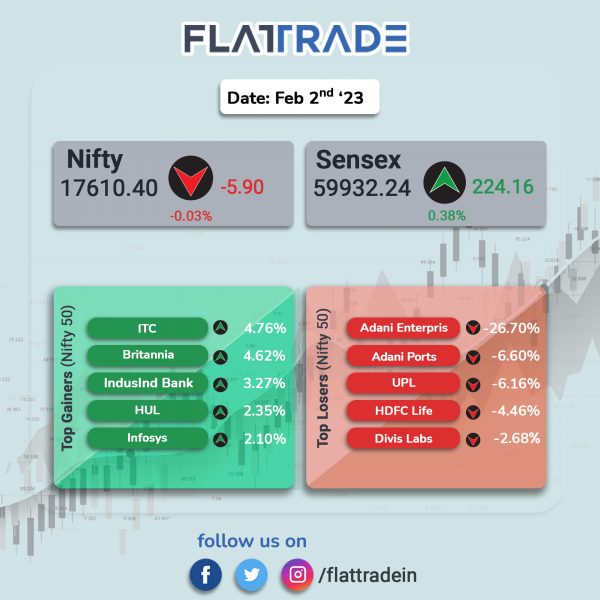

Sensex ended in the green as IT and FMCG stocks rose, while Nifty ended flat as the rout in Adani Group stocks continued, wiping off $100 billion in market value. Meanwhile, share prices of insurance companies fell after the budget tax proposal that would dampen the appeal of high-value life insurance policies. The Sensex rose 0.38%, while Nifty 50 index slipped 0.03%.

In broader markets, Nifty Midcap 100 index rose 0.15%, while BSE Smallcap index advanced 0.36%

Top losers were Nifty Metal [-4.35%], Energy [-2.26%], Oil & Gas [-1.97%], Pharma [-0.4%] and Financial Services [-0.35%]. Top gainers were FMCG [2.28%], IT [1.83%], Private Bank [0.68%] and Realty [0.38%].

Indian rupee fell 25 paise to 82.17 against the US dollar on Thursday.

Stock in News Today

Housing Development Finance Corporation Ltd (HDFC): The NBFC reported a 13% rise in its net profit for the third quarter of FY23 at Rs 3,691 crore as compared to Rs 3,260 crore in the year-ago quarter. Meanwhile, its revenue from operations rose 29% year-on-year (YoY) to Rs 15,230 crore as against Rs 11,783 crore. The net interest income for the reported quarter stood at Rs 4,840 crore compared to Rs 4,284 crore in the year-ago period, up 13%. As at December 31, 2022, the assets under management (AUM) stood at Rs 7,01,485 crore as against Rs 6,18,917 crore in the same period last fiscal. Meanwhile, the company said that individual loans comprise 82% of the AUM.

IDFC: The company said on Wednesday that it is investing Rs 2,200 crore in IDFC First Bank to increase its stake in the bank to 40% from 36.38% currently. This will provide growth capital to IDFC First Bank, the company said. Further, the IDFC board has declared a special interim dividend of Rs 11 per share, due to which the Government of India, the largest shareholder in IDFC, would receive a payout of Rs 287 crore. Further, IDFC and IDFC Financial Holding have begun the process of merger with IDFC First Bank.

Tata Steel: The company has acquired 26,97,674 equity shares of Tata Steel Utilities and Infrastructure Services (TSUISL), a wholly-owned subsidiary of the company at a premium of Rs 205 per share on rights basis, for an amount aggregating to Rs 58 crore. These funds shall be utilized by TSUISL to invest in its step-down subsidiary,Tata Steel Special Economic Zone (TSSEZ) to assist TSSEZ in partial repayment of its existing loans.

Ashok Leyland: The truck maker reported a net profit of Rs 361.34 crore in Q3FY23 compared with a net loss of Rs 5.76 crore in Q3FY22. Net sales jumped 63.3% to Rs 8,984.95 crore in Q3FY23 as against Rs 5,503.64 crore in Q3FY22. EBITDA surged 255% to Rs 797 crore in Q3FY23 as against Rs 224 crore in Q3FY22 and margin stood at 8.8% in Q3FY23 as compared with 4% in Q3FY22. Ashok Leyland’s domestic MHCV volume stood at 28221 units, grwoing by 69% over the same period last year. The company has achieved a MHCV market share of 33% in Q3FY23.

UTI Asset Management Company: The asset managing firm reported a 53% drop in consolidated net profit to Rs 60 crore in Q3FY23 from Rs 127 crore in Q3FY22. Total revenue from operations fell by 5% YoY to Rs 295 crore during the quarter. Total expenses increased by 19% to Rs 191 crore in Q3FY23 as compared with Q3FY22, due to higher employee expenses (up 7% YoY) and higher other expenses (up 10% YoY). The total AUM stood at Rs 14,97,777 crore and its total market share for the Q3FY 23 was at 5.98%.

Suven Life Sciences: The company reported a consolidated net loss of Rs 51.12 crore in the quarter ended December 2022 as against a net loss of Rs 33.69 crore during the quarter ended December 2021. Sales declined 32.28% to Rs 3 crore in the quarter ended December 2022 as against Rs 4.43 crore during the quarter ended December 2021.

Greenlam Industries: The company said its consolidated net profit rose 5.12% to Rs 28.33 crore in the quarter ended December 2022 as against Rs 26.95 crore during the quarter ended December 2021. Revenue rose 11.96% to Rs 503.50 crore in the quarter ended December 2022 as against Rs 449.71 crore during the quarter ended December 2021.

Brightcom Group: The company said that Brightcom Group and Consumable, Inc. have formed a 51/49 joint venture named Brightcom Audio US, LLC. The joint venture aims to revolutionize the $30 billion Out-of-Home (OOH) Audio Advertising industry by introducing innovative solutions that utilize cutting-edge technology and offer unique user experiences.

Symphony: The company’s board will consider a share buyback on 8 February 2023. The company is engaged in the field of residential, commercial and industrial air cooling and other appliances both in the domestic and overseas markets.

Timken India: The company reported a net profit of Rs 70.60 crore in Q3FY23, up 1.15% as against Rs 69.80 crore in Q3FY22. Revenue from operations rose 19.5% YoY to Rs 609.40 crore in the reported quarter. Total expense increased 26.52% to Rs 528.6 crore as cost of material consumed rose 11.25% to Rs 215.6 crore, while employee benefits expenses rose 21.16% to Rs 41.8 crore.

Ujjivan Small Finance Bank: The lender said that the Reserve Bank of India (RBI) has give the green signal to the company’s proposal for voluntary amalgamation of Ujjivan Financial Services with Ujjivan Small Finance Bank subject to the fulfilment of certain conditions as stipulated by the central bank. The amalgamation is subject to approval from the NCLT, requisite majority of shareholders and creditors of both transferor and transferee companies and ensuring compliance with all applicable statutory and regulatory requirements.

Meanwhile, the lender’s net profit reported to Rs 293.19 crore in the quarter ended December 2022 as against net loss of Rs 33.83 crore during the quarter ended December 2021. Total Operating Income rose 52.80% to Rs 1081.62 crore in the reported quarter as against Rs 707.87 crore in the same period last fiscal.

ISGEC Heavy Engineering: The diversified heavy engineering company said that it bagged an order for 500 KLPD ethanol plant on syrup, and 100 KLPD ethanol/Extra Neutral Alcohol (ENA) plant on grain on turnkey basis. The order is from Panchganga Sugar and Power in Maharashtra. ISGEC is a . It manufactures process equipment, presses, iron & steel castings, and boiler pressure parts.

Redington Ltd: The company reported a 2.2% decline in consolidated net profit to Rs 379.70 crore in Q3FY23 from Rs 388.07 crore posted in Q3FY22. Revenue from operations surged 30.6% to Rs 21,674.31 crore in the quarter ended December 2022 as against Rs 16,600.74 crore n the year-ago period. EBITDA in Q3FY23 stood at Rs 621.7 crore, registering a growth of 14% compared with Rs 544.3 core registered in Q3FY22.

RailTel Corporation of India: The company received an order worth Rs 253.35 crore from State Bank of India for provisioning of 4G LTE for 15,000 ATMs across India with maintenance work for five years. Meanwhile, the company’s consolidated net profit declined 51.6% to Rs 31.95 crore despite an 8.8% rise in net sales to Rs 454.32 crore in Q3FY23 over Q3FY22.

Deepak Fertilisers & Petrochemicals: The company said it signed a supply proposal for purchasing natural gas from Gujrat State Petroleum Corporation (GSPC) for three years effective from 1 May 2023. It is a Brent Index linked contract for supply of 16.44 mn MMBTU of natural gas (NG) over three year period.

D B Corp: The company’s net profit declined 44.20% to Rs 48.28 crore in the quarter ended December 2022 as against Rs 86.52 crore during the quarter ended December 2021. Sales rose 3.72% to Rs 565.81 crore in the quarter ended December 2022 as against Rs 545.52 crore during the quarter ended December 2021.

Zydus Wellness: The company’s net profit declined 16.05% to Rs 19.56 crore in the quarter ended December 2022 as against Rs 23.30 crore during the quarter ended December 2021. Sales rose 7.28% to Rs 412.96 crore in the quarter ended December 2022 as against Rs 384.93 crore during the quarter ended December 2021.

Firstsource Solutions: The company’s net profit rose 16.58% to Rs 157.92 crore in the quarter ended December 2022 as against Rs 135.46 crore during the quarter ended December 2021. Revenue rose 3.99% to Rs 1503.31 crore in the quarter ended December 2022 as against Rs 1445.64 crore during the quarter ended December 2021.

Cera Sanitaryware: The company’s net profit rose 30.45% to Rs 56.42 crore in the quarter ended December 2022 as against Rs 43.25 crore during the quarter ended December 2021. Revenue rose 13.19% to Rs 457.82 crore in the quarter under review as against Rs 404.46 crore during the year-ago quarter.

Bajaj Electricals: The company’s net profit rose 26.78% to Rs 61.12 crore in the quarter ended December 2022 as against Rs 48.21 crore during the quarter ended December 2021. Revenue rose 12.02% to Rs 1462.91 crore in the quarter ended December 2022 as against Rs 1305.94 crore during the quarter ended December 2021.

Hawkins Cookers: The company’s net profit declined 5.54% to Rs 18.09 crore in the quarter ended December 2022 as against Rs 19.15 crore during the quarter ended December 2021. Revenue declined 4.35% to Rs 256.87 crore in the quarter ended December 2022 as against Rs 268.54 crore during the quarter ended December 2021.