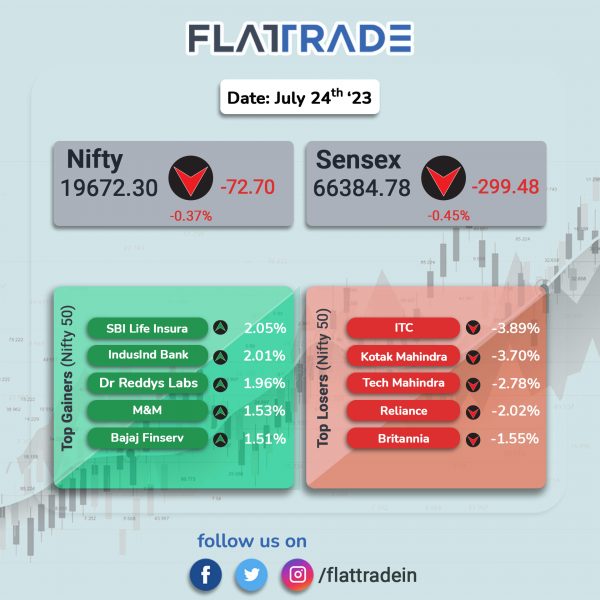

Sensex, Nifty dropped on Monday led by losses in index heavyweights such as ITC, Kotak Mahindra Bank, Reliance Industries, etc. The Sensex fell 0.45% and the Nifty 50 index dropped 0.37%.

In broader markets, Nifty Midcap 100 fell 0.15% and the BSE Smallcap edged up 0.07%.

Top losers among Nifty sectoral indices FMCG [-1.72%], Metal [-0.73%], Oil & Gas [-0.71%], Energy [-0.36%], and Bank [-0.33%]. Top gainers were Pharma [0.41%], Realty [0.2%], Auto [0.17%], and PSU Bank [0.1%].

Indian rupee rose 13 paise to 81.83 against the US dollar on Monday.

Stock in News Today

ITC: The conglomerate announced that its board has approved the demerger of its hotels business and this is expected to unlock value for 30 lakh shareholders. “After due consideration, the board accorded its in-principle approval to the demerger of hotels business under a scheme of arrangement, with the company holding a stake of about 40% in the new entity and the balance shareholding of about 60% to be held directly by the company’s shareholders proportionate to their shareholding in the company,” ITC said. Shares fell 3.89% to Rs 471.35 apiece.

HDFC AMC: The asset manager reported a net profit of Rs 477.5 crore in Q1FY24, up 52% from Rs 314.2 crore in the year-ago period. Total income was up 37.47% YoY to Rs 732.57 crore in Q1FY24. Operating profit for the quarter ended 30 June 2023 was Rs 4,133 crore as compared to Rs 3737 crore for the quarter ended 30 June 2022. Its QAAUM (quarterly average assets under management) stood at Rs 4,85,700 crore at the end of June 2023 compared to Rs 1,45,300 crore in the year-ago period.

Canara Bank: The public sector lender has reported a net profit of Rs 3,534.8 crore for the quarter ended June 2023, witnessing a sharp 74.8% jump from Rs 2,022 crore in the same quarter last year. Its net interest income (NII) in Q1FY24 increased 27.7% to Rs 8,665.7 crore as compared to Rs 6,784.7 crore on a yearly basis. Net Interest Margin (NIM) during the quarter under review was at 3.05% as against 3.07% in the previous quarter. Net NPA ratio fell 16 bps to 1.57% from 1.73%, sequentially. The bank’s total domestic deposit at the end of March 2023 increased 4.9% to Rs 11,04,506 crore from Rs 10,52,907 crore, YoY. Its global deposits rose 6.5% YoY to Rs 11,92,470 crore.

TVS Motor: The two-wheeler maker’s standalone net profit surged 45.9% to Rs 467.67 crore on 20.12% rise in revenue from operations to Rs 7,217.91 crore in Q1FY24 over Q1FY23. The company posted an Ebitda of Rs 764 crore in Q1FY24, up 27% from Rs 599 crore in Q1FY23. The overall two-wheeler and three-wheeler sales grew by 5% YoY to 9.53 lakh units in the quarter ended June 2023.

IDBI Bank: The lender said its net profit was up 61.9% YoY at Rs 1,224.2 crore in Q1FY24 as against Rs 756.4 crore in Q1FY23. Net Interest Income rose 60.7% to Rs 3,997.6 crore in Q1FY24 as against Rs 2,487.5 crore in Q1FY23. Net NPA stood at 0.44% in Q1FY24 as against 0.92% in Q1FY23. Its operating profit for Q1FY24 surged 47 per cent to Rs 3,019 crore, as against Rs 2,051 crore in the corresponding period last year.

Samvardhana Motherson International Limited (SAMIL): The company said Samvardhana Motherson Automotive Systems Group BV (SMRPBV) has received approval from SAMIL to acquire assets and shares of Dr Schneider Group entities from the insolvency administrator, Dr Joachim Exner. The overall enterprise value of this transaction is approximately euro 118.3 million, subject to certain actualisation, and is expected to be closed at the end of the third quarter of this financial year 2023-24. Overall equity value is expected to be in the range of euro 70-80 million along with financial debt of not more than euro 20 million.

Mahindra & Mahindra (M&M): The Mahindra Group plans to support interested American companies to set up manufacturing bases in India. The Mahindra Group will support interested companies in setting up their manufacturing base in India in a range of ways, including (i) through an integrated approach to manufacturing (infrastructure, supply chain, technology/automation, and others); (ii) a modular plug-and-play suite of offerings; (iii) experience sharing on regulations and compliance; and (iv) environmental, social and governance (ESG) focus.

Biocon: The company’s subsidiary, Biocon Biologics Ltd (BBL), announced that the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has issued a positive opinion recommending approval of YESAFILI, an aflibercept biosimilar. It is an ophthalmology product, which is intended for the treatment of neovascular (wet AMD) age-related macular degeneration, visual impairment due to macular oedema secondary to retinal vein occlusion (branch RVO or central RVO), visual impairment due to diabetic macular oedema (DME) and visual impairment due to myopic choroidal neovascularisation (myopic CNV).

Rane Brakes: The company’s net profit fell 10.3% YoY to Rs 5.2 crore in Q1FY24 as against Rs 6 crore in Q1FY23. Revenue was up 9.3% at Rs 152.3 crore in Q1FY24 as against Rs 139.3 crore in Q1FY23. Ebitda was up 16.2% YoY at Rs 11.5 crore in Q1FY24 from Rs 9.9 crore in Q1FY23.

Tamilnad Mercantile Bank: The company’s net profit was up 11.5% YoY at Rs 261.2 crore in Q1FY24 from Rs 234 crore in Q1FY23. Net interest income fell 1.9% YoY at Rs 514.1 crore in Q1FY24 as against Rs 524 crore in Q1FY23. Net NPA at 0.66% in Q1FY24 compared with 0.62% in the preceding quarter.

Titagarh Rail Systems: The company reported a standalone net profit of Rs 67.57 crore in Q1FY24, higher than Rs 23.02 crore posted in Q1FY23. Revenue from operations jumped 110% to Rs 910.76 crore in Q1FY24 from Rs 433.71 crore recorded in the corresponding quarter last fiscal. Ebitda in Q1FY24 stood at Rs 106.11 crore, registering a growth of 158% from Rs 41.09 crore reported in Q1FY23. The company’s revenue from freight rail system stood at Rs 746.08 crore, up 112.45% YoY and passenger rail system stood at Rs 164.68 crore, up 99.56% YoY during the period under review. The wagon maker said that the order book stood at Rs 27,890 crore.

Thangamayil Jewellery: The retailer’s net profit stood at Rs 58.6 crore in Q1FY24 as against Rs 19 crore in Q1FY23. Revenue was up 16.2% YoY at Rs 960 crore as against Rs 826.4 crore in the year-ago period. Ebitda jumped to Rs 82.3 crore in the reported quarter from Rs 28.3 crore in the year-ago period.

PNB Housing Finance: The mortgage lender’s net profit was up 47.8% at Rs 347.3 crore in Q1FY24 from Rs 235 crore in Q1FY23. Revenue was up 21% YoY at Rs 1,707.6 crore in Q1FY24 as against Rs 1,410.7 crore in Q1FY23.

BASF India: The company’s net profit fell 42.7% YoY to Rs 112.7 crore in Q1FY24 from Rs 196.8 crore in Q1FY23. Revenue was down 13.2% at Rs 3,374.7 crore in Q1FY24 as against Rs 3,887.8 crore in Q1FY23. EBITDA dropped 36.3% to Rs 197.8 crore in Q1FY24 as against Rs 310.7 crore in Q1FY23.

Poonawalla Fincorp: The financial services company’s net profit surged 61.8% to Rs 200.2 crore in Q1FY24 as against Rs 123.7 crore in Q1FY23. Revenue was up 71.7% YoY at Rs 698.5 crore in Q1FY24 as against Rs 406.9 crore in Q1FY23. The company’s disbursements stood at Rs 7,063 crore, up 143% YoY and 11% QoQ. Assets under management (AUM) stood at Rs 17,776 crore, up 41% YoY and 10% QoQ. The company’s net NPA stood at 0.76%, down 35 basis points year-on-year.

J&K Bank: The lender’s net profit soared 96.7% YoY to Rs 326.5 crore in Q1FY24 as against Rs 166 crore in Q1FY23. Net Interest Income expanded 24.1% at Rs 1,283.3 crore in Q1FY23 as against Rs 1,034.2 crore in Q1FY23.

SRF: The chemicals maker registered a 41% decline in net profit for the quarter ended June 2023 to Rs 359.3 crore, down from Rs 632 crore last fiscal. Its topline also slipped 14.3 percent year-on-year to Rs 3,338.4 crore in the April-June period from Rs 3,894 crore.

RITES: The company announced that it has emerged as the lowest bidder in the tenders for procurement of locomotives and wagons invited by CFM, Mozambique. The company said that the order is subject to award after the due process of CFM, Mozambique’s scrutiny/ evaluation as per the requisite requirements mentioned in the tender documents. The estimated value of the bid is approximately Rs 500 crore.

Sportking India: The company reported 78% drop in net profit to Rs 18 crore in Q1FY24 from Rs 83 crore in Q1FY23. Total operational revenues fell by 11% to Rs 539 crore in Q1FY24 from Rs 606 crore in the same period last year. Ebitda declined by 63% to Rs 50 crore in Q1FY24 from Rs 134 crore in Q1FY23.

Kriti Industries (India): The company reported a consolidated net profit of Rs 7.86 crore in Q1FY24 as against a net loss of Rs 9.11 crore in Q1FY23. Net sales increased by 52.3% YoY to Rs 279.55 in Q1FY24. Shares fell 20% in intraday trade on the NSE.

Indraprastha Gas: The city gas distributor has reported a 4% increase in net profit to Rs 438.40 crore on a 7% rise in net revenue from operations to Rs 3406.98 crore in Q1FY24 as compared with Q1FY23. Total volumes rose by 4% to 746.19 million standard cubic metre (SCM) in Q1 FY24 from 717.84 million SCM in Q1 FY23. Of this, CNG volume added up to 561.42 million SCM (up 4% YoY) and PNG volumes aggregated to 184.77 million SCM (up 4% YoY). Ebitda improved by 4% to Rs 642.38 crore in Q1 FY24 from Rs 617.51 crore in Q1 FY23.