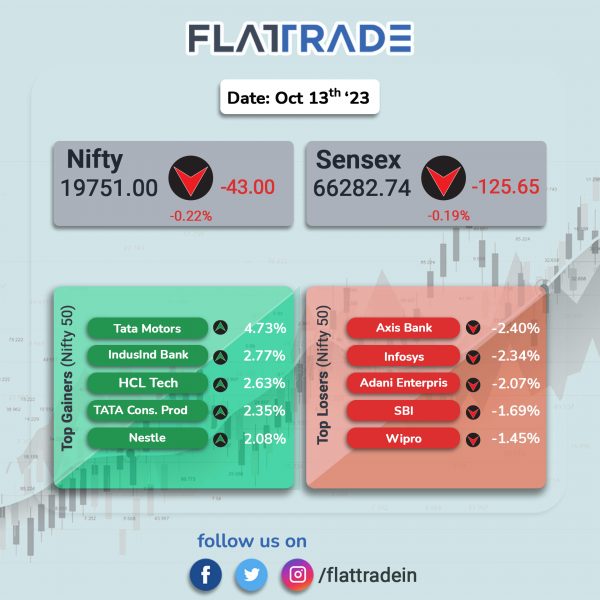

Benchmark equity indices pared some losses and closed lower due to significant losses in IT and bank stocks. The Sensex fell 0.18% and the Nifty ended 0.22% lower.

In broader markets, the Nifty Midcap 100 dropped 0.12% and the BSE Smallcap slipped 0.03%.

Top losers were PSU Bank [-1.39%], Media [-1.18%], Bank [-0.7%], Metal [-0.62%], and IT [-0.61%]. Top gainers were Auto [0.88%], Realty [0.43%], Pharma [0.32%], and FMCG [0.3%].

The Indian rupee closed flat at 83.26 against the US dollar on Friday.

Stock in News Today

HDFC Life Insurance: The company reported a consolidated net profit of Rs 378 crore for the second quarter of FY24, a growth of 15% from Rs 329 crore in the same quarter last fiscal. The company’s net premium income in Q2FY24 increased 13% to Rs 14,797 crore from Rs 13,138 crore in the year-ago period. The first-year premium recorded a growth of 6% YoY at Rs 2,566 crore in the reported quarter compared to Rs 2,423 crore in the year-ago period. The total assets under management (AUM) at the end of September 2023 quarter stood at Rs 2.64 lakh crore, a rise of 18% YoY.

Ashok Leyland: The company has bagged an order for 1,666 Buses from Tamil Nadu State Transport Undertakings. The buses will be equipped with the advanced iGen6 BS VI technology, featuring a robust 147 kW (197 hp) H-series engine. The order is expected to be executed between November 2023 and March 2024.

Indian Oil (IOCL): The company’s board has accorded approval to the investment plan of IndianOil NTPC Green Energy (JV) for setting up of renewable energy power plants and approved the equity contribution of up to Rs 1660.15 crore towards IndianOil’s share of 50% in the equity share capital of the JV company. The board also appointed Anuj Jain, Director (Finance) of the company has been designated as the CFO of the company.

Vedanta: The company informed that a wholly owned subsidiary of the company, in the name of Vedanta Iron And Steel Limited has been incorporated with an authorized capital of Rs 1 lakh and registered office in Maharashtra.

Mahindra Lifespace: The company has acquired a land parcel of approximately 5.38 acres situated at Wagholi, Pune. The land has a saleable area potential of approximately 1.5 million square feet for residential development, according to its regulatory filing.

AXISCADES Technologies: The company said that its board has approved 100% acquisition of EPCOGEN, a solutions provider focused on engineering design and solutions for energy space. Hyderabad-based EPCOGEN is a niche solutions provider focused on engineering design and solutions for energy space. The cost of the said acquisition is Rs 26.25 crore and three years earnout of Rs 7 crore based on performance ending FY26. The company expects to conclude the acquisition by December 2023.

Aditya Birla Money: The company said its net profit rose 22.76% to Rs 11.92 crore in the quarter ended September 2023 as against Rs 9.71 crore during the previous quarter ended September 2022. Sales rose 41.30% to Rs 96.37 crore in the quarter ended September 2023 as against Rs 68.20 crore during the previous quarter ended September 2022.

Landmark Cars: The company said that it has received a letter of intent (LoI) from MG Motor India for opening a dealership in Goa. This dealership will be established by Aeromark Cars, a wholly owned subsidiary company of Landmark Cars. This business will include sales and after sales of MG Cars. This will be the third MG Motor dealership of the company after Indore and Bhopal in Madhya Pradesh.

Tata Motors: Shares of the company surged 4.7% after its subsidiary, Jaguar Land Rover, posted strong sales numbers in H1FY24, helped by record sales in both quarters. During April-September period, JLR reported sales of 2,356 units, a 105% YoY growth. Range Rover, Range Rover Sport, and Defender contributed to 72% of the total order book.

Zomato: The food delivery company has launched Xtreme service that will allow merchants to send and receive small parcels. With this launch, the company aims to diversify its revenue channel and also make use of the startup’s wide network of delivery partners.

SpiceJet: Shares of the company soared 20% after ET Now reported that IndiGo’s co-founder Rakesh Gangwal was at advance stage of talks to buy a sizeable stake in the company.

Dodla Dairy: The company announced that Anjaneyulu Ganji, Chief Financial Officer (CFO) & Key Managerial Personnel (KMP) of the company, has tendered his resignation due to personal reasons and he will be relieved from his duties effective from 30 November 2023 after closing of business hours.

Sai Silks Kalamandir: The company’s revenue fell 10.46% to Rs 304.62 crore in Q2FY24 from Rs 340.17 crore in Q2FY23. Ebitda was down 20.18% at Rs 44.62 crore in Q2FY24 from Rs 55.9 crore in Q2FY23. Its net profit fell 41.24% to Rs 16.78 crore in Q2FY24 as against Rs 28.56 crore in Q2FY23.