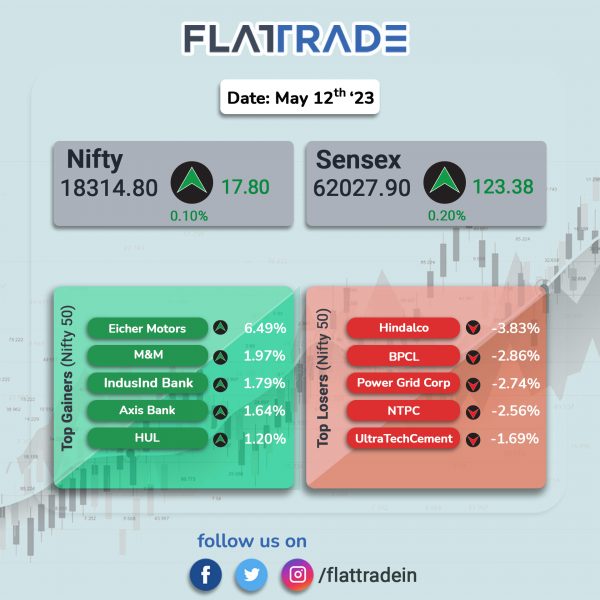

Benchmark equity indices closed slightly higher, helped by gains in auto and bank stocks. The Sensex rose 0.2% and the Nifty gained 0.1%.

In broader markets, the Nifty Midcap 100 fell 0.41% and the BSE Smallcap was down 0.08%.

Top gainers were Auto [0.77%], Bank [0.73%], Private Bank [0.62%], Financial Services [0.54%], and PSU Bank [0.21%]. Top losers were Metal [-1.84%], Energy [-1.14%], Media [-1.12%], Oil & Gas [-0.89%], and Pharma [-0.56%].

Indian rupee weakened by 7 paise to 82.16 against the US dollar on Friday.

Stock in News Today

Hindustan Aeronautics Ltd (HAL): The aerospace and defence major said its revenue from operations rose 8% YoY to Rs 12,495 crore. Ebitda jumped 30% YoY to Rs 3,241 crore. The net profit fell 8% YoY to Rs 2,841 crore. The company’s order book stood at Rs 81,784 crore. The board declared second interim dividend of Rs 20 per equity share. The total interim dividend declared for FY23 is Rs 40.

Vedanta: The mining major reported a 67.5% year-on-year drop to Rs 1,881 crore in the quarter ended March 2023 quarter. The company’s revenue from operations dropped 5.4% YoY to Rs 37,225 crore. Ebitda margin declined to 29% in Q4 from 39% in the March quarter of FY22, while the consolidated quarterly Ebitda stood at Rs 9,362 crore, up 32% QoQ.

ZEEL: Shares of the media company fell over 6% as the proposed merger with Sony hit yet another obstacle. Reports indicate that the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) notified the Mumbai bench of the National Company Law Tribunal (NCLT) that the Securities and Exchange Board of India (SEBI) had instructed them to inform the tribunal of a recent order issued against Shirpur Gold Refinery, an Essel Group company.

Ambuja Cements: The Adani-owned company said that it has been declared as the ‘preferred bidder’ for the Devalmari Katepalli limestone block in an e-auction conducted by the Government of Maharashtra. The block is situated in Gadchiroli, Maharashtra over an area of approximately 538 Hectare with estimated limestone resource of around 150 million tonnes having CaO content of more than 42%.

Meanwhile, the company has placed orders to expand clinker capacity by 8 million tonnes at Bhatapara, Chattisgarh and Maratha, Maharashtra units on highest ESG standards with 42 MW of (waste heat recovery system) WHRS, provision to utilize 50% (alternative fuels and raw materials) AFR and provision to operate on green power. The capacity expansion projects will enable production of Blended Green Cement of 14 million tonnes. These projects are expected to be commissioned in 24 months and the capex will be funded from internal accruals.

Cipla: The pharma company said its net profit surged 45.3% to Rs 526 in Q4FY23 from Rs 362.1 crore in Q4FY22. The consolidated revenue rose 9.1% to Rs 5739.3 crore in Q4FY23 from Rs 5620.3 crore in Q4FY22. For the year, consolidated net profit rose 11.24% to Rs 2,832.89 crore on 4.55% increase in total revenue from operations to Rs 22,753.12 crore. EBITDA rose 9.8% YoY to Rs 5,027 crore in FY23. The board recommended a final dividend of Rs 8.5 per equity share for the year ended 31 March 2023.

PDS: Shares of the company tanked over 6% in intraday trade after the company’s consolidated net profit slipped 26.6% to Rs 56.58 crore in Q4FY23 from Rs 77.13 crore recorded in Q4FY22. Revenue from operations fell marginally to Rs 2,741.66 crore in Q4 FY23 as against Rs 2,775.44 crore reported in the same period a year ago. Ebitda was at Rs 133 crore in Q4FY23, a growth of 28% YoY. On a full year basis, the company’s consolidated net profit rose 6.7% to Rs 264.98 crore on 19.8% jump in revenue to Rs 10,577 crore in FY23 over FY22.

CARE Ratings: The company reported 10.6% decline in net profit of Rs 25.86 crore in Q4FY23 as compared with Rs 28.92 crore in Q4FY22. Total Income rose 16.8% to Rs 78.17 crore in Q4 FY23 as compared with Rs 66.94 crore in Q4 FY22. Ebitda stood at Rs 29.5 crore in the quarter ended March 2023 as compared with Rs 28.8 crore in the quarter ended March 2022.

On full year basis, the company’s net profit jumped 22.9% to Rs 103.80 crore on 15.5% rise in total income to Rs 285.94 crore in FY23 over FY22. The board has recommended a final dividend of Rs 7 per equity share and a special dividend of Rs 8 per equity share for FY23, subject to approval of shareholders. The record date for payment of dividend will be 7 July 2023.

BLS International Services: The company reported 95.8% jump in consolidated net profit to Rs 69.21 crore in Q4FY23 as against Rs 35.35 crore reported in Q4FY22. Consolidated revenue from operations surged 76.7% YoY to Rs 448.63 crore in Q4FY23 from Rs 253.84 crore in the corresponding quarter previous year. The revenue was mainly driven by strong recovery in visa application volumes and digital services. Ebitda stood at Rs 66.53 crore in Q4FY23, up 89.9% from Rs 35.04 crore in Q4FY22.

Intellect Design Arena: Shares rallied over 13% in intraday trade after the company reported 46.16% jump in consolidated net profit of Rs 90.66 crore in Q4FY23 as compared with Rs 62.03 crore in Q3 FY23. Total revenue rose 12.54% to Rs 615.50 crore in Q4FY23 as compared with Rs 546.92 crore in Q3FY22. Ebitda stood at Rs 143 crore in Q4FY23, up 28.83% from Rs 111 crore in Q4FY22. On full year basis, the company’s consolidated net profit declined 23.4% to Rs 267.23 crore despite of 18.8% jump in total revenue to Rs 2,231.25 crore in FY23 over FY22.

Gillette India: The razor manufacturer reported 48.2% jump in net profit to Rs 102.70 crore in the quarter ended March 2023 as against Rs 69.31 crore recorded in quarter ended March 2022. Revenue form operations grew by 9.3% year on year to Rs 619.07 crore during the quarter. The sales rise was mainly driven by strong brand fundamentals, strength of product portfolio, and improved retail execution. During the quarter under review, revenue from Grooming rose 10.01% YoY to Rs 491.35 crore and revenue from Oral Care stood at Rs 127.72 crore (up 6.55% YoY).

Sapphire Foods India: The company said its consolidated net profit jumped multi-fold times to Rs 136 crore in Q4FY23 as against Rs 26.5 crore in Q4FY22. Consolidated revenue from operations was up 12.8% YoY to Rs 560.4 crore in Q4FY23 from Rs 496.8 crore in the year-ago period. Ebitda fell 1.5% YoY to Rs 98.2 crore in the reported quarter as against Rs 99.7 crore in the year-ago period.

Greaves Cotton: The company reported a consolidated net profit was up 59.5% YoY at Rs 26.7 crore in Q4FY23 as against Rs 16.7 crore in Q4FY22. Consolidated revenue rose 33.2% YoY at Rs 827 crore in Q4FY23 as against Rs 620.8 crore in Q4FY22. EBITDA jumped 20.4% to Rs 49 crore in Q4FY23 as against Rs 40.7 crore in Q4FY22.

Polycab: The company’s consolidated net profit (from continuing operations) jumped 31.68% to Rs 428.42 crore on 8.9% rise in revenue from operations to Rs 4,323.68 crore in Q4FY23 over Q4FY22. The company said that revenue rose driven by healthy volume growth in Cables business. Ebitda grew 27% YoY to Rs 603.2 crore in Q4FY23. The company expanded its global footprint to 70 countries.

Sharika Enterprises: Shares of the firm hit an upper limit of 20% after the company said it has secured a purchase order of Rs 24.69 crore for supplying 48F OPGW and optical unit to LS Cables India. The company will supply 2000 KM Optical Ground Wire (OPGW) (48 Fiber) to LS Cable India. The order is expected to be executed in the next six months.

NIBE: The company said it received seven purchase order from Larsen & Toubro for manufacturing of bridge center module structure for a total consideration of Rs 16.80 crore. The contract is to be executed on or before 28 February 2025. NIBE trades in electronic components, fabrication materials, and provides technical consultancy.