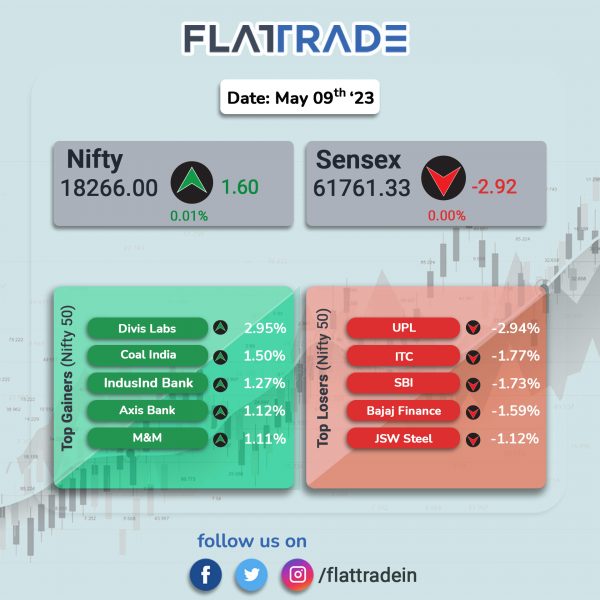

Benchmark equity indices closed flat as investors booked profits amid mixed global cues. The Sensex closed flat and the Nifty was up 0.01%.

In broader markets, the Nifty Midcap 100 index inched up 0.04% and the BSE Smallcap fell 0.35%.

Top gainers were IT [0.73%], Auto [0.47%], Pharma [0.42%], Oil & Gas [0.18%], and Private Bank [0.14%]. Top losers were PSU Bank [-2.75%], Realty [-0.85%], FMCG [-0.35% ], Media [-0.23%], and Bank [-0.20%].

Indian rupee fell 24 paise to 82.04 against the US dollar on Tuesday.

Stock in News Today

Raymond: The consolidated net profit dropped 26.1% YoY at Rs 194.5 crore in Q4FY23 as against Rs 263.3 crore in the year-ago period. The consolidated revenue was up 9.8% YoY at Rs 2,150.2 crore in Q4FY23 from Rs 1,958.1 crore in the year-ago period. Ebitda was up 18.4% YoY at Rs 336.8 crore in Q4FY23 as against Rs 284.4 crore in the corresponding period last fiscal. The company has declared a dividend of Rs 3 per share for FY23.

Happiest Minds Tech: The IT solutions provider’s consolidated net profit rose marginally to Rs 57.66 crore in Q4FY23 from Rs 57.58 crore recorded in Q3FY23. Revenue from operations grew by 3.03% to Rs 377.98 crore in Q4FY23 over Q3FY23. Ebitda rose 3.5% QoQ and 23.3% YoY to Rs 100.62 crore in Q4FY23. Happiest Minds added 16 new clients in the quarter ended March 2023 totalling 237 clients.

Indiabulls Real Estate (IBREL): Shares of the company hit a lower circuit of 20% after the National Company Law Tribunal (NCLT), Chandigarh Bench, withheld the merger of NAM Estates and Embassy One into the company. The merger already stands sanctioned by the NCLT, Bengaluru Bench, which has jurisdiction over NAM Estates and Embassy One, on 22 April 2022. However, the NCLT, Chandigarh Bench, which has jurisdiction over IBREL, had earlier raised certain concerns based on the objections cited by Income Tax department to the merger, the firm stated.

Indiabulls Real Estate said that it strongly believes that these objections and concerns were unfounded, unjustified and do not impact the merger in a significant manner and had accordingly addressed the same before the NCLT. The company will await the detailed order to further evaluate the next steps and shall explore all options, including filing an appeal against the order of the NCLT, Chandigarh Bench, before the National Company Law Appellate Tribunal (NCLAT) at the earliest, the company said.

Zomato: Shares of Zomato tanked 6% after the media reported that US-based fund manager Invesco has slashed the valuation of food and grocery delivery platform Swiggy. According to the media reports, Invesco has slashed Swiggy’s valuation to $5.5 billion from $8.2 billion and it is the second time that Invesco’s has markdown for Swiggy in less than a year. Earlier in April, it had reduced the company’s valuation to $8.2 billion from $10.7 billion.

Mankind Pharma: The company had a strong stock market debut. The scrip was listed at a price of Rs 1,300, at a premium of 20.37% as compared to the issue price of Rs 1080 apiece. The shares hit a high of Rs 1430 per share and closed at Rs 1422.30 apiece.

Chalet Hotels: The company’s consolidated net profit was at Rs 39.2 crore in Q4FY23 compared with a net loss of Rs 11.2 crore in the year-ago period. Consolidated Revenue rose to Rs 337.87 crore in Q4FY23 from Rs 148 crore the same quarter last fiscal. Ebitda surged to Rs 152.3 crore in Q4FY23 as against Rs 31.5 crore in the year-ago period.

Poly Medicure: The company’s consolidated net profit was up 62.4% YoY at Rs 58.8 crore in Q4FY23 as against Rs 36.2 crore in the year-ago period. Consolidated revenue rose 19.1% YoY to Rs 306.8 crore in Q4FY23 as against Rs 257.5 crore in the year-ago period. EBITDA jumped 49.4% to Rs 83.2 crore in Q4FY23 as against Rs 55.7 crore in Q4FY22.

Ganesh Housing Corporation: The company’s consolidated net profit up 84.5% at Rs 46.5 crore as against Rs 25.2 crore in the year-ago period. Consolidate revenue rose 15.4% to Rs 179.29 crore in Q4FY23 as against Rs 155.4 crore in Q4FY22. EBITDA soared 93.7% to Rs 101.1 crore in Q4FY23 as against Rs 52.2 crore in Q4FY22.

HFCL: The company’s consolidated net profit rose 10% to Rs 71.8 crore in Q4FY23 as against Rs 65 crore in Q4FY22. Consolidated revenue jumped 21.1% YoY to Rs 1,433 crore in Q4FY23 as against Rs 1,183 crore in Q4FY22. EBITDA was up 24.4% at Rs 154.4 crore as against Rs 124.1 crore in the year-ago period.

Matrimony: The company said its consolidated net profit was down 2.55% at Rs 11.4 crore in Q4FY23 as against Rs 11.7 crore in the year-ago period. The consolidated revenue was up 3.5% at Rs 114.5 crore in Q4FY23 as against Rs 110.6 crore in Q4FY22. Ebitda fell 10.7% YoY to Rs 16.7 crore in Q4FY23.

T D Power Systems: The company said its consolidated net profit was up 43.3% YoY at Rs 35.4 crore in Q4FY23 as against Rs 24.7 crore in Q4FY22. Its consolidated revenue rose 9.9% YoY to Rs 249.8 crore from Rs 227.2 crore in the year-ago period. Ebitda jumped 41.5% YoY at Rs 43.3 crore in Q4FY23.

Man Infraconstruction: The company’s consolidated net profit stood at Rs 91.5 crore in Q4FY23 as against Rs 41.4 crore in the year-ago period. Consolidated Revenue jumped to Rs 680.26 crore in Q4FY23 as against Rs 264.3 crore in the year-ago period. Ebitda more than doubled to Rs 124.5 crore in Q4FY23 from Rs 55 crore in the corresponding period last fiscal.

Westlife Foodworld: The company’s consolidated net profit was up 30.3% YoY at Rs 20.3 crore as against Rs 15.6 crore in the year-ago period. Consolidated revenue rose 22.3% YoY to Rs 556.3 crore in Q4FY23 as against Rs 455 crore in the year-ago period. Ebitda jumped 34.2% YoY at Rs 136.3 crore in Q4FY23 as against Rs 101.6 crore in the same period last fiscal.

Venus Remedies: Shares of the company rose over 5% after the company said it had secured marketing authorisation for two more widely used cancer drugs from Philippines and Iraq. According to Saransh Chaudhary, the President of Global Critical Care at Venus Remedies, the recent marketing approvals from the Philippines and Iraq will not only expand the company’s global reach but also improve access to life-saving treatments for patients.

Greenply Industries: The company said that its board has approved the formation of a JV with SAMET B.V. for manufacturing and selling functional furniture hardware through a manufacturing facility in India. The functional furniture hardware would include slide systems for wooden and metallic drawers, hinge systems, lift-up systems and other connection fittings, etc. The company’s board has also approved incorporation of a joint venture (JV) company in the name of “Greenply Samet India Private Limited”. The JV company to be incorporated shall be on equal shareholding basis (1:1) as a private limited company in accordance with Indian laws.

Dev Information Technology: The company said it bagged an order from Gujarat State Fertilizers & Chemicals (GSFC) for setting up enterprise class mailing solution at its head office. The scope of work includes seamless integration with existing GSFC IT infra setup. The contract is worth about Rs 2.15 crore and it is to be executed in two months.