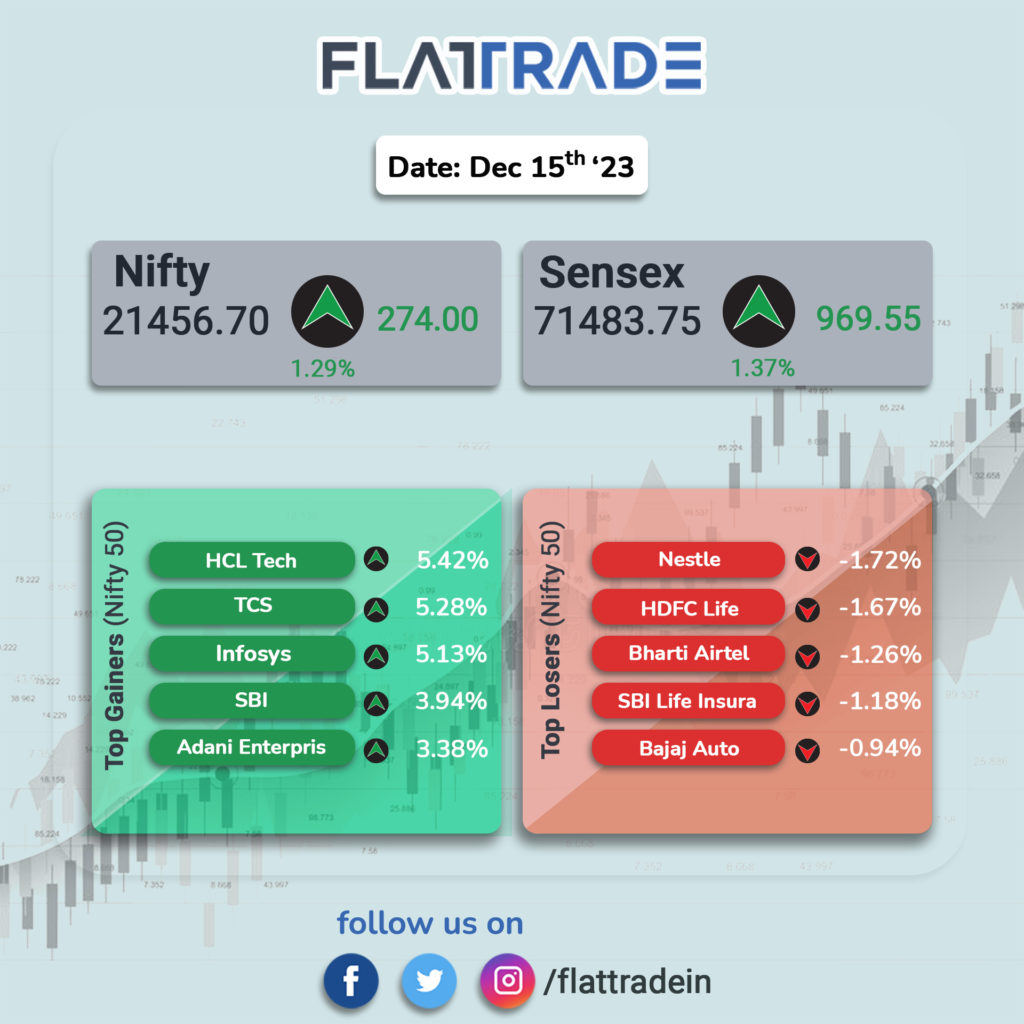

Dalal Street continues the bull run as the Fed dovish outlook fuels optimism among investors. At close, Sensex was up 969.60 points or 1.38% at 71,483.75, and the Nifty was up 273.95 points or 1.29% at 21,456.65.

In broader markets,BSE smallcap and midcap indices extended their bull runs to hit fresh lifetime highs of 42,147 and 36,421, respectively.

The Indian rupee dived 28 paise to Rs. 83.06 against the US dollar on Friday.

Stock in News Today

HCL Tech: Shares of the IT major led the Nifty, gaining 4.5 % to Rs 1,477. The surge followed the US Fed meeting in which the American central bank indicated the possibility of three rate cuts in 2024, signalling the end of the high-interest rate cycle.

Tech Mahindra: The stock gained 4.2 % to Rs 1,317 after the outcome of the US Fed meeting, which has triggered hopes of lower interest rates which will help Indian IT firms that get bulk of their business from the US and other western countries.

LTIMindtree: Shares of the Larsen and Toubro Group company surged 4% to Rs 6,192 after the IT services provider launched a new delivery centre in Mexico City as it expands its presence in Latin America.

Infosys: Shares of the IT services company gained 4% to Rs 1,564 after the US Fed meeting. The US Fed has indicated the possibility of three rate cuts in 2024, signalling the end of the high-interest rate cycle. The expectation is that US Fed rates will either stay unchanged or decrease in the future.

TCS: Shares of India’s leading IT company gained 4% to Rs 3,817 buoyed by US’s signal to cut interest rates. IT stocks have gathered momentum following dovish comments from the Fed.

HDFC Life Insurance Company Limited: The stock dropped 3% to Rs 666, extending losses for the third day in a row. Recently, IRDAI proposed a higher surrender value on non-PAR products.

Nestle Ltd: Shares of FMCG major extended losses after falling 2 % to Rs 24,310 on December 15. Volumes were high as 82,000 shares changed hands against the daily one-week average of 70,000.

Bharti Airtel: Shares of the telecom giant fell almost a 1% to Rs 996. The drop comes after brokerage firm Morgan Stanley downgraded the stock to “equal weight”.