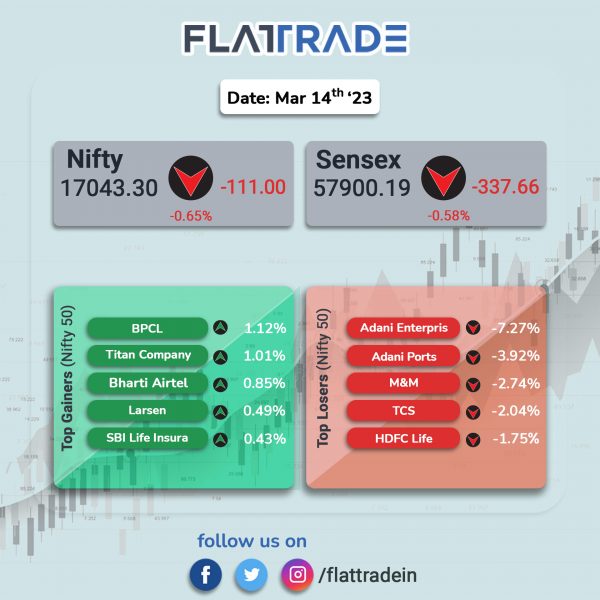

Dalal Street ended lower with PSU Banks and IT stocks leading losses, while investors awaited the US inflation data due later. The Sensex fell 0.58% and the Nifty shed 0.65%.

In broader markets, the Nifty Midcap 100 dropped 0.52% and the BSE Smallcap lost 0.84%.

Top losers were PSU Bank [-1.9%], IT [-1.65%], Metal [-1.22%], Realty [-1.01%] and Auto [-0.89%]. Nifty Media index gained 0.16%, while Pharma index was little changed. All other Nifty sectoral indices closed in the red.

Indian rupee fell 37 paise to 82.49 against the US dollar on Tuesday.

The Wholesale Price Index (WPI)-based inflation declined to a 25-month low of 3.85% in February 2023 compared to 4.73% in January 2023, government data showed on Tuesday. This is the ninth straight month of decline in WPI-based inflation. The food index inflation eased to 2.76% in February from 2.95% in January. The decline is attributed to fall in prices of crude petroleum & natural gas, non-food articles, food products, minerals, computer, electronic & optical products, chemicals & chemical products, electrical equipment and motor vehicles, trailers & semi-trailers,” the Commerce and Industry Ministry said.

Stock in News Today

Tata Motors: The company’s luxury arm Jaguar Land Rover said that it is partnering with Tata Technologies to accelerate its digital transformation. As part of the collaboration, Tata Technologies will deliver end-to-end integrated Enterprise Resource Planning (ERP) to transform Jaguar Land Rover’s manufacturing, logistics, supply chain, finance and purchasing modules by bringing data and knowledge from multiple departments into one single source. The first phase will include Jaguar Land Rover’s (JLR) UK core production facilities, with solutions subsequently deployed to other global locations.

Tata Consultancy Services (TCS): The IT major announced the launch of its 5G-enabled solution, TCS Cognitive Plant Operations Adviser for the Microsoft Azure Private Mobile Edge Computing (PMEC) platform, to help companies in industries like manufacturing, oil and gas, consumer packaged goods, and pharmaceuticals transform production. The platform will harness AI and machine learning to make the production more intelligent, agile and resilient. TCS Cognitive Plant Operations Adviser is a composite AI solution for manufacturing and process plant operations that uses Microsoft Project Bonsai low-code, AI platform, for which TCS is a launch partner, to provide insights and information to plant operators for taking real-time and autonomous decisions.

Hindustan Petroleum Corporation Ltd (HPCL): The oil marketing company has entered into an agreement to manufacture, distribute and market lubricants of US-based Chevron in India, the two companies said. The partnership will encompass licensing, production, distribution, and marketing of Chevron’s lubricant products under the Caltex brand, including Chevron’s proprietary Havoline and Delo branded lubricant product.

State Bank of India (SBI): The lender will increase the benchmark prime lending rate by 70 bps to 14.85% from March 15 (Wednesday). The state-owned lender has raised its base rate by 70bps to 10.10%. The public-sector lender, however, has decided to keep the marginal cost of funds-based lending rates unchanged.

Life Insurance Corporation (LIC): The insurance behemoth Tuesday said it has elevated Tablesh Pandey, executive director of the company, as its managing director. His appointment is effective from April 1, 2023, according to a regulatory filing. Pandey will replace present managing director B C Patnaik, it said.

In other news, LIC announced that Siddhartha Mohanty, managing director, has taken charge of the financial and administrative powers and functions of the chairperson of LIC, in the interim, in addition to his own duties, with effect from March 14.

Mahindra & Mahindra (M&M): The auto major said that it has sold 2,29,80,000 equity shares representing 6.058% of the paid-up share capital of Mahindra CIE Automotive, a listed associate of the company. The auto maker said that the sale was executed on the stock exchanges at a gross price of Rs. 357.39 per share. Following the sale, the shareholding of the company in MCIE has fallen from 9.253% to 3.195% of its share capital.

GMR Airports Infrastructure: The company’s step-down subsidiary, GMR Hyderabad International Airport (GHIAL), has successfully raised funds through issuance of non-convertible debentures (NCDs) amounting to Rs 840 crore, on private placement basis. The NCDs have an interest rate of 8.71% per annum payable quarterly for an initial period of five years. The interest rate will be reset for next five years. The 10-year listed, rated, redeemable, secured NCDs will be listed on Bombay Stock Exchange (BSE). The proceeds from the NCDs will be utilized for partial refinancing of $100 million of the existing foreign currency bonds of 2024, for which tendering has been completed, along with accrued interest and other tender offer/issue expenses.

Varun Beverages: The company has invested 9.80% of Equity Share Capital (5.68% on fully diluted basis) of Lone Cypress Ventures, a special purpose vehicle inter-alia engaged to supply solar power to consumers in Uttar Pradesh. The company intends to obtain solar power (generation and supply) from SPV for its facilities located in Sandila, Uttar Pradesh and Kosi, Uttar Pradesh.

Divgi TorqTransfer Systems: The auto ancillary company made a tepid stock market debut today. The stock was listed with a 5% premium at Rs 620 on the NSE compared to its issue price of Rs 590 per share. The shares hit a low of Rs 560 apiece and closed Rs 605.2 apiece on the NSE.

Mastek: The company announced its new business partnership with Dulsco, a people and environmental solutions company. Mastek will implement an integrated cloud platform to digitally transform Dulsco’s Finance, Enterprise Performance Management (EPM), Supply Chain, Customer Experience, Transportation and Human Capital Management (HCM) functions. Mastek’s partnership with Dulsco will unify the latter’s disparate systems with a best-of-the-breed staffing and ERP solution, and bring in ultra-resilience for their vast customers and sharper business insights, improved productivity, and enhanced business efficiency.

Glenmark Pharmaceuticals: The company announced that it has received final approval by the USFDA for Clindamycin Hydrochloride capsules. Clindamycin Hydrochloride capsules are used to treat bacterial infections of the lungs, skin, blood, female reproductive organs, and internal organs. This medicine may be given to patients who have had an allergic reaction to penicillin. Clindamycin will not work for colds, flu, or other virus infections. Glenmark’s Clindamycin Hydrochloride capsules USP will be distributed in the US by Glenmark Pharmaceuticals Inc., USA. The approved drug is the generic version of Cleocin Hydrochloride capsule of Pfizer Inc. According to IQVIA, sales data for the 12-month period ending January 2023, the Cleocin Hydrochloride capsules achieved annual sales of approximately $33.6 million.

Dilip Buildcon: The infrastructure company has received provisional completion certificate for the six-laning project of Nidagatta-Mysore section on NH-275 in Karnataka and it will be executed on Hybrid Annuity Mode. The project has been declared fit for entry into commercial operations as on March 9.

Magellanic Cloud: Shares of the company surged 4.72% after the company said that its board has approved issuing 3 bonus equity shares for each share held (3:1). The company has set the record date on March 22 and the bonus shares will be credited on or before March 27. The paid-up equity share capital will increase to Rs 1,16,87,90,240 post-bonus issue from Rs 29,21,97,560 as on date.