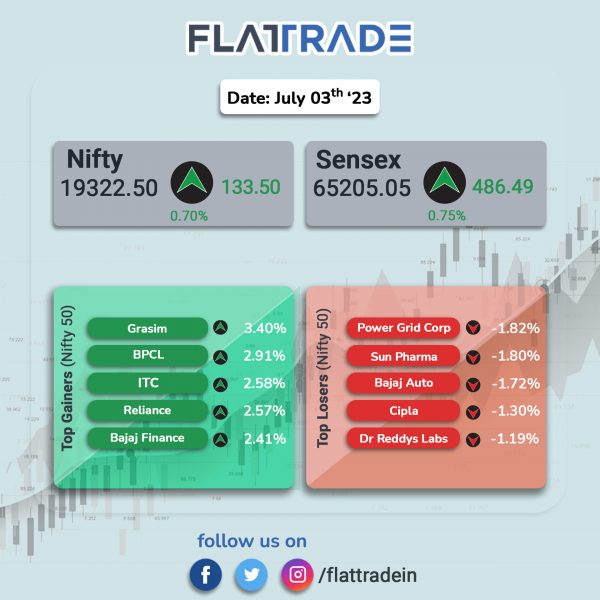

Benchmark equity indices soared, helped by positive global trends and gains in index heavyweight such ITC, Reliance Industries, and SBI. The Sensex rose 0.75% and the Nifty ended 0.7% higher.

In broader markets, the Nifty Midcap 100 index rose 0.25% and the BSE Smallcap jumped 0.56%.

Top gainers were PSU Bank [3.61%], Oil & Gas [2.26%], Metal [1.07%], FMCG [1.05%], and Financial Services [0.98%]. Top losers were Pharma [-1.11%], IT [-0.47%], and Auto [-0.27%].

Indian rupee rose 9 paise to 81.95 against the US dollar on Monday.

Stock in News Today

Adani Ports and SEZ: The company said that it has handled approximately 32.8 million metric tones (MMT) cargo in June 2023, implying a growth of 2.89% as compared with 31.88 MMT in June 2022. The above cargo volume includes approximately 1 MMT at its Haifa ports. Logistics volume continued to record significant jump with YTD rail volumes of 131,420 TEUs (18% YoY) and GPWIS volumes of 4.35 MMT (40%). During April-June 2023, APSEZ clocked approximately 101.4 MMT of total cargo volumes, which is a strong 11.5% YoY growth.

Mahindra & Mahindra (M&M): The automaker said that its overall auto sales for the month of June 2023 stood at 62,429 vehicles, registering a growth of 15.4% as against 54,096 vehicles sold in June 2022. On a sequential basis, M&M’s total auto sales rose 1.65% in June 2023 as against 61,415 units sold in May 2023. Exports in June 2023 fell 10% YoY to 2,505 vehicles.

Federal Bank: The private sector lender said that its total deposits stood at Rs 2,22,513 crore as of June 30, 2023, a growth of 21.36% as compared with Rs 1,83,355 crore in the year-ago period. Federal Bank’s CASA deposits stood at Rs 70,872 crore as of June 30, 2023, up 4.93% from Rs 67,540 crore as of June 30, 2022. The bank’s gross advances grew by 20.9% to Rs 1,86,593 crore from Rs 1,54,392 crore in the year-ago period.

TVS Motor Company: The company sold 3,16,411 units of two and three-wheelers in June 2023 as compared with 308,501 units sold in June 2022. The company sold 304,401 units in June 2023 as against 293,715 units sold in June 2022. Domestic two-wheeler sale stood at 235,833 units, up 22% YoY. The company’s total exports registered sales of 79,144 units in June 2023 as against 114,449 units June 2022, down 31% YoY.

IIFL Finance: The NBFC company said in an exchange filing that it has raised $175 million from HSBC, Union Bank, and Bank of Baroda through the external commercial borrowing (ECB) route in June 2023. In addition, IIF Finance also raised $100 million through the ECB route in March 2023. It includes $50 million in long-term funding from Export Development Canada and the co-financing of $50 million from Deutsche Bank (Singapore).

Bajaj Auto: The company’s total auto sales declined 2% to 3,40,981 units in June 2023 as against 3,47,004 units sold in June 2022. Domestic sales jumped 45% to 1,99,983 units in June 2023 as compared to 1,38,351 units in June 2022. Exports dropped 32% to 1,40,998 units in June 2023 as against 2,08,653 units sold in the same period last year.

Ashok Leyland: The company’s total commercial vehicle sales jumped by 5% to 15,221 units in June 2023 from 14,531 units in June 2022. Total CV sales in the domestic market for the period under review amounted to 14,363 units, higher by 7% compared with the same period last year.

South Indian Bank (SIB): Shares of the bank rose 6.22% after the bank registered strong growth in its gross advances and total deposits in Q1FY24. The gross advances stood at Rs 74,107 crore, an increase from Rs 64,704 crore reported in the year-ago period. SIB’s total deposits rose to Rs 95,524 crore in the first quarter of FY24, from Rs 88,196 crore in the corresponding period last year.

Bank of Maharashtra: The bank’s total deposits stood at Rs 2,44,364 crore as on 30 June 2023, a 24.73% rise from Rs 1,95,909 crore as on 30 June 2022. The public sector bank reported a 24.93% growth in gross advances to Rs 1,75,603 crore during April-June 2023 period as against Rs 1,40,561 crore in the year-ago period.

SpiceJet, City Union Bank: SpiceJet repaid Rs 100 crore loan to Tamil Nadu-based City Union Bank. The last tranche of Rs 25 crore was paid on June 30, 2023, closing the loan account which was taken in 2012. With this repayment, all securities that had been pledged with the bank has been released.

Zee Entertainment Enterprises (ZEE): The media company shares rose 4.3% in intraday trade after it made final payments to IndusInd Bank and settled the insolvency case initiated by the bank against the company. A bench headed by Chairperson Justice Ashok Bhushan told the lawyers that in the light of the settlement, the corporate insolvency resolution process could be closed, as per Cogencis.

Ramco Systems: The company’s board has approved the appointment of Subramanian Sundaresan as chief executive officer (CEO) with effect from July 3. Sundaresan holds a Master of Science (Management) degree from New Jersey Institute of Technology, US and Bachelor of Engineering (Mechanical) degree from Bangalore University, India. P.R. Venketrama Raja, chairman, Ramco Systems, said, “ The appointment of Sundar Subramanian as the CEO will bolster our leadership team, bringing in operational excellence, effective decision-making and create an environment for collaboration and growth.”

Steel Strips Wheels (SSWL): The company said its net turnover rose 9.02% to Rs 355.83 crore in June 2023 as against Rs 326.36 crore reported in June 2022. The company achieved gross turnover of Rs 429.26 crore in June 2023, recording a growth of 6.21% from Rs 404.16 crore posted in June 2022. During the period under review, total exports zoomed 268% YoY in June 2023. The company’s Truck segment jumped 31% YoY in June 2023 followed by Passenger Car segment, which surged 39% YoY.

Zydus Lifesciences: The company announced that it has received Establishment Inspection Report (EIR) from the US Food and Drug Administration (USFDA) at its manufacturing facility located at Pharmez, Ahmedabad. The drug regulator conducted inspection from March 20 to March 24. The inspection has been classified as Voluntary Action Indicated (VAI).

V.S.T. Tillers Tractors: The company said that its power tiller sales rose by 7% to 4,016 units, while its tractor sales improved by 6% to 622 in June 2023 over June 2022.

Alembic Pharmaceuticals: The company said that it has received various product approvals from the US Food & Drug Administration (USFDA) during the quarter ended 30 June 2023. The company has received final approval for Bepotastine Besilate Ophthalmic Solution and Nadolol Tablets. Bepotastine Besilate is an antihistamine indicated for the treatment of itching associated with signs and symptoms of allergic conjunctivitis, while Nadolol are indicated for the long-term management of patients with angina pectoris and for the treatment of hypertension, to lower blood pressure. The company has received tentative approval for Doxycycline Capsules, which are indicated for the treatment of only inflammatory lesions of rosacea in adult patients.

NCC: Hyderabad-based construction company announced that it has received new orders worth Rs 2,055 crore in June 2023 from private and state government agencies. The above contracts is likely to be executed over a period of 20 to 27 months from the date of award.

Fortis Healthcare: Japanese-based brokerage firm Nomura maintained a ‘Buy’ rating on the company citing the company’s continued revenue growth and sustained improvement in its Ebitda margin. Nomura raise the target price for Fortis Healthcare to Rs 368 per share, from Rs 325 apiece.

Mahindra & Mahindra Financial Services (MMFS): The company said that it has recorded an overall disbursement of approximately Rs 4,250 crore in June 2023, a 12% YoY growth. For Q1FY24, disbursements jumped 28% YoY to about Rs 12,150 crore. The collection efficiency (CE) was constant at 96% for June 2023 as compared to June 2022. The company said that it continued to maintain comfortable liquidity chest of about 3 months’ requirement.

BSE: The stock exchange operator informed the exchange that its board will meet on July 6, 2023 to consider a share buyback proposal. Shares of the company 10% higher to Friday’s closing price.

APL Apollo Tubes: The company reported quarterly sales volume of 6.62 lakh ton in the April to June quarter of FY24 as compared to 4.23 lakh ton in the same quarter of the last fiscal. The sales volume were supported by higher proportion from value added products, according to its exchange filing. The company further said that the sales mix will improve in coming quarters with rising contribution of innovative products.

Paras Defence And Space Technologies: The company’s subsidiary, Paras Aerospace, has won a contract worth Rs 42.4 crore from the Indian Farmer Fertiliser Cooperative. The company will supply 400 agri-drones, including accessories, spares and training for drone pilots.

GTPL Hathway: The company said that it has entered into share purchase and subscription cum shareholders agreement with Metro Cast Network India to acquire 4,37,676 equity shares for cash consideration of approximately Rs 25 crore. The investment in Metro Cast is strategic in nature with an object of enhancing the company’s footprint in its existing markets of Maharashtra and Karnataka.