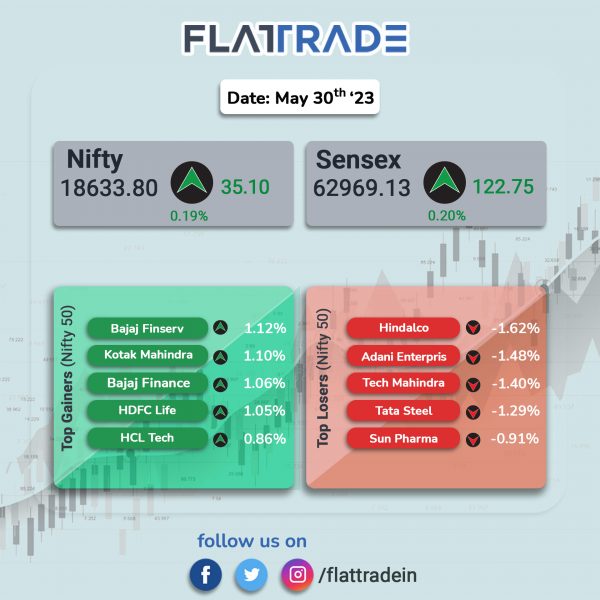

Benchmark equity indices closed slightly higher as FMCG and Private Bank stocks advanced amid mixed global cues. The Sensex rose 0.2% and the Nifty 50 index gained 0.19%.

In broader markets, the Nifty Midcap 100 index advanced 0.25% and the BSE Smallcap was up 0.22%.

Top gainers were Media [0.68%], FMCG [0.59%], Private Bank [0.58%], Financial Services [0.38%], and IT [0.2%]. Top losers were Metal [-0.91%], Auto [-0.29%], Realty [-0.21%], Oil & Gas [-0.18%], and Energy [-0.18%].

Indian rupee depreciated by 9 paise to close at 82.72 against the US dollar on Tuesday.

Stock in News Today

Apollo Hospitals Enterprise: The company’s net profit jumped 50.5% to Rs 146 crore in Q4FY23 as against Rs 97 in Q4FY22. Its revenue was up 21.3% to Rs 4302.2 crore in Q4FY23 as against Rs 3546.4 crore in Q4FY22. EBITDA rose 5.4% to Rs 488.2 crore in Q4FY23 as against Rs 463.3 crore in Q4FY22.

Sun Pharma: The company announced that it has entered into a licensing agreement with Philogen S.p.A for commercializing Philogen’s specialty product, Nidlegy (Daromun) in the territories of Europe, Australia and New Zealand. Nidlegy, currently in Phase-III clinical trials, is a new anti-cancer biopharmaceutical which is being developed by Philogen for the treatment of melanoma and non-melanoma skin cancers. The two partner companies will share post-commercialization economics in about 50:50 ratio.

Vedanta: Finsider International, a unit of Vedanta, pledged 4.4% of the latter’s equity to Glencore International AG for a facility worth $250 million. The facility availed from Glencore will be operated by Vedanta Resources.

NMDC: The state-owned iron ore miner has slashed prices of lump ore and fines, effective from May 29, 2023. The prices of lump ore (65.5%, 6-40mm) have been reduced by Rs 600 or 13.33%, to Rs 3,900 per ton compared with Rs 4,500 per ton fixed on March 21, 2023. The prices of iron ore fines (64%, -10 mm) have been cut by Rs 550 or 13.38%, to Rs 3,560 per ton from Rs 4,110 per ton set on 21 March 2023.

Force Motors: The company reported consolidated net profit of Rs 146.59 crore in Q4FY23 as compared with net loss of Rs 42.79 crore in Q4FY22. Revenue from operations jumped 69.01% to Rs 1,490.25 crore in Q4FY23 as compared with Rs 881.47 crore in Q4FY22. On full year basis, the company reported consolidated net profit of Rs 133.64 crore in FY23 as compared with a net loss of Rs 91.08 crore in FY22. Revenue from operations jumped 55.2% year on year to Rs 5,028.98 crore in FY23 over FY22. The company’s board has recommended a dividend of Rs 10 per equity share for financial year 2022-2023.

3M India: The company’s net profit was up 22.4% YoY at Rs 135.7 crore in Q4FY23 as against Rs 111 crore in Q4FY22. Revenue was up 13.0% at Rs 1,046 crore in Q4FY23 as against Rs 925.6 crore in Q4FY22. EBITDA was up 16% at Rs 298.9 crore in Q4FY23 as against Rs 257.8 crore in Q4FY22.

Lux Industries: The company’s net profit tumbled 57.7% YoY at Rs 31.2 crore in Q4FY23 as against Rs 74 crore in Q4FY22. Revenue was up 21.9% YoY at Rs 715.2 crore in Q4FY23 as against Rs 586.9 crore in Q4FY22. EBITDA was down 60.5% YoY at Rs 42.2 crore in Q4FY23 as against Rs 106.9 crore in Q4FY22.

Arvind Fashions: The company’s consolidated net profit stood at Rs 10.92 crore in Q4FY23, steeply higher from Rs 0.78 crore in Q4FY22. Revenue from operations jumped 24.36% to Rs 1,140.01 crore in Q4FY23 from Rs 916.70 crore in Q4FY22. EBITDA stood at Rs 138 crore in Q4FY23, up 47% from Rs 94 crore in Q4FY22. On full year basis, the company reported net profit of Rs 36.71 crore in FY23 as compared with net loss of Rs 267.40 crore in FY22. Revenue from operations jumped 44.675 year on year to Rs 4,421.08 crore in FY23 over FY22. The board has recommended a dividend of Rs 1 per equity share for FY23, subject to approval of shareholders.

Marksans Pharma: The company’s consolidated net profit soared 191.46% to Rs 81.93 crore in Q4FY23 as against Rs 28.11 crore recorded in Q4FY22. Revenue from operations rose 16.25% YoY to Rs 485.98 crore in the quarter ended March 2023. EBITDA surged 72.1% YoY to Rs 109.5 crore in Q4FY23 as against Rs 63.6 crore reported in Q4 FY22. EBITDA margin improved to 22.5% in Q4FY23 as compared to 15.2% recorded in the same period last year.

Landmark Cars: The company’s net profit was up 28.3% YoY at Rs 24 crore in Q4FY23 as against Rs 18.7 crore in Q4FY22. Revenue was up 17.5% at Rs 854 crore in Q4FY23 as against Rs 727 crore in Q4FY22. EBITDA was up 17% at Rs 61 crore in Q4FY23 as against Rs 52 crore in Q4FY22.

BCL Industries: The company’s net profit was up 6.6% at Rs 24.3 crore in Q4FY23 as against Rs 23 crore in Q4FY22. Revenue was down 9.9% at Rs 456.9 crore in Q4FY23 as against Rs 507.1 crore in Q4FY22. EBITDA was up 22.6% YoY at Rs 47.2 crore in Q4FY23 as against Rs 38.5 in Q4FY22.

EID Parry: The sugar manufacturer said its net profit was down 40.9% at Rs 178.9 crore in Q4FY23 as against Rs 303 crore in Q4FY22. Revenue was up 21.1% YoY at Rs 6,860.3 crore in Q4FY23 as against Rs 5,665.8 crore in Q4FY22. EBITDA was up 4.2% at Rs 643.5 crore in Q4FY23 as against Rs 617.5 crore in Q4FY22.

Mawana Sugars: The company’s net profit was up 67.5% at Rs 52.1 crore in Q4FY23 as against Rs 31.1 crore in Q4FY22. Revenue rose 19.1% to Rs 350.3 crore in Q4FY23 as against Rs 294.1 crore in Q4FY22. EBITDA was up 31.3% at Rs 81.3 crore in Q4FY23 as against Rs 61.9 crore in Q4FY22.

Shriram Properties: The company’s consolidated net profit tumbled 76.51% to Rs 15.23 crore on 42.53% decline in revenue from operations to Rs 117.85 crore in Q4FY23 over Q4FY22. On full year basis, the company’s consolidated net profit surged to Rs 65.97 crore in FY23 from Rs 9.78 crore posted in FY22. Revenue jumped 55.79% YoY to Rs 674.40 crore in the financial year ended March 2023.

D B Realty: The company said that it has executed agreements with the Prestige Group for divestment of the company’s stake in Prestige (BKC) Realtors and Turf Estate Joint Venture LLP for a total consideration of Rs 1,176.49 crore. The real estate developer said that it has signed a securities purchase agreement (SPA) with Prestige Falcon Realty Ventures for sale of D B Realty’s 50% holding in Prestige (BKC) Realtors. The company said that the completion of sale and transfer will be within 60 days from the date of the delivery.

Eureka Forbes: The company reported a 98% jump in net profit to Rs 16.28 crore in Q4FY23 from Rs 4.82 crore posted in Q4FY22. Revenue from operations stood at Rs 508.1 crore in the quarter ended March 2023, registering a decline of 8% on YoY basis, owing to weak market conditions. EBITDA grew 35.6% YoY to Rs 47.4 crore while EBITDA margin improved by 300 basis points YoY to 9.3% during the period under review.

Stove Kraft: The company reported a net loss of Rs 6 crore in Q4FY23 as against a net profit Rs 8.65 crore posted in Q4FY22. Revenue from operations rose 6.4% YoY to Rs 278.06 crore in the quarter ended March 2023. EBITDA slipped 62% YoY to Rs 5.9 crore during the period under review.

Mazagon Dock Shipbuilders: The company’s net profit stood at Rs 326.2 crore in Q4FY23 as against Rs 159 crore in Q4FY22. Revenue was up 49% at Rs 2,078.6 crore in Q4FY23 as against Rs 1,396.4 crore in Q4FY22. EBITDA rose to Rs 210.6 crore in Q4FY23 as against Rs 77.3 crore in Q4FY22.

Inox Wind: The company has bagged an order for a 150MW wind project from NTPC Green Energy’s renewable arm. The project shall be executed in Gujarat. Inox Wind has recieved a total order of 550 MW from NTPC till date.

V-Guard: The company’s net profit was down 41.2% YoY at Rs 52.7 crore in Q4FY23 as against Rs 90 crore in Q4FY22. Revenue was up 7.6% YoY at Rs 1,140.1 crore in Q4FY23 as against Rs 1,059.2 crore in Q4FY22. EBITDA down 11.9% YoY at Rs 98.6 crore in Q4FY23 as against Rs 111.9 crore in Q4FY22.

RattanIndia Enterprises: The company announced that it has launched a new cargo drone ‘L-40’ by its company, Throttle Aerospace Systems. The new L-40 drone has a higher payload capacity of 40 kgs as compared to the 20 kgs capacity L-20 drones.