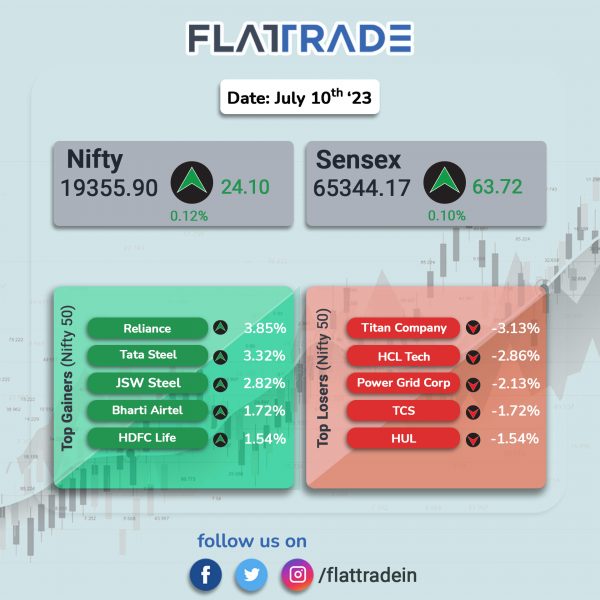

Benchmark equity indices closed marginally higher as RIL and metal stocks gained. The Sensex rose 0.1% and the Nifty advanced 0.12%.

In broader markets, the Nifty Midcap 100 index fell 0.38% and the BSE Smallcap lost 0.26%.

Top losers were IT [-1.24%], Media [-0.95%], Realty [-0.85%], FMCG [-0.77%], and Auto [-0.62%]. Top gainers were Metal [1.69%], Energy [0.65%], Oil & Gas [0.59%].

Indian rupee ended at 82.57 against the US dollar on Monday as against Friday’s close of 82.74.

Stock in News Today

State Bank of India (SBI): The company said that CRISIL Ratings has assigned its ‘CRISIL AA+/Stable’ rating to the Rs 10,000 crore Tier-I bonds (under Basel III) of the bank. CRISIL cited that the rating was driven by SBI group’s dominant market position in the Indian banking industry, strong resource profile and adequate capitalisation. The agency also said that the bank’s liquidity position is ‘superior’ as it has a sizeable retail deposit base.

Larsen & Toubro (L&T): The company and Spain-based Navantia, have signed a teaming agreement (TA) for the purpose of submission of a techno-commercial bid for the Indian Navy’s P75 (India) submarine program. Project 75 (I) requires the Indian bidder to tie up with a foreign collaborator (FC) and execute the program for delivery of six conventional submarines equipped with air-independent propulsion (AIP). Moreover, L&T and Navantia are also seeking cooperation in other military programmes as well as in green energy opportunities, including offshore wind through Navantia Seanergies division.

L&T has announced that it has completed the transition of $150 million term loan with Bank of America into a sustainability linked loan (SLL). This SLL reiterates Larsen & Toubro’s continued commitment to its environmental, social and governance (ESG) goals. The company said that the facility incorporates interest rate adjustments linked to the achievement of two of L&T’s predetermined sustainability targets – the reduction of greenhouse gas emission intensity and water consumption intensity against the target levels.

Mahindra & Mahindra (M&M): The company is in advanced talks with British International Investment (BII) and some other global investors to raise up to Rs 5,000 crore ($605 million) for its electric vehicles (EV) unit, The Economic Times reported citing sources. The company has outlined a capital expenditure of close to Rs 10,000 crore in its EV subsidiaries between FY22 and FY27.

Zee Entertainment Enterprises (ZEE): The Securities and Appellate Tribunal (SAT) has rejected a request to stay an interim order passed by the Securities and Exchange Board of India (SEBI) against Essel group chairman Subhash Chandra and ZEE’s MD & CEO Punit Goenka. A SAT bench headed by Justice Tarun Agarwala said that there was no urgency to stay the order. SAT directed the ZEE promoters to file their response to SEBI within two weeks and also asked SEBI to complete the investigations within a week, after taking up responses from Goenka and Chandra.

Vadilal Industries and Vadilal Enterprises: US-based private investment firm Bain Capital is in talks to buy Indian ice cream maker Vadilal and also considering taking control of Vadilal Industries and Vadilal Enterprises, according to CNBC-TV18. Bain Capital is also interested in merging the two Vadilal entities and is valuing Vadilal’s ice cream business at over Rs 3,000 crore ($363.11 million) the report said citing sources.

ICICI Prudential Life Insurance Company: The company’s growth in assured new business rose 8.8% year-on-year in the quarter ended June 2023, according to an exchange filing. The value for its new business doubled to Rs 2,765 crore in fiscal 2023 as against Rs 1,328 crore in 2019, a CAGR of 20.1% in four years. The company’s total annualised premium equivalent grew 11.7% YoY to Rs 8,640 crore.

Hindustan Zinc: The company announced that it will give an interim dividend of Rs 7 a share aggregating up to Rs 2,957 crore for FY24. This follows a payout to investors last year of around Rs 31,900 crore rupees in four tranches. The company paid five dividends in FY23 totalling about Rs 37,700 crore.

Adani Enterprises: The company informed that its wholly owned subsidiary, Adani Digital Labs (ADL) has acquired 29.81% stake of Stark Enterprises (SEPL) for Rs 3.56 crore. The company said that the acquisition will help Adani Group to enhance its travel line of business.

Info Edge (India): The company said that its wholly owned subsidiary, Redstart Labs (India), has agreed to invest in Brainsight Technology, which is the business of healthcare technology. The company uses AI enabled application to provide evidence-based treatment hooks for neurosurgeons, psychiatrists and neurologists; and a private and empathetic digital aid for patients, and related business activities.

SpiceJet: The carries said that its board will consider and approve raising of fresh capital in its meeting scheduled on Wednesday (July 12). The airline company may issue equity shares and/or convertible securities on preferential basis, subject to approvals from regulators and shareholders of the company.

Container Corporation of India (CONCOR): The company said that its total throughput increased by 7.95% to 10,93,610 twenty-foot equivalent units (TEUs) in Q1FY24 from 10,13,048 TEUs recorded in Q1 FY23. While the export-import (EXIM) throughput improved by 7.24% year on year to 8,41,690 TEUs for quarter ended June 2023, domestic (DOM) throughput jumped 10.40% YoY to 2,51,920 TEUs in Q1FY24.

Prism Johnson: The company said that its board has approved sale of certain freehold limestone bearing land parcels in Kotapadu and Kalavatla villages in Andhra Pradesh aggregating 1,420.72 acres to The Ramco Cements. The board has also approved the transfer of mining lease granted by the Government of Andhra Pradesh by Prism to Ramco Cements, over an extent of 663.46 hectares located in the villages of Kotapadu and Kalavatla, Kolimigundla Mandal, Nandyal District, Andhra Pradesh. The said transaction is expected to be completed by 31 July 2023, subject to necessary approvals, if any.

Xchanging Solutions: The company said that its board has approved interim dividend of Rs 15 per equity share for FY24. The record date to determine eligible members for receiving the interim dividend will be July 28, 2023.

Max Ventures and Industries: The company announced that its real estate arm, Max Estates, has achieved pre-formal launch sales of over Rs 1,800 crore for its first luxury residential project at Noida. Based in Sector 128, Noida, Estate 128 is built across 10 acres, with 3 high rise towers having 201 units. ‘The Hub at Estate 128′, admeasuring approximately 46,000 sq. ft. encompasses state of the art indoor and outdoor amenities including swimming pool, spa, sports facilities, multipurpose hall, dining, among others.

Schaeffler India: The company informed that its board has approved appointment of Hardevi Vazirani, additional director designated as chief financial officer (CFO) and director-finance (wholetime director) of the company with effect from February 13, 2024. Satish Patel, director-finance & CFO of Schaeffler India, will be superannuating on February 12, 2024. Hardevi Vazirani has been part of Schaeffler for three decades, during which she held various roles in IT, finance & corporate strategy including invaluable international exposure during her four years stint in Shanghai and three years in Singapore, where she played vital roles in AP region.

Gallantt Ispat: The company has entered into an agreement with East Coast Railway, Bhubaneshwar, Odisha, to buy and own Railway Wagons to get rid of wagons shortfall with lndian Railways. The company said that owning two railway rakes would cost the company about Rs 55 crore, but having own rakes would assure that raw materials are dispatched timely, hassle free and cost effectively.

Gujarat Alkalies & Chemicals (GACL): The company has dispatched first lot of purified Phosphoric Acid and Hydrazine Hydrate from Dahej facility. GACL had established a commercial plant in Dahej at an estimated cost of Rs 405 crore to manufacture 10,000 MTA of Hydrazine Hydrate. GACL has also established a purified phosphoric acid plant having a capacity of 33,870 MTA at Dahej.

IRB Infrastructure Developers: The company’s gross toll collection rose 16.48% to Rs 383.35 crore in June 2023 as compared with Rs 329.12 crore in June 2022. Sequentially, the company’s gross toll collection decreased 6.76% as against Rs 411.15 crore recorded in May 2023.

Cyient DLM: The company made a strong stock market debut as the shares opened at Rs 403 as against an issue price of Rs 265 per share. It touched a high of Rs 427 per share, but closed at Rs 420.6 per share on the NSE.

Easy Trip Planners: The company has entered into a general sales agreement with SpiceJet Airlines. The company will sell and promote SpiceJet products and services in India, according to the agreement.

Gland Pharma: The US drug regulator has approved the company’s abbreviated new drug application for Fomepizole injectable. Fomepizole injection is an antidote for ethylene glycol such as antifreeze, or methanol poisoning.