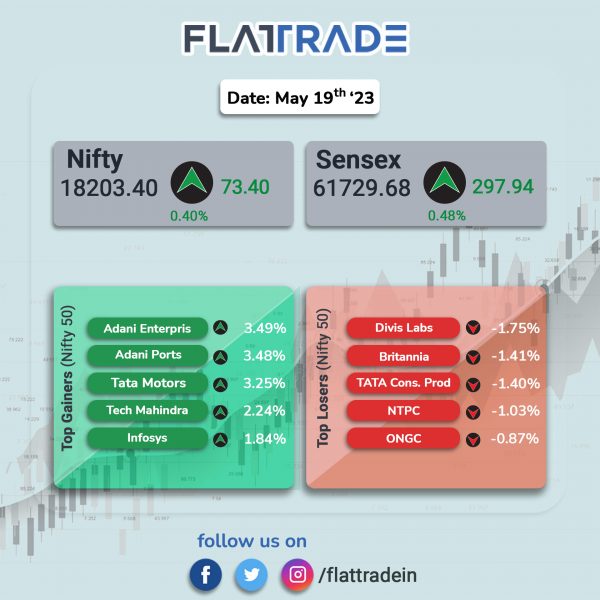

Sensex, Nifty closed higher as IT, realty and auto stocks gained. The Sensex was up 0.48% and the Nifty 50 index advanced 0.41%.

Broader markets underperformed benchmark stock indices. The Nifty Midcap 100 fell 0.06% and the BSE Smallcap ended 0.16% lower.

Top gainers among Nifty sectoral indices were IT [1.47%], Realty [0.87%], Auto [0.70%], Bank [0.50%], and Private Bank [0.45%]. Top losers was Pharma [-0.96%].

Indian rupee fell 6 paise to 82.66 against the US dollar on Friday.

Stock in News Today

Punjab National Bank (PNB): The public sector lender reported a net profit of Rs 1,158.6 crore for the quarter ended March 2023 as against Rs 2,01.6 crore in the year-ago period. The net interest income (NII) was 30% up at Rs 9,498.7 crore as against Rs 7,304.1 crore YoY. The gross NPA stood at 8.74% in the reported quarter as against 9.76% quarter-on-quarter (QoQ).

Godrej Industries: The company posted a consolidated net profit of Rs 300 crore for the March 2023 quarter, up 32.15% from Rs 227 crore in the year-ago period. The company’s consolidated revenue from operation rose by 9.1% to Rs 4,852 crore for the March 2023 quarter as compared to Rs 4,445 crore in the year-ago period. The board has approved re-appointment of Mathew Eipe as an Independent Director of the company for a second term starting from May 13, 2024 up to June 6, 2027, subject to approval of the shareholders, its regulatory filing said.

Route Mobile: The company’s net profit stood at Rs 101.6 crore in Q4FY23 as against Rs 47 crore in Q4FY22. Revenue was up 61.1% at Rs 1,008.7 crore in Q4FY23 as against Rs 626.1 crore in Q4FY22. EBITDA was at Rs 132 crore in Q4FY23 as against Rs 56.3 crore in Q4FY22.

Alkem Laboratories: The company’s net profit was down 34.1% at Rs 70.9 crore in Q4FY23 as against Rs 107.5 crore in Q4FY22. Revenue was up 17% at Rs 2,902.6 crore in Q4FY23 as against Rs 2,483.8 crore in Q4FY22. EBITDA was up 4.8% at Rs 353.2 crore in Q4FY23 as against Rs 337.1 crore in Q4FY22. The board has also recommended a final dividend of Rs 10 per equity share of Rs 2 each for the financial year ended March 2023. The company has fixed 10th August 2023 as the record date for the purpose of payment of final dividend, according to its regulatory filing.

West Coast Paper Mills: The company’s net profit stood at Rs 278.2 crore in Q4FY23 as against Rs 124.5 crore in Q4FY22. Revenue was up 27.2% at Rs 1,357.5 crore in Q4FY23 as against Rs 1,067.4 crore in Q4FY22. EBITDA was at Rs 492.6 crore in Q4FY23 as against Rs 231.1 crore in Q4FY22.

RateGain Travel Technologies: The company’s net profit was at Rs 33.7 crore in Q4FY23 as against Rs 12 crore in Q4FY22. Revenue jumped 69.8% to Rs 183 crore in Q4FY23 as against Rs 107.8 crore in Q4FY22. EBITDA was at Rs 32.1 crore in Q4FY23 as against Rs 15.3 crore in Q4FY22.

WPIL: Shares of the company were locked in 5% after the company’s net profit jumped 45.04% to Rs 71.46 crore on 35.87% rise in revenue from operations to Rs 574.13 crore in Q4FY23 over Q4FY22. On full year basis, the company’s net profit surged 94.37% to Rs 189.16 crore in FY23 as compared with Rs 97.32 crore in FY22. Revenue from operations increased 51.09% year on year to Rs 1,784.79 crore in FY23.

Arvind Smartspaces: The realty firm said its net profit was down 33% at Rs 9.3 crore in Q4FY23 as against Rs 14 crore in Q4FY22. Revenue fell 42.5% to 92.7 crore in Q4FY23 from Rs 161.1 crore in Q4FY22. EBITDA fell 7.7% to Rs 20.3 crore from Rs 22 crore in Q4FY22.

Motherson Sumi Wiring India: The company’s net profit was at Rs 138.5 crore in Q4FY23 as against Rs 46 crore in Q4FY22. Revenue was up 12.2% at Rs 1,864.4 crore in Q4FY23 as against Rs 1,661.5 crore in Q4FY22. EBITDA fell 4.4% at Rs 209.2 crore in Q4FY23 as against Rs 218.9 crore in Q4FY22.

LT Foods: The company’s net profit up 79.3% at Rs 128.2 crore in Q4FY23 as against Rs 72 crore in Q4FY22. Revenue was up 19.3% at Rs 1,821.4 crore in Q4FY23 as against Rs 1,526.3 crore in Q4FY22. EBITDA rose 28.8% to Rs 196.4 crore from Rs 152.5 crore in Q4FY22.

Kirloskar Oil Engines: The company’s net profit was up 16.4% at Rs 78.9 crore in Q4FY23 as against Rs 67.8 crore in Q4FY22. Revenue was up 17.1% at Rs 1,383.7 crore in Q4FY23 as against Rs 1,182 crore in Q4FY22. EBITDA rose 31% to Rs 188 crore in Q4FY23 from Rs 143.5 crore in the year-ago period.

TajGVK Hotels & Resorts: The company’s net profit was at Rs 14.4 crore in Q4FY23 as against Rs 3 crore in Q4FY22. Revenue was up 61.1% at Rs 103.6 crore in Q4FY23 as against Rs 64.3 crore in Q4FY22. EBITDA surged 96.1% to Rs 25.3 crore in Q4FY23 as against Rs 12.9 crore in Q4FY22.

Dilip Buildcon: The company’s consolidated net loss stood at Rs 73.2 crore in Q4FY23 as against loss of Rs 55.5 crore in Q4FY22. Consolidated revenue was up 6.7% at Rs 2,841 crore in Q4FY23 as against Rs 2,663.7 crore in Q4FY22. EBITDA was down 22% at Rs 170.5 crore in Q4FY23 as against Rs 218.6 crore in Q4FY22.

Vinati Organics: The company’s net profit was up 14.1% at Rs 115.4 crore in Q4FY23 as against Rs 101.1 crore in Q4FY22. Revenue was up 3.6% at Rs 503.4 crore in Q4FY23 as against Rs 486.1 crore in Q4FY22. EBITDA was up 9.7% at Rs 152.2 crore in Q4FY23 as against Rs 138.8 crore in Q4FY22.

KEI Industries: The company said it was granted a long-term lease for 99 years on an industrial land measuring 2,88,106 square meters at Sanand-II Industrial Estate in Gujarat. The land has been allocated by the Gujarat Industrial Development Corporation (GIDC). The company plans to establish a greenfield manufacturing facility for the production of electrical cables and wires. KEI Industries is involved in manufacturing low tension, high tension and extra high voltage cables, along with control and instrumentation and specialty cables, house wires and stainless-steel wires.

Krishna Institute Medical Science (KIMS): The company reported 15.6% rise in consolidated net profit at Rs 93.27 core in Q4FY23 as compared with Rs 80.68 crore in Q4FY22. Revenue from operations for the quarter jumped 54.68% YoY to Rs 575.92 crore. EBITDA stood at Rs 168.13 crore in Q4FY23, a growth of 38.1% as compared with Rs 121.76 crore posted in the same quarter last year. On full year basis, the company’s net profit rose 1.9% to Rs 336.32 crore on 33.13% jump in revenue from operations to Rs 2,197.67 crore in FY23 over FY22.

Gulf Oil Lubricants India: The company reported 1.92% fall in net profit to Rs 62.17 crore on a 23.94% rise in net revenue to Rs 792.05 crore in Q4FY23 over Q4FY22. EBITDA declined by 1.74% to Rs 87.54 crore in Q4FY23 from Rs 89.09 crore in Q4FY22. The board has recommended a dividend of Rs 25 per equity share for the FY23.

G R Infraprojects: The company’s consolidated net profit jumped 40.9% YoY to Rs 389.68 crore on 2.7% YoY rise in revenue from operations to Rs 2,461.96 crore in Q4FY23 over Q4FY22. EBITDA declined 28.07% to Rs 289.8 crore in Q4FY23 as compared with Rs 403 crore in corresponding quarter last year. As on 31 March 2023, the order book stood at Rs 19,529.4 crore.

RITES: The company’s consolidated net profit fell 3.5% to Rs 132.01 crore in Q4FY23 on 10.3% decline in net sales to Rs 686.81 crore in Q4FY23 over Q4FY22. Consolidated EBITDA declined 7.0% to Rs 191 crore in Q4FY23 as against Rs 206 crore in Q4FY22. Shares fell over 5% on Friday.