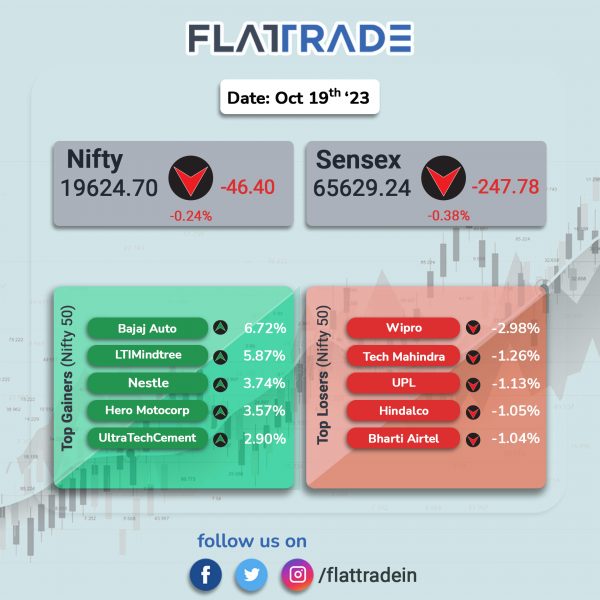

Benchmark equity indices ended lower as investors became risk averse amid the ongoing geopolitical conflict in the Middle East. The Sensex fell 0.37% and the Nifty dropped 0.24%.

In broader markets, the Nifty Midcap 100 slipped 0.09% and the BSE Smallcap rose 0.07%.

Top losers were Metal [-0.88%], Oil & Gas [-0.53%], Financial Services [-0.39%], Pharma [-0.38%], and Realty [-0.35%]. Top gainers were Auto [0.5%], Media [0.14%], and FMCG [0.14%].

The India rupee rose 3 paise to 83.24 against the US dollar on Thursday.

Stock in News Today

UltraTech Cement: The company has reported a net profit of Rs 1,281 crore for the quarter ended September 2023, up 69% from Rs 756 crore in the same period last year. Revenue from operations during Q2FY24 rose 15% YoY to Rs 16,012 crore as against Rs 13,893 crore in the year-ago period. Ebitda for the reported quarter came in at Rs 2,498 crore, with margins of 15.9%. The cement major reported a robust volume growth of 16% for the quarter ended September 2023 and the domestic sales volume stood at 25.66 million tonnes, a 15% YoY rise.

Nestle India: The FMCG major said that its consolidated net profit surged 37% YoY to Rs 908.1 crore for the quarter ended September 2023. The net profit stood at Rs 661.4 crore in the same period last year. Revenue from operations stood at Rs 5,036.82 crore in the reported quarter, up 9.4% YoY. The company announced a second interim dividend of Rs 140 per share that will be paid on or before November 16. The total payout will amount to Rs 1,349.82 crore. The company has fixed November 1 as the record date for determining the eligibility of shareholders. Further, the board has approved splitting the existing equity shares having face value of Rs 10 per share into 10 equity shares having face value of Re 1 per share.

PVR Inox: The multiplex chain has reported a consolidated net profit of Rs 166 crore for the quarter ended September 2023 as against a net loss of Rs 71 crore in the year-ago period. Revenue from operations during the quarter under review jumped 191% to Rs 2,000 crore as against Rs 686 crore in the same period last year. The company reported an Ebitda of Rs 706 crore in Q2FY24, from Rs 154 crore in the corresponding quarter of last fiscal. Ebitda margin improved to 35.3% in the reported period, compared with 22.4% a year ago.

Adani Energy Solutions: The company has fully commissioned the Warora Kurnool Transmission (WKTL), spanning 1,756 circuit kilometers across Maharashtra, Telangana, and Andhra Pradesh. The project will strengthen the national grid to ensure seamless power flow of 4500 MW between Western region and Southern region.

Kotak Mahindra Bank: The lender said its subsidiary Kotak Alternate Asset Managers has acquired 6.12% stake in Nkure Therapeutics via conversion of 10 lakh Compulsorily Convertible Debentures into 1.29 lakh Compulsorily Convertible Preference Shares worth Rs 77 apiece.NKURE is engaged in research wherein cells and their derivatives are used to generate therapeutic products to treat cancer and cancer-related pathologies and it has not started commercial activities.

Coforge: The company reported a 2.5% growth in revenue to Rs 2,276.2 crore, higher from Rs 2,221 crore in the June quarter and a 9.5% increase in profit to ₹181 crore in Q2FY24 from Rs 165.3 crore in the previous quarter last fiscal. In constant currency terms, the company’s revenue rose 2.5% sequentially to Rs 2,276.2 crore from Rs 2,221 crore in the June 2023 quarter. The company reiterated its forecast for annual revenue growth in the range of 13-16% in constant currency terms in fiscal year 2024. An interim dividend of Rs 19 per share has been recommended by the board and the record date is set for November 2, 2023.

KFin Technologies: The announced that it had signed a multi-year investment management solution (IMS) contract with LIC Pension Fund Ltd (LICPFL). The contract entails designing, creating and administering the investment management solution for enhanced customer service, security and compliance.

Oracle Financial Services Software: The company reported a 5% YoY jump in net profit at Rs 417.4 crore for the second quarter ended September 2023 as against a net profit of Rs 397.7 crore in the corresponding quarter last year. Consolidated revenue stood at Rs 1,444.4 crore during the quarter under review, up 5% against Rs 1,376 crore in the corresponding period of last year.

Titagarh Rail Systems: The company’s consolidated revenue was up 54.08% YoY to Rs 935.45 crore in Q2FY24 as against Rs 607.11 crore in Q2FY23. Ebitda jumped 108.97% to Rs 115.08 crore Q2FY24 as against Rs 55.07 crore in Q2FY23. Consolidated net profit rose 56.9% to Rs 70.59 crore in Q2FY24 as against Rs 44.99 crore in Q2FY23.

AXISCADES Technologies: The company has launched an Engineering Design Centre (EDC) in Saltney, UK, to cater to the demands of the aerospace industry and various

promising business opportunities in the region. The Engineering Design Centre will serve as a hub for innovation, collaboration, and cutting-edge and evolving engineering solutions across aerospace, automotive, and other industry sectors.

Shakti Pumps: The company informed that its has received a contract from Maharashtra State Electricity Distribution Company Limited (MSEDCL), for 50,000 off-grid Solar Photovoltaic Water Pumping Systems (SPWPS) pumps. The total value of the 50,000 pumps is about Rs 1,603 Crores (inclusive of GST) and the contract is expected to be executed over 24 months.

Sonata Software: The company said that it has signed an agreement with Global Cloud Xchange (GCX), a leading network service provider powering global connectivity for new media providers, telecom carriers and enterprises. “Our capabilities and investments in Cloud, Data and AI will be at the core to deliver the next leg of transformation for GCX,” said Samir Dhir, MD and CEO at Sonata Software.

Hindalco Industries: The company said that Anant Maheshwari has tendered his resignation as an Independent Director of the company w.e.f. closing hours of Wednesday, October 18, 2023, due to personal reasons.

Shyam Metalics And Energy: The company has acquired Mittal Corp for Rs 351 crore after after NCLT approved the resolution plan submitted for acquisition of Mittal Corp by Shyam Sel and Power, a subsidiary of the company. With this development, the company has entered into the stainless steel sector, expanding its operations and solidifying its position as a diversified steel and power conglomerate.

Central Bank of India: The lender has entered into a strategic co-lending partnership with Capri Global Capital to offer MSME Loans at competitive rates. Under the partnership, Capri Global Capital will originate and process Loan proposals under MSME Sector as per jointly formulated credit parameters and eligibility criteria and Central Bank of India will take into its books 80% of the MSME Loans under mutually agreed terms.

Ramkrishna Forgings: The company’s consolidated revenue was up 19.04% YoY at Rs 981.49 crore in Q2FY24 over Rs 824.44 crore in Q2FY23. Consolidated Ebitda was up 17.45% YoY at Rs 205.98 crore in Q2FY24 as against Rs 175.37 crore in Q2FY23. Consolidated net profit rose 22.27% YoY at Rs 82.19 crore in Q2FY24 as against Rs 67.22 crore in Q2FY23.

Mastek: The company reported a net profit of Rs 65.29 crore in Q2FY24, down 11.2% from Rs 73.53 crore in Q2FY23. Revenue was up 5.55% at Rs 765.54 crore in Q2FY24 as against Rs 725.25 crore in Q2FY23. Ebit fell 4.81% to Rs 102.14 crore in Q2FY24 from Rs 107.29 crore in Q2FY23.

SJVN: The company has offered power to the beneficiaries of Northern Region from 1,000 MW Solar PV Station to be developed under CPSU scheme of Government of India at Village Bandarewala / Karnisar, Tehsil Poogal, District Bikaner, Rajasthan. The power generated by the project will be used by Government entities, either directly or through discoms. Further, Jammu & Kashmir Power Corporation Limited and Rajasthan Urja Vidyut Nigam Limited has given their consent for purchase of 600 MW & 500 MW power, respectively, against a total capacity of 1000 MW at a tariff of Rs 2.57/ kWh.