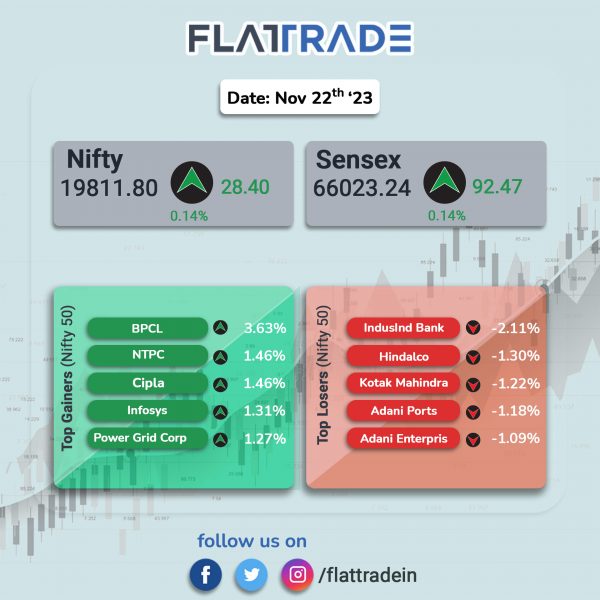

Benchmark equity indices closed higher, aided by gains in IT, auto and pharma stocks. However, gains were capped by losses in banking stocks. The Sensex and the Nifty 50 indices closed 0.14% higher, each.

In broader markets, the Nifty Midcap 100 rose 0.34% and the BSE Smallcap fell 0.63%.

Top gainers were IT [0.74%], Auto [0.66%], Pharma [0.63%], FMCG [0.43%], and Oil & Gas [0.34%]. Top losers were PSU Bank [-1.14%], Metal [-0.9%], Media [-0.87%], Realty [-0.69%], and Private Bank [-0.67%].

The Indian rupee appreciated by 3 paise to close at 83.32 against the US dollar on Wednesday.

Stock in News Today

Aurobindo Pharma: The company informed that a new subsidiary named ‘Auro Trading Private Limited’ has been incorporated with an authorized capital of Rs 10 lakh. Auro Trading will be a wholly owned subsidiary of the company that will carry on trading in generic formulations business. Separately, the company said that it has completed the acquisition of Theranym Biologics from Curateq Biologics, and Theranym Biologics has become direct subsidiary of the company with effect from November 22.

The company said that its wholly owned subsidiary, Evive Biotech, has received an approval from the US Food and Drug Administration (FDA) for Ryzneuta which is indicated to decrease the incidence of infection, as manifested by febrile neutropenia, in adult patients with non-myeloid malignancies receiving myelosuppressive anti-cancer drugs associated with a clinically significant incidence of febrile neutropenia.

CG Power and Industrial Solutions: The company said that it has filed an application with Ministry of Electronics and Information Technology (MeitY), Government of India seeking approval to set up an Outsourced Semiconductor Assembly and Test (OSAT) facility in India. Further, the company said that the estimated investment on the project over a period of five years is USD 791 million and the same is expected to be funded by a combination of subsidy, JV Partners equity contribution and debt.

Yes Bank: The private sector lender has revised fixed deposit (FD) interest rates upwards by 25 basis points (bps) for specific tenures on deposits under Rs 2 crore. With this latest revision, regular customers can now avail interest rates ranging between 3.25% and 7.75%. Senior citizens can avail interest rates from 3.75% to 8.25%. These revised interest rates are effective from November 21.

PNC Infratech: The company announced that it has received provisional certificate for four laning of Jagdishpur – Faizabad highway project in Uttar Pradesh on hybrid annuity mode (HAM). The project is executed by one of its subsidiary companies namely PNC Gonrti Highways (Concessionaire). The bid cost of the project is Rs 1,530 crore plus price index multiple amount as per the concession agreement. Further, provisional completion certificate dated 21 November 2023 declaring the project fit for entry into commercial operations with effect from 18 November 2023 has been issued by the independent engineer.

NHPC: The company inform in an exchange filing that the critical Head Race Tunnel (HRT) works at Teesta-VI HE Project (500 MW), Sikkim have been resumed.

Power Finance Corporation: The company informed informed that Ramakanali B Panagarh Transmission Limited, Special Purpose Vehicle company, has been incorporated as a wholly owned subsidiary of PFC Consulting Limited (PFCCL) which is a wholly owned subsidiary of Power Finance Corporation. The SPV is incoporated for developing the intra-state transmission system.

GMR Power and Urban Infra: The company has acquired acquired 1,051,154,500 equity shares representing 29.14% stake in subsidiary GMR Energy for $28.5 million. With this transacition, the total stake in the subsidiary has increased to 86.9%.

Sical Logistics: The company informed that Mahanadi Coalfields Limited, a subsidiary of Coal India, has awarded a tender to the joint venture/consortium of DSPL Mining Private Limited and Sical Logistics Limited, in which the Sical will have 25% participation.

JK Paper: The company received an income tax and penalty demand worth Rs 65.56 crore (including an interest of Rs 22.39 crore) for AY 2020–21. The company said it will file the necessary application/appeal against the said order before the appropriate authorities. Further, JK Paper said that it is of the view that the demand is fallacious, legally untenable and would be set aside in the course of proceedings. The company does not anticipate any material impact on financial, operation or other activities of the company.