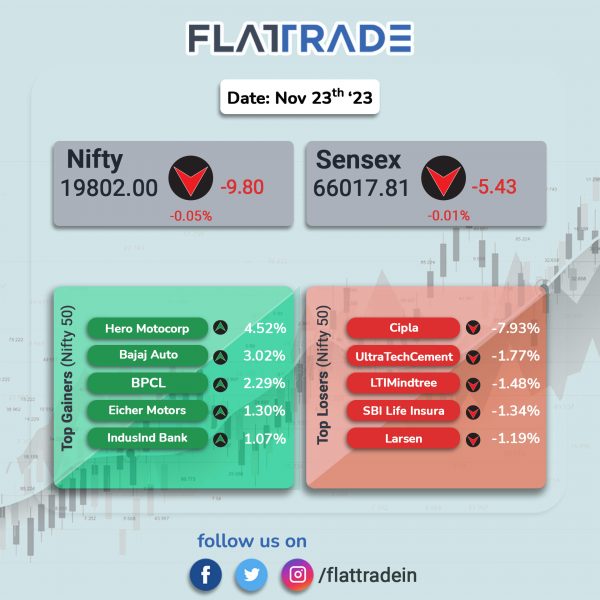

Benchmark equity indices pared early gains to close flat, weighed down by losses in pharma and IT stocks. The Sensex ended flat and the Nifty 50 index inched down fell 0.05%.

In broader markets, the Nifty Midcap 100 was little changed and the BSE Smallcap rose 0.43%.

Top losers were Pharma [-1.57%] and IT [-0.59%]. Top gainers Realty [1.03%], Oil & Gas [0.9%], Metal [0.53%], Private Bank [0.38%], and Auto [0.36%].

The Indian rupee fell 1 paise to 83.34 against the US dollar on Thursday.

Meanwhile, international oil prices fell. WTI Crude price stood at $76.45 per barrel and Brent Crude fell to $81.02 a barrel.

Stock in News Today

State Bank of India (SBI): The public sector lender has sold 2.18% stake in SEPC between November 11 and November 21, 2023, through an open market operations. With stake sale, the lender has reduced its holding in SEPC from 7.15% to 4.97%, according to its exchange filing.

Oil and Natural Gas Corp (ONGC): The Indian government is planning to ask the state-run company to consider launching a rights issue to help fund green projects at refining arm Hindustan Petroleum Corp, Reuters reported citing two sources. The rights issue could raise about $1.9 billion, the report said.The oil ministry is awaiting a response from the finance ministry on the plan for ONGC to launch a rights issue, one of the sources said.

Central Depository Services Limited (CDSL): The company said that it has crossed a milestone of registering over 10-crore demat accounts. Shares of the company jumped over 4%.

Affle (India): The company announced the filing of 15 patents in India and these patents cover various advanced artificial intelligence (AI) areas, such as automated AI agents, personalization, predictive analysis, privacy management, enhanced fraud detection, and security. The patents also pertain to data privacy and enhanced fraud detection approaches for AI agents, incorporating secure public cloud enclave, secure transfer system, and data destruction.

Servotech Power Systems: The company has received an order from Bharat Petroleum Corporation (BPCL) for manufacturing, supplying and installing 2649 AC EV Chargers across the nation. The range of EV chargers includes 3 kW and 7 kW for this project. The chargers will begin from December 15th and will be completed within three months. The company will be responsible for equipping petrol pumps in major Indian cities under the BPCL E-drive Project, playing a key role in the widespread implementation of EV charging solutions.

Cipla: Shares of the company fell 8% after the US drug regulator revealed details of a warning letter sent to the company’s Pithampur facility in Madhya Pradesh. The warning letter summarises violations of current good manufacturing practices regulations for finished pharmaceuticals and product quality defect complaints. It has also asked the pharma company to take help from third party consultants to address the issues at the facilities.

Strides Pharma Science: The company said that its step‐down wholly owned subsidiary, Strides Pharma Global Pte. Singapore, has received approval from the USFDA for generic Suprep Bowel Prep Kit oral solution. The approval bolsters the company’s portfolio of products in bowel preparation that spans both prescription and over the counter offerings. The product has a market size around of approximately $ 143 Million as per IQVIA. The product will be manufactured at the company’s facility in Bengaluru.

Genesys International: The company said that it has signed a strategic partnership with Survey of India (SOI) with an aim to create Digital Twins of major cities and towns. The partnership will leverage Genesys’ all India highly accurate navigable maps, the Genesys constellation of sensors and SOI’s recently launched CORS network which allows for real time high precision positioning data.

Selan Exploration Technology: The company’s board has approved the amalgamation of Antelopus with and into Selan Exploration, according to its exchange filing. The board also approved raising funds up to Rs 250 crore through issuing equity shares, fully or partially convertible debentures, non-convertible debentures. The funds will be used for working capital and general corporate purposes.