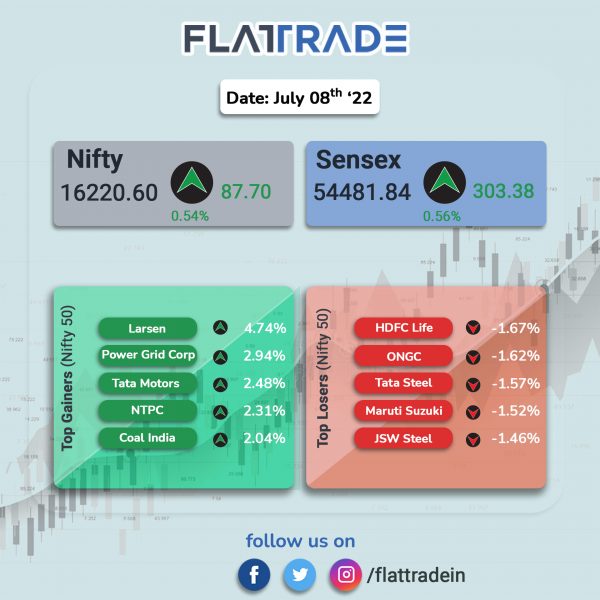

Benchmark indices closed higher, aided by gains in index heavyweights amid a fall in crude prices. The Sensex rose 0.56% and the Nifty 50 index climbed 0.54%.

In broader markets, NSE Midcap 100 index gained 0.28% and BSE Smallcap was up 0.28%.

Top Nifty sectoral gainers were Energy [0.99%], Bank [0.58%], FMCG [0.53%], Financial Services [0.5%] and Pharma [0.48%]. Top losers was Metal index which fell 0.88%.

Indian rupee fell 8 paise to 79.25 against the US dollar on Friday.

IT major TCS will report quarterly earning today in the evening and DMart results will be announced on Saturday.

Stock in News Today

Mahindra & Mahindra (M&M): Shares of the auto major rose 5% after the company approved incorporation of wholly owned subsidiary to undertake four wheeler passenger EV business. The company executed a binding agreement to sell stake in its new electric vehicle arm to British International Investment Plc. Both the companies will invest a total of Rs 3,850 crore in the subsidiary firm.

Power Finance Corporation (PFC): The state-owned company has inked a loan pact with Japan Bank for International Cooperation (JBIC) for JPY 30 billion. JBIC has provided this long term facility to PFC under its initiative ‘Global action for Reconciling Economic growth and Environmental preservation’ (GREEN). JBIC provides funds for projects which ensure the effective reduction of greenhouse gas emissions and conservation of the global environment.

GMR Infrastructure: Angkasa Pura Aviasi (APA), the Joint Venture Company of GMR Airports, which is a subsidiary of GMR Infrastructure, and Indonesia’s state-owned airport operator Angkasa Pura II (AP2), announced that it has assumed the operational charge of the Kualanamu International Airport in Medan, Indonesia. With this, the GMR Group has expanded its international footprint and tt is the only Indian airport operator with a significant presence in South-East Asia and Europe.

City Union Bank (CUB): The lender has tied up with Shriram General Insurance (SGI) for the distribution of the latter’s products through the bank’s network of 727 branches across the country. Under the agreement, SGI will offer personal insurance products such as motor, personal accident, home and travel along with commercial ones such as property, marine and engineering to the bank’s customers.

Happiest Minds: The IT company company has announced partnership with CloudFabrix’s robotic data automation fabric (RDAF). RDAF specialises in unifying data observability, AI and automation. The company will integrate RDAF to meet challenges of data intelligence, reduce operational costs and improve end-user experience.

Coforge: The company has announced partnership with Newgen Software to aid in transforming current processes, enhance operational efficiency, and gain a competitive edge over peers.

Thomas Cook India: The travel services company said it has signed an agreement with group firm SOTC and Turkiye Tourism for promoting the West Asian country as a tourist destination in India. The collaboration will focus in boosting tourism to Turkiye and will also cover both product development and wide-ranging marketing initiatives.